Suppose that in the past year your only deductible expenses were $2000 in mortgage interest and $5000 in charitable contributions. If you are entitled to a standard deduction of $6100, then the maximum total deduction you can claim is how much? Choose the correct answer below. O A. $6100, because that is the sum of the deductible expenses O B. $6100, because that is the standard deduction OC. $7000, because that is the sum of the deductible expenses O D. $13,100, because that is the sum of the deductible expenses and the standard deduction O E. S7000, because that is the product of the deductible expenses OF. $13,100, because that is the product of the deductible expenses and the standard deduction

Suppose that in the past year your only deductible expenses were $2000 in mortgage interest and $5000 in charitable contributions. If you are entitled to a standard deduction of $6100, then the maximum total deduction you can claim is how much? Choose the correct answer below. O A. $6100, because that is the sum of the deductible expenses O B. $6100, because that is the standard deduction OC. $7000, because that is the sum of the deductible expenses O D. $13,100, because that is the sum of the deductible expenses and the standard deduction O E. S7000, because that is the product of the deductible expenses OF. $13,100, because that is the product of the deductible expenses and the standard deduction

Chapter20: Corporations And Parterships

Section: Chapter Questions

Problem 34P

Related questions

Question

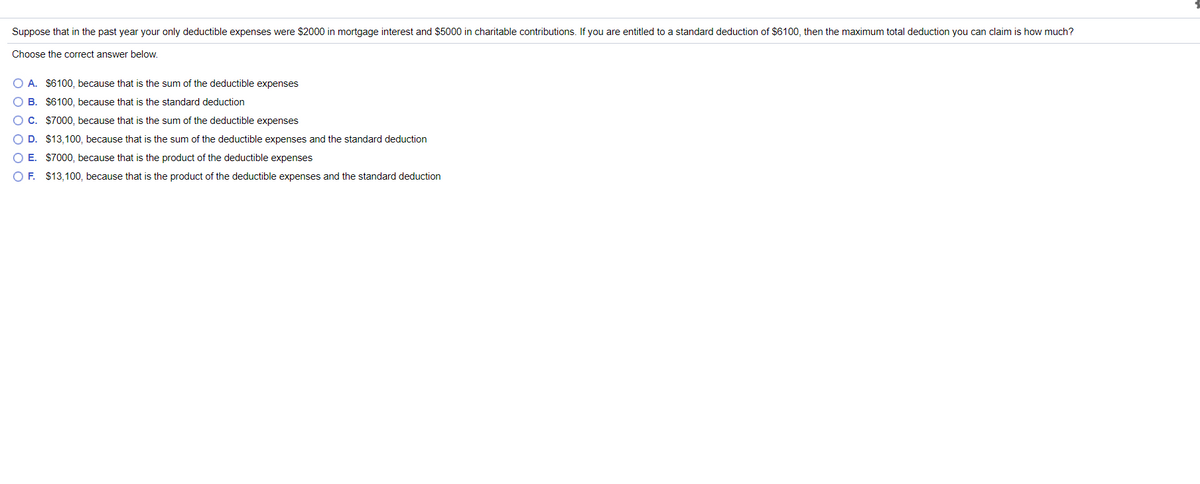

Transcribed Image Text:Suppose that in the past year your only deductible expenses were $2000 in mortgage interest and $5000 in charitable contributions. If you are entitled to a standard deduction of $6100, then the maximum total deduction you can claim is how much?

Choose the correct answer below.

O A. $6100, because that is the sum of the deductible expenses

O B. $6100, because that is the standard deduction

OC. $7000, because that is the sum of the deductible expenses

O D. $13,100, because that is the sum of the deductible expenses and the standard deduction

O E. S7000, because that is the product of the deductible expenses

O F. $13,100, because that is the product of the deductible expenses and the standard deduction

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College