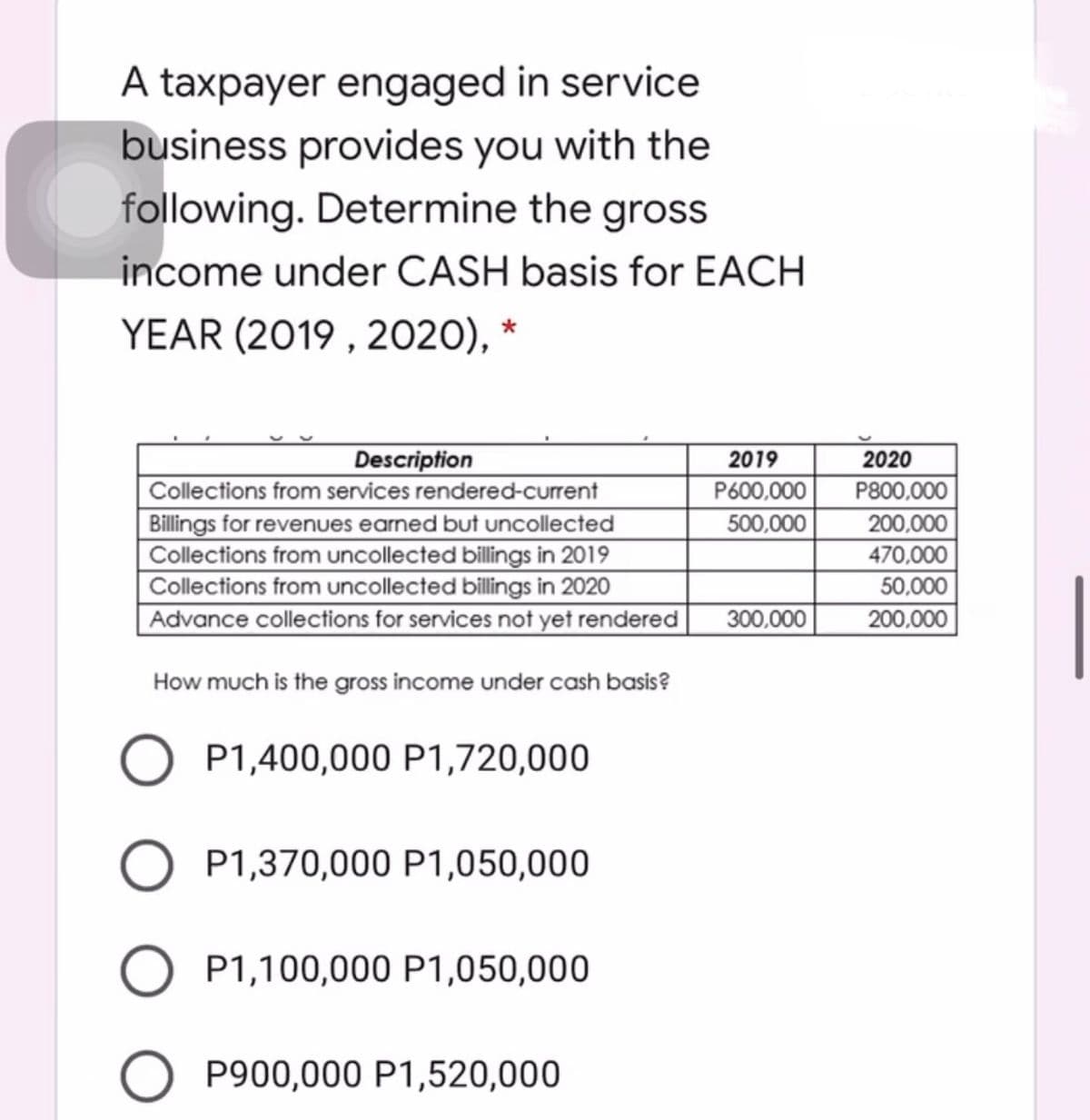

A taxpayer engaged in service business provides you with the following. Determine the gross income under CASH basis for EACH YEAR (2019 , 2020), * 2019 2020 Description Collections from services rendered-current P600,000 P800,000 Billings for revenues earned but uncollected Collections from uncollected billings in 2019 Collections from uncollected billings in 2020 Advance collections for services not yet rendered 500,000 200,000 470,000 50.000 200,000 300,000 How much is the gross income under cash basis? P1,400,000 P1,720,000 P1,370,000 P1,050,000 P1,100,000 P1,050,000 RO00 000 R1 530.000

A taxpayer engaged in service business provides you with the following. Determine the gross income under CASH basis for EACH YEAR (2019 , 2020), * 2019 2020 Description Collections from services rendered-current P600,000 P800,000 Billings for revenues earned but uncollected Collections from uncollected billings in 2019 Collections from uncollected billings in 2020 Advance collections for services not yet rendered 500,000 200,000 470,000 50.000 200,000 300,000 How much is the gross income under cash basis? P1,400,000 P1,720,000 P1,370,000 P1,050,000 P1,100,000 P1,050,000 RO00 000 R1 530.000

Chapter4: Gross Income: Concepts And Inclusions

Section: Chapter Questions

Problem 9DQ

Related questions

Question

Please also answer under accrual basis

Transcribed Image Text:A taxpayer engaged in service

business provides you with the

following. Determine the gross

income under CASH basis for EACH

YEAR (2019 , 2020),

2019

Description

Collections from services rendered-current

2020

P600,000

P800,000

Billings for revenues earned but uncollected

Collections from uncollected billings in 2019

Collections from uncollected billings in 2020

Advance collections for services not yet rendered

200,000

470,000

50,000

200,000

500,000

300,000

How much is the gross income under cash basis?

O P1,400,000 P1,720,000

P1,370,000 P1,050,000

P1,100,000 P1,050,000

O P900,000 P1,520,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT