Suppose that WCI seeks a portfolio that maximizes the expected portfolio return subject to requiring the portfolio's risk (standard deviation) to be less than or equal to 3.00%. Which of the following statements are true? Note: Numerical answers are rounded to 2 significant digits. O Exactly two of the answers are correct. O The risk constraint is binding at the optimal solution. The percentage invested in Investment 2 is less than 14.00% O The percentage invested in Investment 1 is less than 40.00% The expected portfolio return is below 8.00%

Suppose that WCI seeks a portfolio that maximizes the expected portfolio return subject to requiring the portfolio's risk (standard deviation) to be less than or equal to 3.00%. Which of the following statements are true? Note: Numerical answers are rounded to 2 significant digits. O Exactly two of the answers are correct. O The risk constraint is binding at the optimal solution. The percentage invested in Investment 2 is less than 14.00% O The percentage invested in Investment 1 is less than 40.00% The expected portfolio return is below 8.00%

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 8TP: Fenton, Inc., has established a new strategic plan that calls for new capital investment. The...

Related questions

Question

Please do fast ASAP

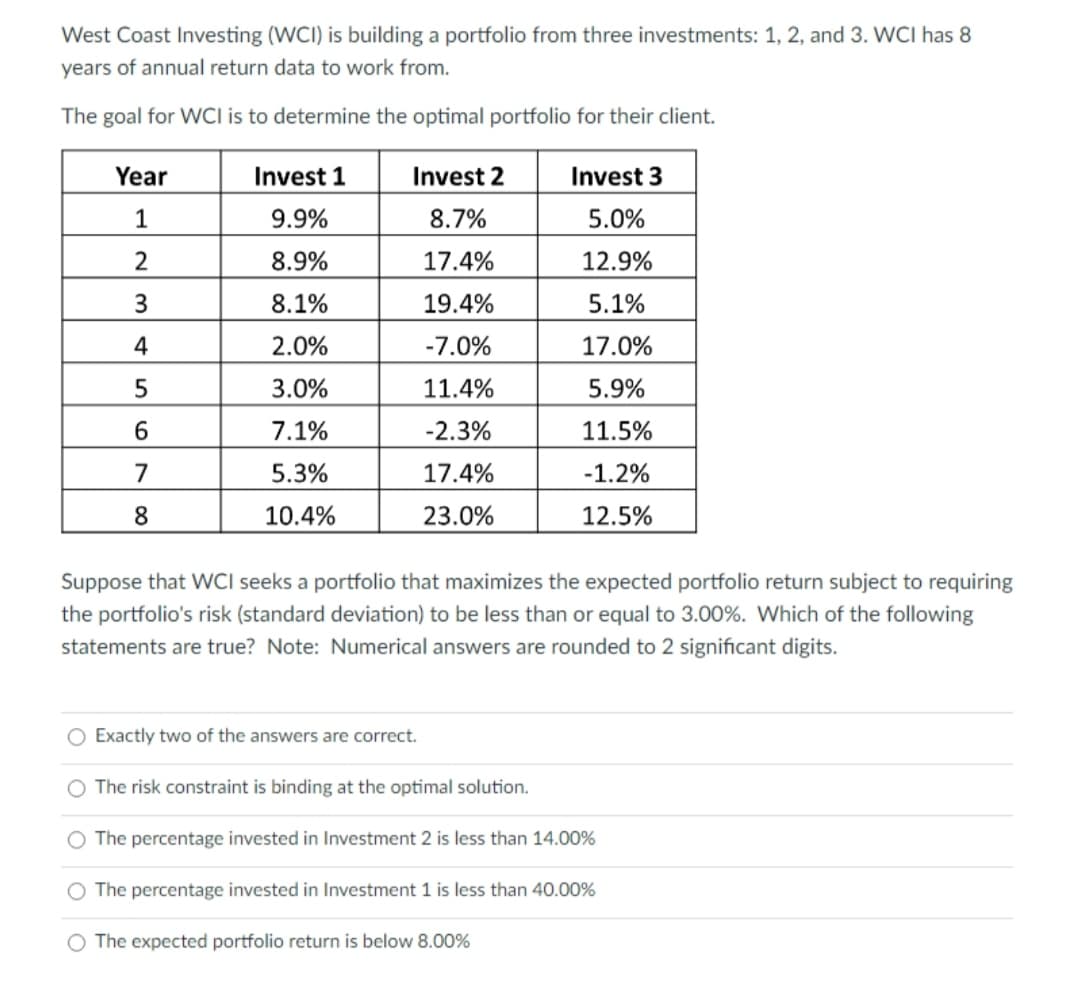

Transcribed Image Text:West Coast Investing (WCI) is building a portfolio from three investments: 1, 2, and 3. WCI has 8

years of annual return data to work from.

The goal for WCI is to determine the optimal portfolio for their client.

Year

Invest 1

Invest 2

Invest 3

1

9.9%

8.7%

5.0%

8.9%

17.4%

12.9%

3

8.1%

19.4%

5.1%

4

2.0%

-7.0%

17.0%

3.0%

11.4%

5.9%

7.1%

-2.3%

11.5%

7

5.3%

17.4%

-1.2%

8

10.4%

23.0%

12.5%

Suppose that WCI seeks a portfolio that maximizes the expected portfolio return subject to requiring

the portfolio's risk (standard deviation) to be less than or equal to 3.00%. Which of the following

statements are true? Note: Numerical answers are rounded to 2 significant digits.

O Exactly two of the answers are correct.

O The risk constraint is binding at the optimal solution.

O The percentage invested in Investment 2 is less than 14.00%

O The percentage invested in Investment 1 is less than 40.00%

O The expected portfolio return is below 8.00%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning