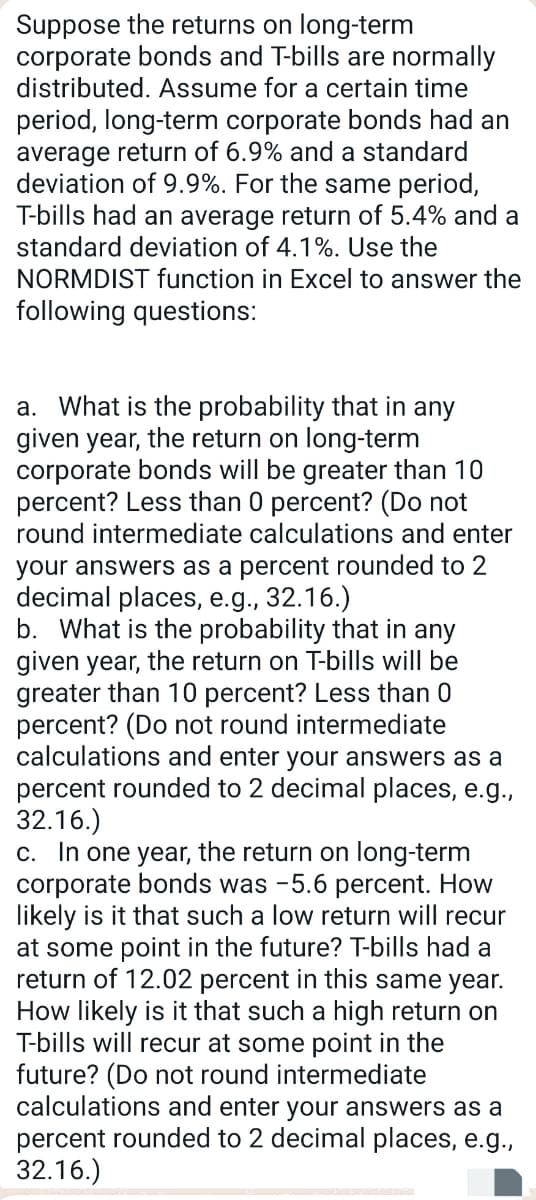

Suppose the returns on long-term corporate bonds and T-bills are normally distributed. Assume for a certain time period, long-term corporate bonds had an average return of 6.9% and a standard deviation of 9.9%. For the same period, T-bills had an average return of 5.4% and a standard deviation of 4.1%. Use the NORMDIST function in Excel to answer the following questions: a. What is the probability that in any given year, the return on long-term corporate bonds will be greater than 10 percent? Less than 0 percent? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the probability that in any given year, the return on T-bills will be greater than 10 percent? Less than 0 percent? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c. In one year, the return on long-term corporate bonds was -5.6 percent. How likely is it that such a low return will recur at some point in the future? T-bills had a return of 12.02 percent in this same year. How likely is it that such a high return on T-bills will recur at some point in the future? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.)

Suppose the returns on long-term corporate bonds and T-bills are normally distributed. Assume for a certain time period, long-term corporate bonds had an average return of 6.9% and a standard deviation of 9.9%. For the same period, T-bills had an average return of 5.4% and a standard deviation of 4.1%. Use the NORMDIST function in Excel to answer the following questions: a. What is the probability that in any given year, the return on long-term corporate bonds will be greater than 10 percent? Less than 0 percent? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the probability that in any given year, the return on T-bills will be greater than 10 percent? Less than 0 percent? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c. In one year, the return on long-term corporate bonds was -5.6 percent. How likely is it that such a low return will recur at some point in the future? T-bills had a return of 12.02 percent in this same year. How likely is it that such a high return on T-bills will recur at some point in the future? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.)

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter10: Statistics

Section10.6: Summarizing Categorical Data

Problem 31PPS

Related questions

Question

Pls correct step by step explanation

Transcribed Image Text:Suppose the returns on long-term

corporate bonds and T-bills are normally

distributed. Assume for a certain time

period, long-term corporate bonds had an

average return of 6.9% and a standard

deviation of 9.9%. For the same period,

T-bills had an average return of 5.4% and a

standard deviation of 4.1%. Use the

NORMDIST function in Excel to answer the

following questions:

a. What is the probability that in any

given year, the return on long-term

corporate bonds will be greater than 10

percent? Less than 0 percent? (Do not

round intermediate calculations and enter

your answers as a percent rounded to 2

decimal places, e.g., 32.16.)

b. What is the probability that in any

given year, the return on T-bills will be

greater than 10 percent? Less than 0

percent? (Do not round intermediate

calculations and enter your answers as a

percent rounded to 2 decimal places, e.g.,

32.16.)

c. In one year, the return on long-term

corporate bonds was -5.6 percent. How

likely is it that such a low return will recur

at some point in the future? T-bills had a

return of 12.02 percent in this same year.

How likely is it that such a high return on

T-bills will recur at some point in the

future? (Do not round intermediate

calculations and enter your answers as a

percent rounded to 2 decimal places, e.g.,

32.16.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Step 1: Describe the given information

VIEWStep 2: Calculate the probability that the return on long-term corporate bonds will be > 10% and < 0%

VIEWStep 3: Calculate the probability that the return on T-bills will be > 10% and < 0%

VIEWStep 4: The likelihood that such low returns will recur at some point in the future for given scenarios

VIEWSolution

VIEWTrending now

This is a popular solution!

Step by step

Solved in 5 steps with 49 images

Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill