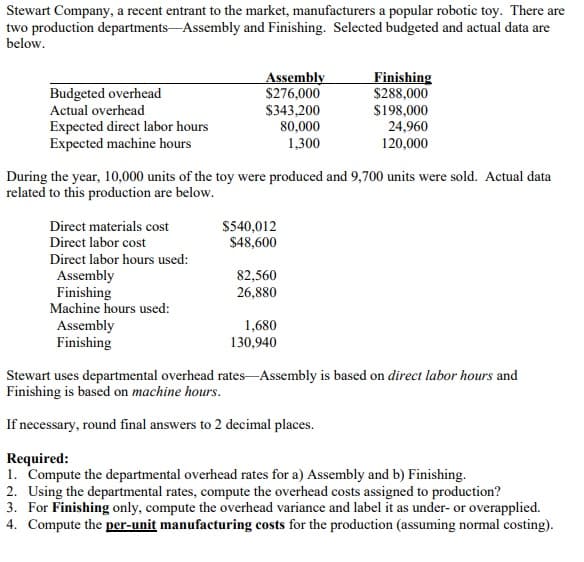

geted al o ctec ctec rear, s pr ct m et la ct la emb ishir nine emb ishir - dep

Q: Ayo Company started 2022 with P94,000 of merchandise inventory on hand. During 2022, P400,000 in mer...

A: Note: 1/15, n/45: Here, 1 represents the discount rate if payment is made within 15 days. And if pay...

Q: 3. Assume the company uses absorption costing and a FIFO inventory flow assumption (FIFO means first...

A: Using FIFO method, goods produced first are to be sold first and using LIFO method, goods produced l...

Q: Blue Limited uses a perpetual inventory system. The inventory records show the following data for it...

A: FIFO is the method of inventory valuation whereby the goods that are initially bought are to be sold...

Q: April May June Manufacturing costs* $156,800 $195,200 $217,600 Insurance expense** 1,000 1,000 1,000...

A: Solution Cash budget is a document produced to help a business manage their cash flows.

Q: Redwood Company sells craft kits and supplies to retail outlets and through its catalog. Some of the...

A: Activity based Costing - In this type of costing, cost are allocated on the basis on no of cost pool...

Q: Compare and contrast the built-in loss duplication rule as it relates to §351 with the built-in loss...

A: The term "complete liquidation" refers to the situation in which a company is unable to continue ope...

Q: riole Company purchased a machine on January 1, 2019, for $927000. At the date of acquisition, the m...

A: Solution Given Cost 927000 Original estimated life 6 years Revised useful life 8 y...

Q: Yellow Company’s inventory at December 31, 2021 was P570,000 based on a physical count of goods pric...

A: Under FOB destination, titles of goods are transferred to the buyer only when goods are delivered to...

Q: AJUMA Farms operates a farm with various plants and a herd of animals. On January 1, 2020, it had te...

A: December 31, 2021 Fair value with no growth (Same Age) 1 years old animal = 10 x 600 = 6,000 Fair ...

Q: The journal entry needed to record P5,000 of advertising for Westwood Manufacturing would include: O...

A: Solution A Journal is a company's official book in which all business transactions are recorded in c...

Q: Activity-Based Costing, Traditional Costing 1. The controller for Mitchell Supply Company has establ...

A: Activity based costing is one of the type of costing system, which shows that all indirect costs and...

Q: The information is taken from the records of Paul Company for 2020: Payment of dividends $4,000 Incr...

A: Cash flow from operating activities indicates the cash inflow or outflow transactions related to the...

Q: The terms of a(n) are specified when an accountant and a client enter into a contract for the provis...

A: Accountant is the person who provides the service of book keeping, tax preparation or accounting. Th...

Q: Please see the picture below. I need help making a retained earnings statement, a balance sheet, a c...

A: Profit margin = Net Income / Sale x 100 Gross margin = Gross Profit / Sales x100

Q: A wholly-owned subsidiary of a corporation is liguidated. The corporation has a basis of $300,000 in...

A: Realized gain Realized gain is referred to as those results from selling an asset at a price higher...

Q: Meena is a trader. On 31 December 2017 Meena's cash book (bank columns) showed an overdrawn balance ...

A: The bank reconciliation statement is prepared to equate the balances of cash book and passbook with ...

Q: A group of thirty 2-year old cattle was held at January 1, 2021. On this same date, additional five...

A: Fair value means replacement value or price at which product can be resold to the customers in the m...

Q: On January 1, 2022. TGIG sold equipment with historical cost of P10,000,000 and accumulated deprecia...

A: Carrying amount of the Note = Present value of the annual instalments where, Present value of the an...

Q: Computing the Proceeds from the Sale of Notes Receivable Below are several customer notes receivable...

A: Maturity Value = Face Value of Note + Interest to Maturity Proceeds = Maturity Value - Discount All ...

Q: O c. callable bom O d. debenture E

A:

Q: If bonds are issued between interest dates, the entry on the bocC of the issuing corporation could i...

A: Interest is calculated on face value of a bond.

Q: Requirements: 1 Aug Started business with $150, 000 in the bank 3 Aug Bo...

A: A journal entry is a form of accounting entry that is used to report a business transaction in a com...

Q: da loa er 31,

A: Interest Income - It is the amount of money paid by the borrower over and above the loan amount to t...

Q: Data concerning Runnells Corporation's single product appear below: Per Unit % of Sales Selling Pric...

A: Marginal Costing - Marginal Costing is the method of computing operating profit by bifurcating varia...

Q: A concrete pavement on a street would cost 10000 and would last for 5 years with a negligible repair...

A: solution given Initial cost 10000 Annual repair cost 1000 Life 5 years Interes...

Q: The following data pertain to a particular item sold by Pomegranate Company. 8/1 – Beg. invy: 2,000...

A: Weighted Average Method In the weighted average method each time purchases made by the entity and th...

Q: CH11_HW_QA2_PIR Required 1: 1-a. Compute the throughput time for each month. 1-b. Compute the man...

A: Throughout time This was the Managerial Accounting techniques to find out the production time of the...

Q: Changes in Current Operating Assets and Liabilities-Indirect Method Victor Corporation's comparative...

A: Cash flow from operating activities indicates the cash inflow or outflow transactions related to the...

Q: How much were the discounts lost?

A: Solution Concept Discount term 3/10 net 30 means that if the payment is made within 10 days of invoi...

Q: Compute the company’s return on investment (ROI) for the period using the ROI formula stated in term...

A: The question pertains to calculation of ROI in terms of net margin and turnover. This method used tw...

Q: At the end of 202

A:

Q: A wholly-owned subsidiary of a corporation is liquidated. The corporation has a basis of $300,000 in...

A: Recognized gain: Recognized gains are represented inside the distinction between the preliminary cos...

Q: Unit Selling Price Ave. Unit (Updated) P 400 1,300 1,700 1,250 600 No. Brand Туре Size Units Unit Co...

A: Inventory is written in the balance sheet under current assets. It should be recorded at lower of co...

Q: What is the carrying amount of the note as of December 31, 2022? On January 1, 2022. TGIG sold equip...

A: Carrying amount of the Note = Present value of the annual instalments where, Present value of the an...

Q: 5. Pong Incorporated's income statement for the most recent month is given below. Total $150,000 60,...

A: Net Operating Income: Net operating income (NOI) decides an element's or alternately property's inco...

Q: The interest rate written in the terms of the bond indenture is known as the 14 Select one: O a. cou...

A: Solution Concept The rate stated in the bond instrument is called the stated rate Coupon rate means...

Q: The following information on cost and net realizable value of Bramble Ltd's various inventory catego...

A: Lets understand the basics. As per IAS 2 "Inventory", inventory should be recoded at cost or NRV whi...

Q: Before Pronghorn Corporation engages in the following treasury stock transactions, its general ledge...

A: Sno Account Titles and Explanation Debit Credit A Treasury Stock (370 shares X $ 40 per share...

Q: The Blueberry Company values its inventory by using the FIFO retail method.. The following informati...

A: FIFO stands for First in First out. The goods Purchased first are to be sold first.

Q: On January 1, 2021, Ackerman Company acquires 80% of Seidel Company for $1,712,000 in cash considera...

A: Consolidation When the financial performance and the position of a parent and a subsidiary company a...

Q: On January 1, Year 1, Kennard Co. issued $2,000,000, 5%, 10-year bonds, with interest payable on Jun...

A:

Q: Direct materials Direct labour Variable overhead: Supplies Maintenance Power $5.50 2.8 0.65 0.25 0.1...

A: Solution Concept Flexible budget is a budget which is prepared by adjusting the variable cost as per...

Q: You are assigned to prepare the financial statements of LIVA Company for the year 2021. The followin...

A: Average Cost Method: The average cost technique gives a cost to inventory items based on the overall...

Q: 8.Which of the following occurs/takes place under the gross price method of recording purchases? a...

A: Gross price method of recording purchases is the method of recording purchases which will not consid...

Q: cash discounts taken dur

A: dsocunt rate of 3/10, net 30 means 3% cash discount if the payment is made within 3 days, else full ...

Q: The packaging department began the month with 500 units that were 100% complete with regard to mater...

A: Units transferred out = Beginning WIP + Units started - Ending WIP Compute the equivalent units of m...

Q: When the market rate of interest was 12%, Halprin Corporation issued s768,000, 11%, five year bonds ...

A: Lets understand the basics. When market interest rate is more than the bond interest rate bond is kn...

Q: What is the cost of ending inventory

A: Retail inventory method refers to an accounting method which is used by the companies to compute the...

Q: Instructions Prepare an income statement, a retained carnings statement, and a balance sheet from th...

A: Plevin Company's Income Statement, Statement of Retained Earnings and Balance Sheet are attached in ...

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 5 images

- Firenza Company manufactures specialty tools to customer order. Budgeted overhead for the coming year is: Previously, Sanjay Bhatt, Firenza Companys controller, had applied overhead on the basis of machine hours. Expected machine hours for the coming year are 50,000. Sanjay has been reading about activity-based costing, and he wonders whether or not it might offer some advantages to his company. He decided that appropriate drivers for overhead activities are purchase orders for purchasing, number of setups for setup cost, engineering hours for engineering cost, and machine hours for other. Budgeted amounts for these drivers are 5,000 purchase orders, 500 setups, and 2,500 engineering hours. Sanjay has been asked to prepare bids for two jobs with the following information: The typical bid price includes a 40 percent markup over full manufacturing cost. Required: 1. Calculate a plantwide rate for Firenza Company based on machine hours. What is the bid price of each job using this rate? 2. Calculate activity rates for the four overhead activities. What is the bid price of each job using these rates? 3. Which bids are more accurate? Why?Adam Corporation manufactures computer tables and has the following budgeted indirect manufacturing cost information for the next year: If Adam uses the step-down (sequential) method, beginning with the Maintenance Department, to allocate support department costs to production departments, the total overhead (rounded to the nearest dollar) for the Machining Department to allocate to its products would be: a. 407,500. b. 422,750. c. 442,053. d. 445,000.Assume that at the beginning of 20x2, Cicleta trained the 2 assembly workers in a new approach that had the objective of increasing the efficiency of the assembly process. Cicleta also began moving toward a JIT purchasing and manufacturing system. When JIT is fully implemented, the demand for expediting is expected to be virtually eliminated. It is expected to take two to three years for full implementation. Assume that receiving cost is a step-fixed cost with steps of 1,500 orders. The other three activities employ resources that are acquired as used and needed. At the end of 20x2, the following results were reported for the four activities: Required: 1. Prepare a trend report that shows the non-value-added costs for each activity for 20x1 and 20x2 and the change in costs for the two periods. Discuss the reports implications. 2. Explain the role of activity reduction for receiving and for expediting. What is the expected value of SQ for each activity after JIT is fully implemented? 3. What if at the end of 20x2, the selling price of a competing product is reduced by 27 per unit? Assume that the firm produces and sells 20,000 units of its product and that its product is associated only with the four activities being considered. By virtue of the waste-reduction savings, can the competitors price reduction be matched without reducing the unit profit margin of the product that prevailed at the beginning of the year? If not, how much more waste reduction is needed to achieve this outcome? In this case, what price decision would you recommend?

- Hatch Manufacturing produces multiple machine parts. The theoretical cycle time for one of its products is 65 minutes per unit. The budgeted conversion costs for the manufacturing cell dedicated to the product are 12,960,000 per year. The total labor minutes available are 1,440,000. During the year, the cell was able to produce 0.6 units of the product per hour. Suppose also that production incentives exist to minimize unit product costs. Required: 1. Compute the theoretical conversion cost per unit. 2. Compute the applied conversion cost per minute (the amount of conversion cost actually assigned to the product). 3. Discuss how this approach to assigning conversion cost can improve delivery time performance. Explain how conversion cost acts as a performance driver for on-time deliveries.Douglas Davis, controller for Marston, Inc., prepared the following budget for manufacturing costs at two different levels of activity for 20X1: During 20X1, Marston worked a total of 80,000 direct labor hours, used 250,000 machine hours, made 32,000 moves, and performed 120 batch inspections. The following actual costs were incurred: Marston applies overhead using rates based on direct labor hours, machine hours, number of moves, and number of batches. The second level of activity (the right column in the preceding table) is the practical level of activity (the available activity for resources acquired in advance of usage) and is used to compute predetermined overhead pool rates. Required: 1. Prepare a performance report for Marstons manufacturing costs in the current year. 2. Assume that one of the products produced by Marston is budgeted to use 10,000 direct labor hours, 15,000 machine hours, and 500 moves and will be produced in five batches. A total of 10,000 units will be produced during the year. Calculate the budgeted unit manufacturing cost. 3. One of Marstons managers said the following: Budgeting at the activity level makes a lot of sense. It really helps us manage costs better. But the previous budget really needs to provide more detailed information. For example, I know that the moving materials activity involves the use of forklifts and operators, and this information is lost when only the total cost of the activity for various levels of output is reported. We have four forklifts, each capable of providing 10,000 moves per year. We lease these forklifts for five years, at 10,000 per year. Furthermore, for our two shifts, we need up to eight operators if we run all four forklifts. Each operator is paid a salary of 30,000 per year. Also, I know that fuel costs about 0.25 per move. Assuming that these are the only three items, expand the detail of the flexible budget for moving materials to reveal the cost of these three resource items for 20,000 moves and 40,000 moves, respectively. Based on these comments, explain how this additional information can help Marston better manage its costs. (Especially consider how activity-based budgeting may provide useful information for non-value-added activities.)Nozama.com Inc. sells consumer electronics over the Internet. For the next period, the budgeted cost of the sales order processing activity is 250,000 and 50,000 sales orders are estimated to be processed. a. Determine the activity rate of the sales order processing activity. b. Determine the amount of sales order processing cost associated with 30,000 sales orders.

- Krouse Company produces two products, forged putter heads and laminated putter heads, which are sold through specialty golf shops. The company is in the process of developing itsoperating budget for the coming year. Selected data regarding the companys two products areas follows: Manufacturing overhead is applied to units using direct labor hours. Variable manufacturing overhead Ls projected to be 25,000, and fixed manufacturing overhead is expected to be15,000. The estimated cost to produce one unit of the laminated putter head is: a. 42. b. 46. c. 52. d. 62.Handbrain Inc. is considering a change to activity-based product costing. The company produces two products, cell phones and tablet PCs, in a single production department. The production department is estimated to require 2,000 direct labor hours. The total indirect labor is budgeted to be 200,000. Time records from indirect labor employees revealed that they spent 30% of their time setting up production runs and 70% of their time supporting actual production. The following information about cell phones and tablet PCs was determined from the corporate records: a. Determine the indirect labor cost per unit allocated to cell phones and tablet PCs under a single plantwide factory overhead rate system using the direct labor hours as the allocation base. b. Determine the budgeted activity costs and activity rates for the indirect labor under activity-based costing. Assume two activitiesone for setup and the other for production support. c. Determine the activity cost per unit for indirect labor allocated to each product under activity-based costing. d. Why are the per-unit allocated costs in (a) different from the per-unit activity cost assigned to the products in (c)?Harriman Industries manufactures engines for the aerospace industry. It has completed manufacturing the first unit of the new ZX-9 engine design. Management believes that the 1,000 labor hours required to complete this unit are reasonable and is prepared to go forward with the manufacture of additional units. An 80 percent cumulative average-time learning curve model for direct labor hours is assumed to be valid. Data on costs are as follows: Required: 1. Set up a table with columns for cumulative number of units, cumulative average time per unit in hours, and the cumulative total time in hours. Complete the table for 1, 2, 4, 8, 16, and 32 units. (Round hours to one significant digit.) 2. What are the total variable costs of producing 1, 2, 4, 8, 16, and 32 units? What is the variable cost per unit for 1, 2, 4, 8, 16, and 32 units?

- Jacson Company produces two brands of a popular pain medication: regular strength and extra strength. Regular strength is produced in tablet form, and extra strength is produced in capsule form. All direct materials needed for each batch are requisitioned at the start. The work orders for two batches of the products are shown below, along with some associated cost information: In the Mixing Department, conversion costs are applied on the basis of direct labor hours. Budgeted conversion costs for the department for the year were 60,000 for direct labor and 190,000 for overhead. Budgeted direct labor hours were 5,000. It takes one minute of labor time to mix the ingredients needed for a 100-unit bottle (for either product). In the Bottling Department, conversion costs are applied on the basis of machine hours. Budgeted conversion costs for the department for the year were 400,000. Budgeted machine hours were 20,000. It takes one-half minute of machine time to fill a bottle of 100 units. Required: 1. What are the conversion costs applied in the Mixing Department for each batch? The Bottling Department? 2. Calculate the cost per bottle for the regular and extra strength pain medications. 3. Prepare the journal entries that record the costs of the 12,000 regular strength batch as it moves through the various operations. 4. Suppose that the direct materials are requisitioned by each department as needed for a batch. For the 12,000 regular strength batch, direct materials are requisitioned for the Mixing and Bottling departments. Assume that the amount of cost is split evenly between the two departments. How will this change the journal entries made in Requirement 3?Corazon Manufacturing Company has a purchasing department staffed by five purchasing agents. Each agent is paid 28,000 per year and is able to process 4,000 purchase orders. Last year, 17,800 purchase orders were processed by the five agents. Required: 1. Calculate the activity rate per purchase order. 2. Calculate, in terms of purchase orders, the: a. total activity availability b. unused capacity 3. Calculate the dollar cost of: a. total activity availability b. unused capacity 4. Express total activity availability in terms of activity capacity used and unused capacity. 5. What if one of the purchasing agents agreed to work half time for 14,000? How many purchase orders could be processed by four and a half purchasing agents? What would unused capacity be in purchase orders?Salisbury Bottle Company manufactures plastic two-liter bottles for the beverage industry. The cost standards per 100 two-liter bottles are as follows: At the beginning of March, Salisburys management planned to produce 500,000 bottles. The actual number of bottles produced for March was 525,000 bottles. The actual costs for March of the current year were as follows: a. Prepare the March manufacturing standard cost budget (direct labor, direct materials, and factory overhead) for Salisbury, assuming planned production. b. Prepare a budget performance report for manufacturing costs, showing the total cost variances for direct materials, direct labor, and factory overhead for March. c. Interpret the budget performance report.