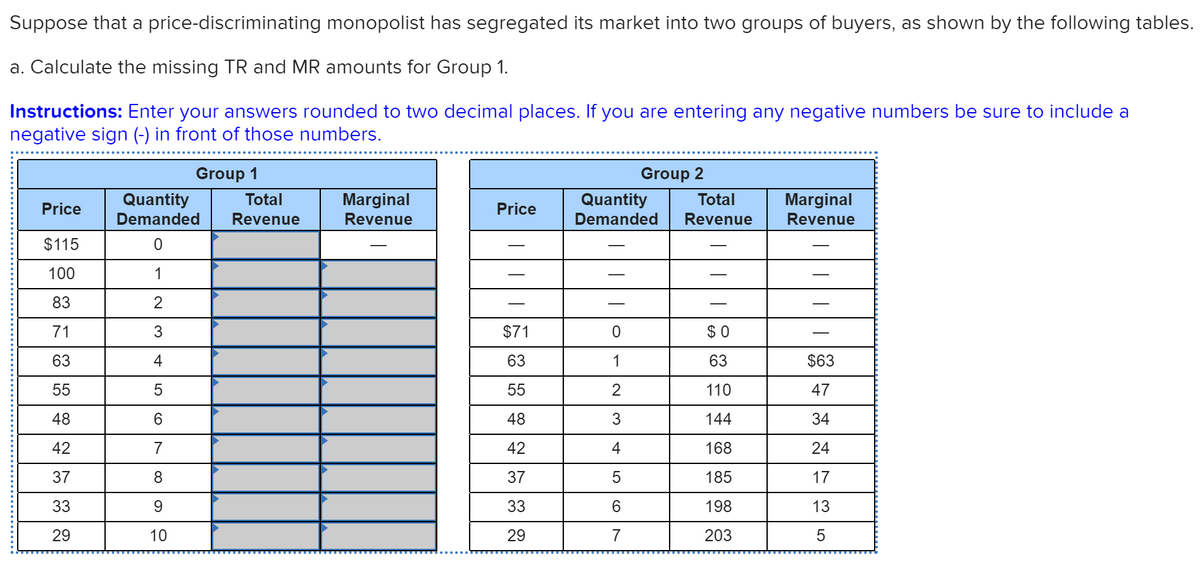

Suppose that a price-discriminating monopolist has segregated its market into two groups of buyers, as shown by the following tables. a. Calculate the missing TR and MR amounts for Group 1. Instructions: Enter your answers rounded to two decimal places. If you are entering any negative numbers be sure to include a negative sign (-) in front of those numbers. Group 1 Group 2 Quantity Demanded Total Marginal Quantity Demanded Marginal Revenue Total Price Price Revenue Revenue Revenue $115 100 1 - 83 2 71 3 $71 $ 0 63 63 1 63 $63 55 55 2 110 47 48 6 48 3 144 34 42 7 42 168 24 37 8 37 5 185 17 33 9. 33 198 13 29 10 29 7 203

Suppose that a price-discriminating monopolist has segregated its market into two groups of buyers, as shown by the following tables. a. Calculate the missing TR and MR amounts for Group 1. Instructions: Enter your answers rounded to two decimal places. If you are entering any negative numbers be sure to include a negative sign (-) in front of those numbers. Group 1 Group 2 Quantity Demanded Total Marginal Quantity Demanded Marginal Revenue Total Price Price Revenue Revenue Revenue $115 100 1 - 83 2 71 3 $71 $ 0 63 63 1 63 $63 55 55 2 110 47 48 6 48 3 144 34 42 7 42 168 24 37 8 37 5 185 17 33 9. 33 198 13 29 10 29 7 203

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter10: Forecasting Financial Statement

Section: Chapter Questions

Problem 4QE: Suppose you are analyzing a firm that is successfully executing a strategy that differentiates its...

Related questions

Question

100%

Transcribed Image Text:Suppose that a price-discriminating monopolist has segregated its market into two groups of buyers, as shown by the following tables.

a. Calculate the missing TR and MR amounts for Group 1.

Instructions: Enter your answers rounded to two decimal places. If you are entering any negative numbers be sure to include a

negative sign (-) in front of those numbers.

Group 1

Group 2

Total

Marginal

Revenue

Quantity

Total

Quantity

Demanded

Marginal

Revenue

Price

Price

Revenue

Demanded

Revenue

$115

100

1

83

71

3

$71

$ 0

63

4

63

1

63

$63

55

55

2

110

47

48

6.

48

144

34

42

7

42

4

168

24

37

8

37

185

17

33

9.

33

6.

198

13

29

10

29

7

203

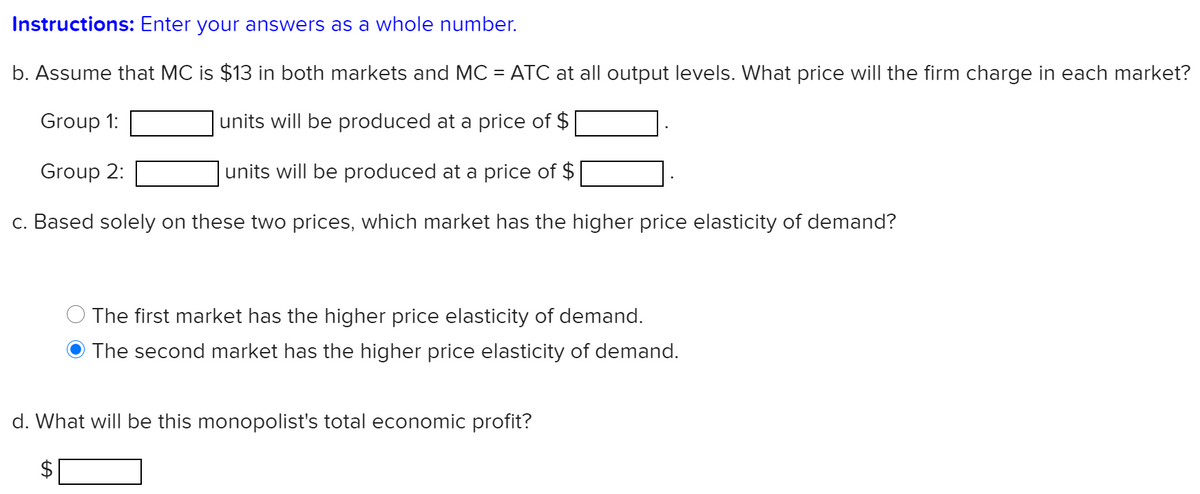

Transcribed Image Text:Instructions: Enter your answers as a whole number.

b. Assume that MC is $13 in both markets and MC = ATC at all output levels. What price will the firm charge in each market?

Group 1:

units will be produced at a price of $

Group 2:

units will be produced at a price of $

c. Based solely on these two prices, which market has the higher price elasticity of demand?

The first market has the higher price elasticity of demand.

The second market has the higher price elasticity of demand.

d. What will be this monopolist's total economic profit?

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning