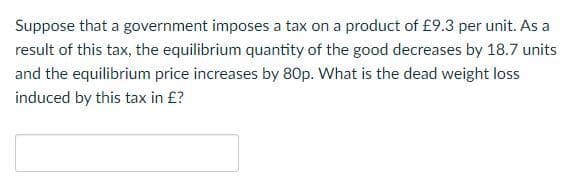

Suppose that a government imposes a tax on a product of £9.3 per unit. As a result of this tax, the equilibrium quantity of the good decreases by 18.7 units and the equilibrium price increases by 80p. What is the dead weight loss induced by this tax in £?

Q: Suppose the demand for pickles on The Citadel is Qd=500-4P, and the supply is Qs=6P. What is…

A: At equilibrium, Demand and supply curve intersect each other. Hence, at equilibrium, Qd=Qs

Q: Suppose demand is given by ??(?) = 1 – ? and supply ??(?) = ?, with prices in dollars. If buyers pay…

A: 1. When the government imposes per unit of tax then the burden of tax is shared by the buyer and…

Q: Assume that the federal government replaces the federal income tax with a national sales tax on all…

A: A federal income tax is the tax system where the incomes of individuals, firms, other companies are…

Q: Find the equilibrium Price and output of the following function: 13P-Qs=27 Qd+4P-24=0 Suppose the…

A: In a market, tax is one of the factors that will affect the market equilibrium and generally lead to…

Q: Suppose the demand for football tickets is QD=360-10P and the market supply is QS=20P. a) What…

A: Government imposes a $4 excise tax per ticket on the sellers of tickets, thus sellers receive $4…

Q: Given the following information: QD= 240-5P QS= P Where QD is the quantity demand, QS is the…

A: QD= 240-5P ........... demand function Qs = P ............. supply function

Q: Given: Qd = 240 - 5P Qs = P Where Qd is the quantity demanded, Qs is the quantity supplied and P…

A:

Q: Which of the following statements are correct? The statutory or legal incidence of a tax determines…

A: The tax can be divided into two categories such as per unit tax and lumpsum tax. Any tax results in…

Q: Discuss the effects of indirect taxes on producers.

A: Effects of indirect taxes on producers Indirect taxes are the taxes levied on the goods and…

Q: According to studeis undertaken by the U.S. Department of Agriculture, the price elasticity of…

A: Because of increase in price of cigarettes,consumption of cigarettes would decrease. Because price…

Q: Assume that the demand for food is relatively inelastic and the demand for jewelry is relatively…

A: Answer: If the same tax is imposed on the goods having elastic and inelastic demand then the good…

Q: Find the net indirect taxes if the indirect taxes are $60 and the subsidies are $15?

A: indirect taxes = $60 subsidies = $15 net indirect taxes = ?

Q: Why do you oppose the taxation of purchasing NFTs? Infoslide: An NFT, which stands for non-fungible…

A: A digital asset that depicts real-world elements like as art, music, in-game items, and films is…

Q: Given the following information: QD= 240-5P QS= P Where QD is the quantity demand, QS is the…

A: Producer surplus refer to the difference between the minimum acceptance price of the producer and…

Q: According to studies undertaken by the U.S. Department of Agriculture, the price elasticity of…

A: Price Elasticity refers to the degrees of responsiveness of change in quantity demand with respect…

Q: Find the consumer and producer tax burden. e) Calculate the tax revenue that the government…

A: The tax Shifts the supply curve to the left and decreases supply which decreases the quantity and…

Q: An income tax put on a person's income raises the same amount of revenue as a quantity tax put on…

A: People are exposed to a consumption tax when they spend money, similar to how much they buy. When…

Q: Question 2a - Part 1 Given the following information Qp = 240 - 5P Qs = P where Qp is the quantity…

A:

Q: Given the following information QD = 240-5p QS = P Where QD is the quantity demanded, Qs is the…

A: Consumer surplus refer to the difference between the maximum willing to accept price and actually…

Q: Given the following information QD = 240-5p QS = P Where QD is the quantity demanded, Qs is the…

A:

Q: In 2018, the Government of the Federated Republic of Coconut Islands had a budget surplus of $20…

A: Budget = Tax revenue - Government expenditure +20 = tax revenue -324 Tax revenue = 344

Q: Given the following information QD = 240-5p QS = P Where QD is the quantity demanded, Qs is the…

A: Equilibrium price, is such a price at which quantity demanded QD equals quantity supplied QS QD =…

Q: It is generally agreed that excise taxes should be imposed on sellers of tobacco but not on sellers…

A: An indirect tax that is being levied on the sale, license, or production of certain goods by the…

Q: what will happen to the equilibrium of mobile phones of government announces higher sales taxes on…

A: Imposition of sales tax results in leftward shift of the supply curve.

Q: The figure below represents the market for Gasoline, where initially the equilibrium price was…

A: Equilibrium is achieved at the output level where Qs equals Qd. Thus, Q*= 250 units and P*= $5.60

Q: Given the following information: QD= 240-5P QS= P Where QD is the quantity demand, QS is the…

A: Meaning of Quantity Demanded and Quantity Supplied: The term quantity demanded is the situation…

Q: Given the following information QD = 240-5P QS= P Where QD is the quantity demanded, Qs is the…

A: Equilibrium is achieved where quantity supplied equals quantity demanded.

Q: Consider the following demand and supply function of product ZT: Qd = 25 - 1.25 P Qs = -9 + 3 P…

A: Equilibrium is achieved at the output level where Qs equals Qd.

Q: Suppose the supply is perfectly inelastic, which means the price elasticity of supply is 0. A…

A: As supply is perfectly inelastic , the supply curve is vertical in nature. The imposition of tax…

Q: smoking to cancer plans to raise the excise tax in cigarettes so the price rises by 10 percent. The…

A: Price elasticity of demand is in turn being defined as the % change in quantity which is being…

Q: Q)Economics If the tax elasticity of supply is 0.16, by how much will the quantity supplied increase…

A: The tax elasticity of supply (T.Es) demonstrates the effect of a change in marginal tax rate on the…

Q: Suppose that a tax is placed on a particular good. If the consumers pay a higher share of the tax,…

A: Elasticity measures the responsiveness of quantity to changes in price level

Q: Question 16 All taxes create some deadweight loss except those on goods that can be resold for a…

A: Answer: Option E (with a perfectly inelastic demand or supply) Explanation: If either the demand or…

Q: .Given the following information Qd= 240 – 5p Qs= P Where Qd is the quantity demanded, Qs is…

A: Perfect competition refers to the situation where there are many buyers and sellers exist in the…

Q: The government of a State has been experiencing an increase in number of obesity cases. Research…

A: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question and…

Q: Given the following information Qd= 240 – 5p Qs = P Where Qd is the quantity demanded, Qs is…

A: The equilibrium condition is where the demand equals to the supply that is, Qd=Qs

Q: . Suppose that the market demand for coffee is Pd = 15 - Qd and the market supply is PsQs-5. What is…

A: In a free market, the equilibrium price and quantity is determined by the forces of the demand and…

Q: Which of the following statements about dead weight loss is false: A)If supply is price elastic,…

A: Answer - Need to find- Which of the following statements about deadweight loss is false Evaluating…

Q: The government of a State has been experiencing an increase in number of obesity cases. Research…

A: The point where demand is equal to its supply is the equilibrium point, at this point the price of…

Q: Given the following information: QD= 240-5P QS= P Where QD is the quantity demand, QS is the…

A: ANS Given; QD=240-5PQS=P At equilibrium QD = QS ∴240-5P=P⇒6P=240⇒P=2406=40 Putting P = 40 in the…

Q: Given the following information QD = 240-5P QS= P Where QD is the quantity demanded, Qs is the…

A: Qd = 240 - 5P Qs = P These equations can be rewritten as Q = 240 - 5P 5P = 240 - Q P = 48 - 0.2Q…

Q: Question 2a - Part 2 Given the following information Qp = 240 - 5P Qs = P %3D where Qp is the…

A:

Q: Given the following information Qp = 240 – 5P Qs = P where Qp is the quantity demanded, Qs is the…

A: Given QD = 240 - 5P QS = P Before Tax At Equilibrium QD =QS240 - 5P = P240 = P + 5P240 = 6PP =…

Q: If the government imposes a $5 excise tax on the production of wine, then from the perspective of…

A: Consider a liner supply function P=a+bQ .... (1)

Q: Given the inelasticity of cigarette demand, discuss an excise tax on cigarettes in terms of…

A: Inelastic demand is one in which there is a slight change in the quantity demanded due to a price…

Q: Equation: Qd (p) = 18-p and Qs (p) = 2p Suppose the goverment imposes a $3 per-unit tax (T =3) on…

A: Qd=18-pQs=2pNow, the equilibriumy price is when:Qd=Qs18-p=2p18=2p+p3p=18p=183p=6Now, substituting…

A5

Step by step

Solved in 2 steps with 1 images

- After the excise tax is imposed, what is the new equilibrium quantity of sofas? d. What is the total amount of revenue collected by the government from the excise tax on sofas?The gasoline demand equation is 100 -20P and the gasoline supply one is 48P. I am trying to figure out if the government levies a Pigouvian tax of $50/ton CO2, what is the effective tax per gallon of gas? Each gallon of gasoline releases 20 lbs (or 0.009 tons) of CO2 when combusted.Suppose the supply of a good is given by the equation QS=600P−1,200 , and the demand for the good is given by the equation QD=1,600−200P , where quantity (Q) is measured in millions of units and price (P) is measured in dollars per unit. The government decides to levy an excise tax of $2.00 per unit on the good, to be paid by the seller. Calculate the value of each of the following, before the tax and after the tax, to complete the table that follows: 1. The equilibrium quantity produced 2. The equilibrium price consumers pay for the good 3. The price received by sellers Before Tax After Tax Equilibrium Quantity (Millions of units) Equilibrium Price per Unit Paid by Consumers Price per Unit Received by Sellers Given the information you calculated in the preceding table, the tax incidence on consumers is per unit of the good, and the tax incidence on producers is per unit of the good. The government receives in tax revenue from levying an excise tax of $2.00 per unit on this good. True…

- Given the following information: QD= 240-5P QS= P Where QD is the quantity demand, QS is the quantity supplied and P is the price. Suppose the government decides to impose tax of $12 per unit on sellers in the market. Determine: Tax revenue _____________.Equation: Qd (p) = 18-p and Qs (p) = 2p Suppose the goverment imposes a $3 per-unit tax (T =3) on each unit of the good being produced. That is, the firms have to pay $3 to the government each time they produce and sell a unit of output . a.) What will be the new equilibrium quantity?Given the following information QD = 240-5p QS = P Where QD is the quantity demanded, Qs is the quantity supplied and P is the price. What is the Equilibrium quantity before tax

- Given the following information QD = 240-5P QS= P Where QD is the quantity demanded, Qs is the quantity supplied and P is the price. Suppose the government decides to impose a tax of $12 per unit on sellers in this market. Determine the Buyers price after tax.Given the following information QD = 240-5P QS= P Where QD is the quantity demanded, Qs is the quantity supplied and P is the price. Suppose the government decides to impose a tax of $12 per unit on sellers in this market. Determine the quantity after tax.Given the following information Qd= 240 – 5p Qs = P Where Qd is the quantity demanded, Qs is the quantity supplied and P is the price.Suppose that the government decides to impose a tax of $12 per unit on sellers in this market. Determine the buyers price after tax

- Given the following information QD = 240-5P QS= P Where QD is the quantity demanded, Qs is the quantity supplied and P is the price. Suppose that the government decides to impose a tax of $12 per unit on sellers in this market. Determine the Demand and Supply equation after the tax.Please help me to ensuere that my answers are correct. Complete all of the blanks. What is the pre-tax equilibrium price Using the demand schedule, what is the elasticity of demand (using the traditional method) if the price had changed the equilibrium price to $60 ? Is it (elastic, inelastic, unit elastic, perfectly elastic, perfectly inelastic): Suppose a $10 tax will be imposed on the production of item A, who will carry more of the burden? (consumer, supplier, neither, equal) The consumer surplus after taxes is The total surplus after taxes is 3 : The total tax revenue is The tax has now been removed because people thought it was unfair. Will total surplus increase, decrease, or stay the same? ]By what amount if any? [ The government decides to impose a price floor at $20. After their action, what is the market price? If there is a shortage or surplus, how much is it? (0 if there isn't one) They then repeal the price floor and create a price ceiling at $40. What is the market price…Given: Qd = 240 - 5P Qs = P Where Qd is the quantity demanded, Qs is the quantity supplied and P is the price. Suppose the government decides to impose a tax of $12.00 per unit on sellers in this market. A) What is the supply equation after tax? B) What is the demand equation after tax?