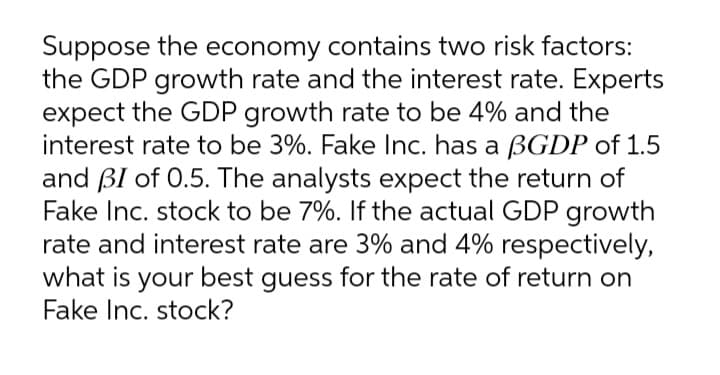

Suppose the economy contains two risk factors: the GDP growth rate and the interest rate. Experts expect the GDP growth rate to be 4% and the interest rate to be 3%. Fake Inc. has a BGDP of 1.5 and ßI of 0.5. The analysts expect the return of Fake Inc. stock to be 7%. If the actual GDP growth rate and interest rate are 3% and 4% respectively, what is your best guess for the rate of return on Fake Inc. stock?

Q: 36) You have been accepted into college. The college guarantees that your tuition will not increase…

A: Present Value of Ordinary Annuity refers to a concept that determines the value of cash flows at…

Q: X, Y and Z. Alternative X requires a cost of ₱50,000 yet guarantees a return of ₱35,000 per year for…

A: Project can be selected based on Net Present Value with highest Value Net present Value is the…

Q: Your division is considering a project with the following net cash flows (in millions): Period 1 2…

A: Here, WACC = 0.11 To Find: NPV of Project A =?

Q: QUESTION 9 Suppose that the forward rate today for the period between 1 year and 2 years in the…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want…

Q: Assume that a bond will make payments every six months as shown on the following timeline (using…

A: Total number of payments are 40 Coupon payment is $19.89 To calculate : Time to maturity in year…

Q: How much less is a perpetuity of $2,000 worth than an annuity due of the same amount for 30 payments…

A: An annuity is a series of monetary payments. A perpetuity is a sort of annuity that lasts…

Q: Compare three alternatives on the basis of their capitalized costs at i 14% per year and select the…

A: Capitalized cost is the present worth of the annual cost over the tenure of the project or…

Q: Assume you graduate from college with $30,000 in student loans. If your interest rate is fixed at…

A: The monthly payment amount can be calculated with the help of present value of annuity function

Q: A loan of $6000 is being repaid with quarterly installments of P at the end of each quarter for 5…

A: Given, Loan amount is $6000 Term of loan is 5 years rate is 12% Payment is made quarterly.

Q: When considering the investor's desired outcome, if you have generated very large returns in the…

A: Re balancing strategy- In portfolio management, the importance of re-balancing strategy is…

Q: You are considering buying a stock that will pay a dividend of $2.5 next year. The dividend is…

A: The stock price can be calculated with the help of dividend discount model

Q: 3. Consider assets A and B with expected returns of E(RA)=12% and E(RB)=20% and standard deviations…

A: Expected return of A=E(Ra) = 12% Expected return of B = E(Rb) = 20% Standard deviation of A = SDa =…

Q: In year 2018, the real rate of interest was 9 percent and infation was meesured at 3 perbent Whet…

A: Real Rate of Return = 9% Inflation = 3%

Q: Stock Y has a beta of 1.2 and an expected return of 11.5 percent. Stock Z has a beta of .80 and an…

A: The risk-free rate of return is the theoretical return on a risk-free investment. Over a given…

Q: You already have $54,700 in your savings account that earns 3.50% compounded annually. You will…

A: The concept of the time value of money states that the same amount of money has more value today…

Q: Abby also has a $400/month car loan payment and a $150/month student loan payment. If her lender…

A: The portion of monthly income that goes into paying the loan installments is known debt-to-income…

Q: Problem 9-16 Problems with Profitability Index [LO1, 7] The Michner Corporation is trying to choose…

A: a1) Let the initial investment = C Annual cashflow = A r = 11% n = 3 years

Q: The regular price of a TV is $1,147 but it is marked down by 32%. What is the sale price? (round…

A: Sale price = $1147 Marked down = 32% Formula Sale price = Regular price*(1-Mark down ratio)

Q: (Bond valuation relationships) A bond of Telink Corporation pays $120 in annual interest, with a…

A: a) Coupon (C) = $120 Par value (P) = $1000 n = 10 years r = 10%

Q: You have two options to invest $1000 in: i) A $1050 face value bond with coupon rate c = 6%. ii) A…

A: Bond is the debt security that investors uses to reduce the risk and increase stable return from…

Q: The method of comparators can be applied using the ratio of operating income to revenue as a basis…

A: Operating Income is an accounting number that measures the amount of operating profit for a company…

Q: Illu.1: NIT Ltd. declared dividend at 25% on its re are quoted in the market at Rs.10. You are requi…

A: Dividend is defined as the return that a shareholder gets from the company for the money invested by…

Q: Suppose now that we have a multi-period project . The project costs $100,000 Perlodi Perlod2 Perlod3…

A: Here,

Q: ABC Corp has an average inventory period (production process time + time before sale) of 36 days.…

A: Short term operating cycle refers to the time required to sell the inventory and realize cash from…

Q: Yoko invested s4000 in a fund for 2 years and was paid simple interest. The total interest that she…

A: Investment (P) = $4000 Period (T) = 2 Years Interest amount (I) = $400

Q: C. Paxton Company provided the following income statement for last year: P 87,021,000 (62,138,249) P…

A: Times interest earned ratio shows how many times a company can cover its interest expense with its…

Q: 2. You invested $39,000 in Yug Industries at an annual interest rate of 5% compounded continuously.…

A: Formula Future value = PV*ert Where PV - Investment amount i.e. $39000 e - Euler's number i.e.…

Q: Is the present value of an ordinary annuity more valuable than an annuity due? Explain.

A: Annuity is a series of even cash flows for a specified duration. It involves regular cash outflow or…

Q: Apply incremental B/C analysis at an interest rate of 8% per year to determine which alternative…

A: The relation between the cost of the project and the benefits from the project is known as…

Q: calculate the interest, purchase price, and effective interest rate of a $50,000, 2.3%, 26 week…

A: Effective annual rate (EAR) refers to a real interest rate which an investor is expect from his…

Q: Given the cash flow diagram below, expressed in months, determine: A. The Present value at a nominal…

A: NPV and IRR both are methods of capital budgeting that are used to make decesion of selecting and…

Q: A six year note for 3500 issued on april1, 2015 with interest at 6.9percent compounded semi annually…

A: To calculate the proceeds on January 1, 2017 firstly we should calculate the future value on…

Q: 23. Calculate the present value (principal) and the compound interest (in $). Use Table 11-2. Round…

A: The present value and compound interest can be calculated as per the principles of time value of…

Q: an investment project provides cash inflows of $850 per year for 5 years. What is the project…

A: Initial cost = $5600 Annual cash inflow = $850 Period = 5 Years

Q: Yegurt Ine has issued a 30-year par value bond that is callable in 5 years. If the coupon rate in…

A: Present Value can be calculated using PV function in excel PV (rate, nper, pmt, [Fv], [type])…

Q: Quèstion 12 What is the covariance of returns between stocks A and B? Expected retum of A is 30% and…

A: Data given: Expected return of A =30% Expected return of B = 23.333333% Year Return A Return B…

Q: What is the correct interest expense on the serial notes payable for 2022?

A: Interest refers to the amount paid by the borrower to bank on the amount borrowed at a fixed or…

Q: What is the discounted value of $3500.00 paid at the end of every six months for 5 years if interest…

A: Here, Equal amount at equal interval = $3,500 Payment at the end of every six months No. of years =…

Q: 8. Scott took a short position for 500 ounces of July gold at $653.25 per ounce. He did not close…

A: Initial margin In order to trade in exchange, investors have to deposit the initial margin…

Q: Ratio Analysis A. Chen Company has current assets equal to P5,000,000. Of these, P1,000,000 is cash,…

A: Solution :1 Current Ratio : Current Assets / Current Liabilities Current Ratio…

Q: An investment pays simple interest, and quadruples in 10 years. What is the interest rate?

A: Time Period = 10 Years

Q: 6) Consider two thirty year bonds with the same purchase price. Each has a coupon rate of 5% paid…

A: Here, Time to maturity = 30 years Semi-annual Coupon rate = 5% Par value = 1,000 First bond nominal…

Q: Calculate the Black-Scholes price of a Call option where: S = $50 %3D K = $45 %3D T-t=.25 O = .20 r…

A: Here we have; Spot price S is $50 Strike Price K is $45 Standard deviation is 20% Risk free rate is…

Q: Company Dividend Yield Price State Street 6.66% $27.09 Use the table above for this question. What…

A: SOLUTION : GIVEN, Dividend Yield = 6.66% Price = $27.09 Now, Calculating the state street's…

Q: ou iust invested 549.000 that you received as an insurance settlement. How much more will this…

A: Money that is invested today earns interest. This makes the future value of money more than present…

Q: Determine the simple payback period of a ₱20,000 with return of 5,000 on year 1; 8,000 on year 2 and…

A: Payback period is the period within which initial investment is recovered. Payback period Formula…

Q: Calculate the Black-Scholes price of a Call option where: S = $50 K = $45 %3D T-t=.25 O = .20 r =…

A: Stock Price S $ 50.00 Strike Price K $…

Q: what would be the total return of the bond in percent? (Assume interest payments are semi-annual.)

A: Bond valuation refers to a method which is used to compute the current value or present value (PV)…

Q: The Michner Corporation is trying to choose between the following two mutually exclusive design…

A: Profitability index is the ratio of the present value of cash flow to the initial investment and…

M4

Step by step

Solved in 2 steps

- Suppose that two factors have been identified for the U.S. economy: the growth rate of industrial production, IP, and the inflation rate, IR. IP is expected to be 3%, and IR 5%. A stock with a beta of 1 on IP and .5 on IR currently is expected to provide a rate of return of 12%. If industrial production actually grows by 5%, while the inflation rate turns out to be 8%, what is your revised estimate of the expected rate of return on the stock?Suppose that two factors have been identified for the U.S. economy: the growth rate of industrial production, IP, and the inflation rate, IR. IP is expected to be 5%, and IR 4.0%. A stock with a beta of 1.2 on IP and 0.6 on IR currently is expected to provide a rate of return of 8%. If industrial production actually grows by 6%, while the inflation rate turns out to be 6.0%, what is your revised estimate of the expected rate of return on the stock? (Do not round intermediate calculations. Round your answer to 1 decimal place.)Suppose that two factors have been identified for the U.S. economy: the growth rate of industrial production, IP, and the inflation rate, IR. IP is expected to be 3%, and IR 3.4%. A stock with a beta of 2.8 on IP and 2.2 on IR currently is expected to provide a rate of return of 15%. If industrial production actually grows by 7%, while the inflation rate turns out to be 5.0%, what is your revised estimate of the expected return on the stock (write as percentage, rounded to one decimal place)?

- A financial manager believes that her firm will earn a 15% return next year. This firm has a beta of 1.8, and the expected return on the market is 8% while the risk-free rate is 2%. First, compute the return this firm should earn given its level of risk. Second, determine whether this firm’s stock is overvalued or undervalued given what the manager thinks this company will earn next year.You are doing some financial projections based on different scenarios for the economy. You believe there is a 10% chance that we will have a strong growth economy, a 20% chance that we will have a growth economy, a 40% chance that we will have a normal economy, a 10% chance that we will have a recession and a 20% chance that we will have a depression. Your expected Stock Fund returns for the scenarios are 24%, 16%, 15%, -8% and -12%, respectively. For your Bond Fund, your expected returns are -7%, -2%, 6%, 2% and -5%, respectively. If you create a Risky Portfolio with a 80/20 mix of Bonds/Stocks, what is the expected volatility of the Portfolio? Group of answer choices 5.36% 11.23% 6.58% 7.84% None of the aboveCalculate the required rate of return for Clean Sweep Inc., assuming that (1) investors expect a 4.0% rate of inflation in the future, (2) the real risk-free rate is 3.0%, (3) the market risk premium is 5.0%, (4) the firm has a beta of 2.30, and (5) its realized rate of return has averaged 15.0% over the last 5 years. Do not round your intermediate calculations.

- You forecast the company RIO will have a sustainable ROE of 15% in the future, similar to the industry average of 15%. The company has a dividend payout ratio of 50% versus industry average of 50%. The company had less debt and operation leverage compare to industry, as a result , RIO has a beta of 1.8 versus the industry average of 2. Based on these information, should the company RIO have a higher or lower PE ratio than the industry average ? Given a risk free rate of 2% and market risk premium of 8%, what is RIO’s “intrinsic” forward PE ratio based on formula?The following four factors were identifies and later used to explain the return on a stock and level of sensitivity GDP growth: β=0.6, Rp=4% Inflation rate: β=0.6, RP=5% Gold Prices: β=0.8, RP=6% Standard and Poor’s 500 Index Returns: β=2.5, RP=8% The risk free rate is 6% Using the APT formula, calculate the expected rate of returns on the stockIf economy booms, RTF, Inc. stock is expected to return 11 percent. If the economy goes into a recessionary period, then RTF is expected to only return 3 percent. The probability of boom is 73 percent while the probability of a recession is 27 percent. What is the variance of the returns on RTF?

- The return on the Rush Corporation in the state of recession is estimated to be -23% and the return on Rush in the state of boom is estimated to be 32%. The return on the Oberman Corporation in the state of recession is estimated to be 45% and the return on Oberman in the state of boom is estimated to be -16%. Given this information, what is the covariance between Rush and Oberman if there is a 0.70 probability that the economy will be in the state of boom and a 0.30 probability that the economy will be in the state of recession. Place your answer in decimal form and not as a percentageCalculate the required rate of return for Climax Inc., assuming that (1) investors expect a 4.0% rate of inflation in the future, (2) the real risk-free rate is 3.0%, (3) the market risk premium is 5.0%, (4) the firm has a beta of 2.30, and (5) its realized rate of return has averaged 15.0% over the last 5 years. Do not round your intermediateYou are a financial analyst, and you are tasked with calculating the expected return and standard deviation of returns for Kershaw Enterprises. Toward that end you are given the following data: · In an expanding economy Kershaw is expected to earn 5.30% · In a booming economy Kershaw is expected to earn 9.50%; · In a contracting economy Kershaw is expected to earn 3.50% · In a recession Kershaw is expected to earn -1.20%; · The probabilities for expansion, boom, contraction and recession are 20%, 25%, 35% and 20% respectively.