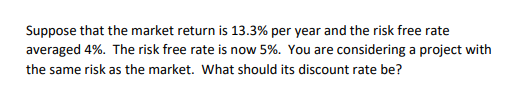

Suppose that the market return is 13.3% per year and the risk free rate averaged 4%. The risk free rate is now 5%. You are considering a project with the same risk as the market. What should its discount rate be?

Q: You’re trying to save to buy a new $245,000 Ferrari. You have $50,000 today that can be invested at…

A: The savings in a bank earn compound interest as the money of the account holder earns interest in a…

Q: Metalfab Pump and Filter expects the cost of steel bodies for 6-inch valves to increase by $3.75…

A: Present worth is calculated as follows using excel. Given Quarter Period Values of cash flows…

Q: Suppose that the index model for two Canadian stocks HD and ML is estimated with the following…

A: From the 2 equations, beta of stock HD and ML can be determined

Q: Find Operating Cash Flow (OCF) annually first ten years and terminal phase, with the following…

A: The Operating Cash Flow (OCF) for the first ten years and terminal phase can be calculated as…

Q: A project has a 0.37 chance of doubling my investment in a year and 0.63 chance of halving my…

A: Return on investment (ROI) is a performance metric used to evaluate how efficiently an investment is…

Q: Paisios Ltd paid a $4.00 dividend per share recently. Paisios normally pays dividends once year.…

A: Dividend is the part or share of profits being distributed to the shareholders. It can be in form of…

Q: Too Young, Incorporated, has a bond outstanding with a coupon rate of 6.5 percent and semiannual…

A: The cost of debt is the expected return of the bond. The after-tax cost of debt is the cost of debt…

Q: Suppose an investor wants to invest $X in a one-month portfolio consisting of ONE risk-free asset…

A: Investors typically cannot "short" risk-free assets, as they are considered safe investments with…

Q: Jiminy's Cricket Farm issued a bond with 20 years to maturity and a semiannual coupon rate of 6…

A: Cost of debt refers to the rate of interest after considering the tax that is paid by the company on…

Q: The most recent financial statements for Acer, Incorporated, are shown here: Income Statement Sales…

A: Answer Particulars Current Next Year Sales $31,800.00 $36,570.00 Cost $18,500.00 $21,275.00…

Q: Consider a European put with an exercise (strike) price of 5.00 and with 6 months to maturity. The…

A: The price of an European put option can be estimated using the Black-Scholes formula. The formula…

Q: Declining FCF Growth Valuation Brushy Mountain Mining Company's coal reserves are being depleted, so…

A: STEP 1 The worth of the company is calculated as the product of the stock value and the debt value.

Q: Calculate the Dividends per Share and Earnings per Share for each year for Brown Company

A: Earnings Per Share: It represents the earnings of a firm for each share held by the shareholder. It…

Q: For diagrams (a) to (d), compute the present values of the cash flows. 3000 200 175 2000 150 1000…

A: Present value is a financial concept that refers to the value of an asset or liability today, given…

Q: tions Select the images below to enlarge. Balance Sheet Murawski Company Balance Sheet December 31…

A: Inventory Turnover ratio is one of the efficiency ratio being used in business. This shows how many…

Q: Consider the following two mutually exclusive projects: Cash flow (A) -RM300,000 20,000 50,000…

A: If the payback period is less than the total estimated time required to recover the cost of the…

Q: Find the discount interest on Php35,500 for 130 days at a discount interest rate of 13.78%.

A: Discount interest is calculated as follows Discount Interest = Loan Amount * Interest rate * Number…

Q: Mortgage payments Principal: $180,000.00 Interest Monthly Rate Payment 3.5% 5% 6% $808 $966 $1070…

A: When a loan is taken then we have to make periodic payments towards that loan. The periodic…

Q: Jonabelle is considering investing in bonds. Some data are as follows: Face Value of bonds P…

A: Issue price of bonds would be present value of interest annuity & maturity amount at market rate…

Q: Provide examples of real-world situations where ALM helped financial institutions to manage risks…

A: Asset and Liability Management (ALM) is a critical function of financial institutions that helps…

Q: our father is about to retire, and he wants to buy an annuity that will provide him with $93,000 of…

A: Annuity is a type of security that pays periodic payments over a period of time. When the payment is…

Q: Seamus has made deposits of $84 into his savings account at the end of every month for 20 years. if…

A: STEP 1 Effective Rate The return on an investment or the amount of interest owing on a loan, when…

Q: Josh wants to determine the rate of return he needs to earn in order to net a real rate of return of…

A: STEP 1 The return on a particular investment computed as an annual percentage and adjusted for…

Q: You want to invest $100.00 for three years at 10%. What will the $100 dollars grow to?

A: Future Value refers to the value of the current asset or investment or of cash flows at a specified…

Q: Compute the number of years (t) if future value (FV) = $5575, present value (FV) = $1812, and…

A: Future Value (FV) is a financial term used to describe the value of an asset at a future date, given…

Q: (Related to Checkpoint 9.3) (Bond valuation relationships) You own a bond that pays $100 in annual…

A: Bond valuation refers to the computation of the fair price of the bond which is to be calculated…

Q: Closing Costs Credit report Loan origination fee Attorney and notary Documentation stamp Processing…

A: Loan amount The loan amount is the sum of money that you are currently obligated to pay us under…

Q: Year 0 1 2 3 Cash Flow -$ 18,400 10,700 9,600 6,100 a. What is the profitability index for the set…

A: Profitability index is the capital budgeting method for calculating the ratio of present value of…

Q: William Jackson, the CEO of RPL, has requested that the tests of controls only be performed once due…

A: Answer (a) 1. Audit procedure for automatically stop of order for any publisher who have exceeded…

Q: Find the semi-annual payment at the end of six months, the first payment is due at the end of 7.5…

A: An annuity is a type of security where periodic payments are made over a period of time. Deferred…

Q: d. What would happened to the price of Solarpower's common stock if it lowered its dividends to $4…

A: Stock Price: It represents the current value of a stock to the buyer and seller. The stock price…

Q: Explain the uses, limitations and merits of the Payback Period compared to Net Present Value in…

A: The payback period method is a capital budgeting method for discovering the period in which the…

Q: Find the compound amount for the following deposit. $18,000 at 6% compounded semi-annually for 7…

A: Answer Amount 18000 Year 7 Rate 6% Comounding Semi-Annualy

Q: The annual inflation rate in the U.S is expected to be 2.68 percent and the annual inflation rate in…

A: The annual inflation rate in the U.S (HUS) is expected to be 2.68 percent. The annual inflation rate…

Q: You are a consultant who was hired to evaluate a new product line for Markum Enterprises. The…

A: Net present value shows the difference between the present value of cash inflows and outflows during…

Q: " 10 1 2 13 14 15 16 17 18 19 20 Suppose you purchased a house 3 years ago and took out a mortgage…

A: NPV stands for net present value and shows the difference between the cash inflows and outflows…

Q: Whispering Corp. is planning to replace an old asset with new equipment that will operate more…

A: Data given: Book value of old asset=$ 2100 Selling price of old asset=$2100 Purchase price of new…

Q: The Lahiri family rents a room in their home on Airbnb. They deposit all of the money that they earn…

A: FV of an investment refers to the value of the cash flows at a maturity date assuming that they grow…

Q: is the meaning of the statement that your net worth is the equity you have in your own life

A: When do business there is some own money and some money is borrowed from the market and there is a…

Q: The balance sheet of Colton Corporation shows long-term debt of $50 million and shareholder equity…

A: Solution: Return on Equity (ROE) means the rate of return earned on shareholder’s equity. It is…

Q: Find the semi-annual payment at the end of six months, the first payment is due at the end of 7.5…

A: Future value (FV) refers to the value of an asset or cash at a specified date in the future,…

Q: where y is Walmart's annual revenue in billions of US dollars, and is the number of years since…

A: In finance we often have to make statistical analysis of the given financial information. This is…

Q: What rate compounded monthly will yield the effective rate 19.75%?

A: The effective rate is 19.75%. Compounding frequency is monthly.

Q: Calculate the cash flow from assets, cash flow to creditors, and cash flow to stockholders for 2022.

A: Cash flow from assets: It represents the total aggregate cash flow related to the business assets.…

Q: An investment project provides cash inflows of $660 per year for eight years. a. What is the project…

A: Payback period of each project is calculated using following equation Payback period = Initial…

Q: Valero Energy's balance sheet showed total current assets of $3,000, all of which were required in…

A: Net operating working capital is the difference between a company's current assets (excluding cash…

Q: Suppose that the year-end prices for one ounce of gold is the same as that of the data shown in the…

A: The HPR of an asset refers to the profit as a percentage of the initial price of the asset that has…

Q: hich ratio(s) would you rely on as an investor? What about as a business manager? Please explain r

A: The ratios are very important in analysing the data about the company and this gives idea about the…

Q: Find the payment necessary to amortize a 12% loan of $2300 compounded quarterly, with 12 quarterly…

A: PMT stands for "payment." In finance and accounting, PMT refers to a fixed payment amount made by a…

Q: 4 Horizontal and Vertical Analysis DIRECTIONS: Using these data from Rollaird Company's comparative…

A: Vertical analysis is one of the financial statement analysis under which each balance sheet item is…

Step by step

Solved in 2 steps

- Giorgio Co. is looking at an investment project with an internal rate of return of 10.8%. The initial outlay for the investment is $90,000. The hurdle rate or minimum acceptable rate of return is 10.2%.You are considering an investment. After a great deal of careful research you determine that the expected return on the investment is 15% per annum. You also estimate the beta to be 2.0. The risk-free rate of interest is 3% and the return on the market is expected to be 13%. Should you accept the project? Explain.A project has two possible outcomes. The good outcome returns $8,000 next year and occurs 88% of the time. The bad outcome is total failure, returning $0, the rest of the time. If the risk free interest rate is 4.8%, the expected market return is 10.4%, and the project beta is 1.1, what is the price of the project today?

- Suppose you have a project that has a .7 chance of doubling your investment in a year and a .3 chance of halving your investment in a year. What is the standard deviation of the rate of return on this investment?A project has two possible outcomes. The good outcome returns $9,000 next year and occurs 59% of the time. The bad outcome is total failure, retuming $0 , the rest of the time. If the risk free interest rate is 3.2% , the expected market return is 12.6% , and the project beta is 1.1 , what is the price of the project today?A project has a 0.68 chance of doubling your investment in a year and a 0.32 chance of halving your investment in a year. What is the standard deviation of the rate of return on this investment?

- Suppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 9 percent, and that the maximum allowable payback and discounted payback statistics for the project are 2.0 and 3.0 years, respectively. Time: 0 1 2 3 4 5 6 Cash flow: −$7,100 $1,000 $2,200 $1,400 $1,400 $1,200 $1,000 Use the IRR decision rule to evaluate this project. (Negative amount should be indicated by a minus sign. Round your answer to 2 decimal places.) Should it be accepted or rejected?multiple choice accepted rejectedSuppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 9 percent, and that the maximum allowable payback and discounted payback statistics for the project are 2.0 and 3.0 years, respectively. Time: 0 1 2 3 4 5 6 Cash flow: −$7,100 $1,100 $2,300 $1,500 $1,500 $1,300 $1,100 Use the NPV decision rule to evaluate this project. (Negative amount should be indicated by a minus sign. Do not round intermediateSuppose your firm is considering investing in a project with the cash flows shown as follows, that the required rate of return on projects of this risk class is 8 percent, and that the maximum allowable payback and discounted payback statistics for the project are 3.5 and 4.5 years, respectively. Use the IRR decision to evaluate this project; should it be accepted or rejected? Time 0 1 2 3 4 5 6 Cash Flow –$ 5,000 $ 1,200 $ 1,400 $ 1,600 $ 1,600 $ 1,100 $ 2,000

- A project has a forecasted cash flow of $121 in year 1 and $132 in year 2. The interest rate is 8%, the estimated risk premium on the market is 10.25%, and the project has a beta of 0.61. If you use a constant risk-adjusted discount rate, answer the following: What is the PV of the project? What is the certainty-equivalent cash flow in year 1 and year 2? What is the ratio of the certainty-equivalent cash flows to the expected cash?Suppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 7 percent, and that the maximum allowable payback and discounted payback statistics for the project are 3.5 and 4.5 years, respectively. Time: 0 1 2 3 4 5 6 Cash flow: −$5,300 $1,190 $2,390 $1,590 $1,590 $1,390 $1,190 Use the IRR decision rule to evaluate this project. IRR ________%Suppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 11 percent, and that the maximum allowable payback and discounted payback statistic for the project are 2 and 3 years, respectively. Time 0 1 2 3 4 5 6 Cash Flow -1,040 140 460 660 660 260 660 Use the NPV decision rule to evaluate this project; should it be accepted or rejected?