Suppose that the supply and demand for widgets is given by the following equations: QD = 36 – 3P = -12 + 5P What is the price elasticity of supply O a. -1 b. 5 C. 1/3 d. 5/3 QUESTION 2 Suppose that the supply and demand for widgets is given by the following equations: QD = 36 – 3P Qs = -12 + 5P If a tax were imposed on widgets, which of the following would be correct. a. The tax would be split between consumers and producers, but consumers would pay the majority of the tax b. The entire tax would be paid by producers c. The tax would be split between consumers and producers, but producers would pay the majority of the tax d. The entire tax would be paid by consumers

Suppose that the supply and demand for widgets is given by the following equations: QD = 36 – 3P = -12 + 5P What is the price elasticity of supply O a. -1 b. 5 C. 1/3 d. 5/3 QUESTION 2 Suppose that the supply and demand for widgets is given by the following equations: QD = 36 – 3P Qs = -12 + 5P If a tax were imposed on widgets, which of the following would be correct. a. The tax would be split between consumers and producers, but consumers would pay the majority of the tax b. The entire tax would be paid by producers c. The tax would be split between consumers and producers, but producers would pay the majority of the tax d. The entire tax would be paid by consumers

Microeconomics: Principles & Policy

14th Edition

ISBN:9781337794992

Author:William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:William J. Baumol, Alan S. Blinder, John L. Solow

Chapter17: Taxation And Resource Allocation

Section: Chapter Questions

Problem 4TY

Related questions

Question

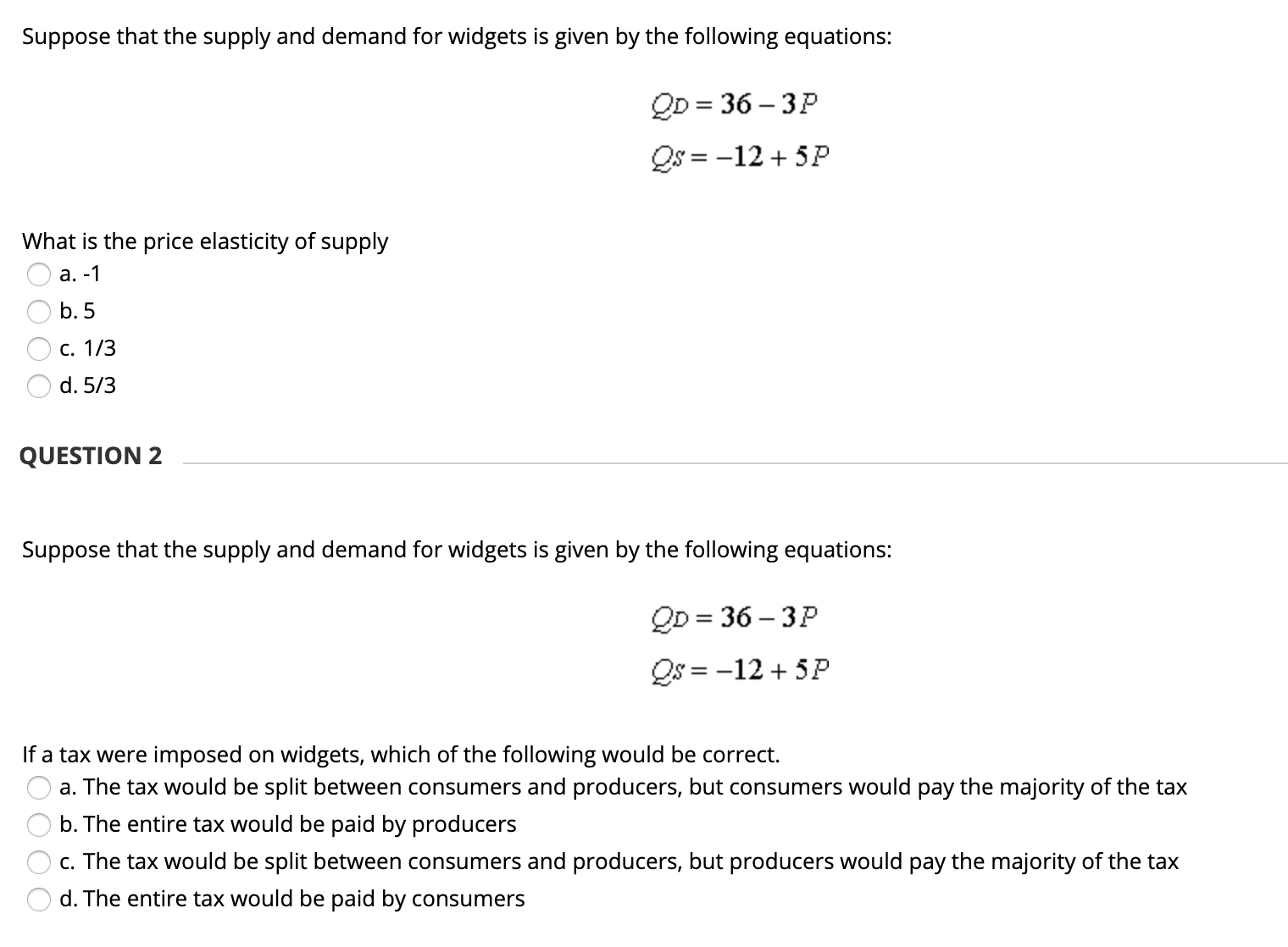

Transcribed Image Text:Suppose that the supply and demand for widgets is given by the following equations:

QD = 36 – 3P

= -12 + 5P

What is the price elasticity of supply

O a. -1

b. 5

C. 1/3

d. 5/3

QUESTION 2

Suppose that the supply and demand for widgets is given by the following equations:

QD = 36 – 3P

Qs = -12 + 5P

If a tax were imposed on widgets, which of the following would be correct.

a. The tax would be split between consumers and producers, but consumers would pay the majority of the tax

b. The entire tax would be paid by producers

c. The tax would be split between consumers and producers, but producers would pay the majority of the tax

d. The entire tax would be paid by consumers

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning