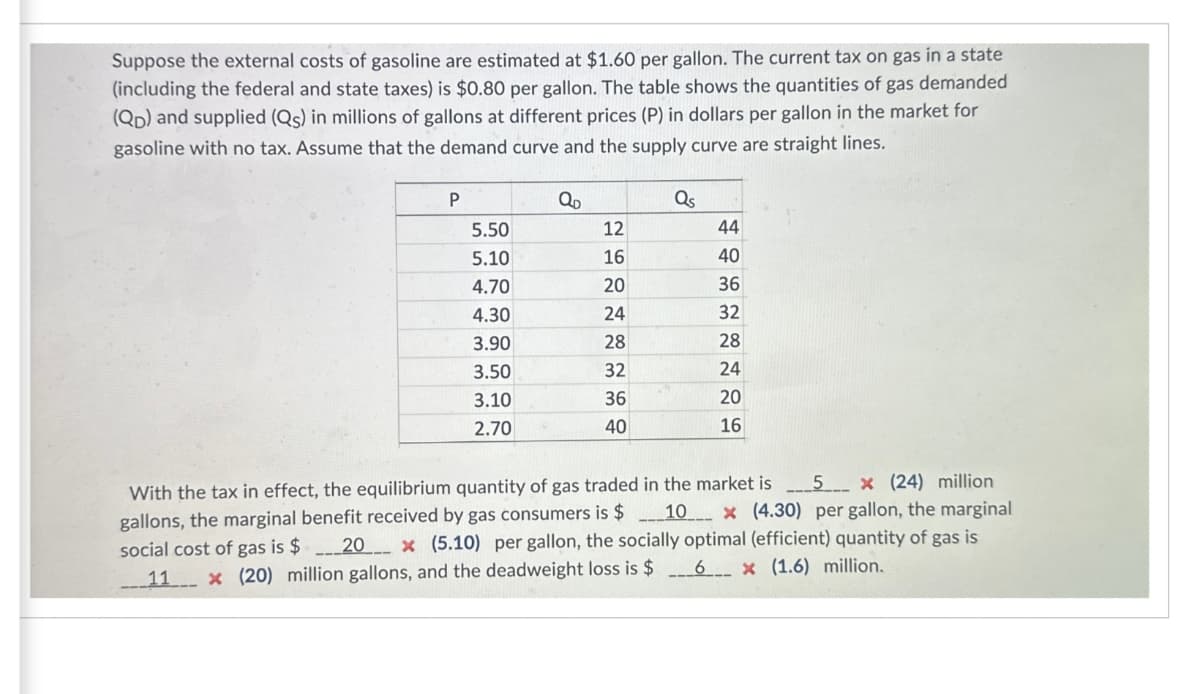

Suppose the external costs of gasoline are estimated at $1.60 per gallon. The current tax on gas in a state (including the federal and state taxes) is $0.80 per gallon. The table shows the quantities of gas demanded (QD) and supplied (Qs) in millions of gallons at different prices (P) in dollars per gallon in the market for gasoline with no tax. Assume that the demand curve and the supply curve are straight lines. QD P 5.50 5.10 4.70 4.30 3.90 3.50 3.10 2.70 12 16 20 24 28 32 36 40 Qs 44 40 36 32 28 24 20 16 With the tax in effect, the equilibrium quantity of gas traded in the market is 5 x (24) million gallons, the marginal benefit received by gas consumers is $10x (4.30) per gallon, the marginal is social cost of gas is $20 x (5.10) per gallon, the socially optimal (efficient) quantity of gas 11 x (20) million gallons, and the deadweight loss is $6 x (1.6) million.

Suppose the external costs of gasoline are estimated at $1.60 per gallon. The current tax on gas in a state (including the federal and state taxes) is $0.80 per gallon. The table shows the quantities of gas demanded (QD) and supplied (Qs) in millions of gallons at different prices (P) in dollars per gallon in the market for gasoline with no tax. Assume that the demand curve and the supply curve are straight lines. QD P 5.50 5.10 4.70 4.30 3.90 3.50 3.10 2.70 12 16 20 24 28 32 36 40 Qs 44 40 36 32 28 24 20 16 With the tax in effect, the equilibrium quantity of gas traded in the market is 5 x (24) million gallons, the marginal benefit received by gas consumers is $10x (4.30) per gallon, the marginal is social cost of gas is $20 x (5.10) per gallon, the socially optimal (efficient) quantity of gas 11 x (20) million gallons, and the deadweight loss is $6 x (1.6) million.

Economics (MindTap Course List)

13th Edition

ISBN:9781337617383

Author:Roger A. Arnold

Publisher:Roger A. Arnold

Chapter30: Market Failure: Externalities, Public Goods, And Asymmetric Information

Section: Chapter Questions

Problem 10QP

Related questions

Question

(The answers are listed in the parentheses please show work on how to get those answers)

Transcribed Image Text:Suppose the external costs of gasoline are estimated at $1.60 per gallon. The current tax on gas in a state

(including the federal and state taxes) is $0.80 per gallon. The table shows the quantities of gas demanded

(QD) and supplied (Qs) in millions of gallons at different prices (P) in dollars per gallon in the market for

gasoline with no tax. Assume that the demand curve and the supply curve are straight lines.

P

5.50

5.10

4.70

4.30

3.90

3.50

3.10

2.70

QD

12

16

20

24

28

32

36

40

Qs

44

40

36

32

28

24

20

16

5x (24) million.

With the tax in effect, the equilibrium quantity of gas traded in the market is

gallons, the marginal benefit received by gas consumers is $10x (4.30) per gallon, the marginal

social cost of gas is $ 20x (5.10) per gallon, the socially optimal (efficient) quantity of gas is

11 x (20) million gallons, and the deadweight loss is $6x (1.6) million.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning