Suppose that Jerry Tan has surplus funds to invest in both stocks, Alpha and Beta. He has decided to form a portfolio with investment in both stocks. The correlation coefficient between the expected return of both stocks is 0.8 and the weightage of investment is 40% for Stock Alpha and 60% for Stock Beta. Required: (i) Compute the expected return of the portfolio. (ii) Compute the variance of the portfolio. (iii) Compute the standard deviation of the portfolio.

Suppose that Jerry Tan has surplus funds to invest in both stocks, Alpha and Beta. He has decided to form a portfolio with investment in both stocks. The correlation coefficient between the expected return of both stocks is 0.8 and the weightage of investment is 40% for Stock Alpha and 60% for Stock Beta. Required: (i) Compute the expected return of the portfolio. (ii) Compute the variance of the portfolio. (iii) Compute the standard deviation of the portfolio.

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter14: Real Options

Section: Chapter Questions

Problem 10MC

Related questions

Question

Suppose that Jerry Tan has surplus funds to invest in both stocks, Alpha and Beta. He has decided to form a portfolio with investment in both stocks. The correlation coefficient between the expected return of both stocks is 0.8 and the weightage of investment is 40% for Stock Alpha and 60% for Stock Beta.

Required:

(i) Compute the expected return of the portfolio.

(ii) Compute the variance of the portfolio.

(iii) Compute the standard deviation of the portfolio.

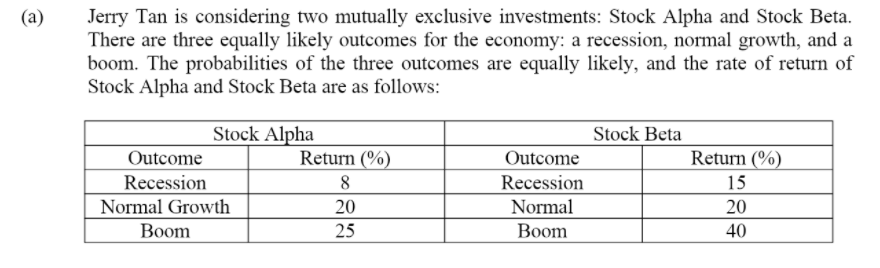

Transcribed Image Text:Jerry Tan is considering two mutually exclusive investments: Stock Alpha and Stock Beta.

There are three equally likely outcomes for the economy: a recession, normal growth, and a

boom. The probabilities of the three outcomes are equally likely, and the rate of return of

Stock Alpha and Stock Beta are as follows:

(a)

Stock Alpha

Stock Beta

Outcome

Return (%)

Outcome

Return (%)

Recession

Normal Growth

8

Recession

15

20

Normal

20

Boom

25

Boom

40

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning