Suppose you are a manager for a certain company. You earn $50,000 per year and are in the 28% federal income tax bracket. Each year you contribute $4,500 tax free to your individual retirement account, IRA. The account earns 6% annual interest. In addition, the amount of tax that you save each year by making these "pre-tax" contributions is invested in a taxable aggressive growth mutual fund averaging 16%. (c)Although the income from this investment is taxable each year, using Table 12-1, how much will the "tax savings" fund be worth (in $) in 30 years? (Round your answer to the nearest cent.) $

Suppose you are a manager for a certain company. You earn $50,000 per year and are in the 28% federal income tax bracket. Each year you contribute $4,500 tax free to your individual retirement account, IRA. The account earns 6% annual interest. In addition, the amount of tax that you save each year by making these "pre-tax" contributions is invested in a taxable aggressive growth mutual fund averaging 16%. (c)Although the income from this investment is taxable each year, using Table 12-1, how much will the "tax savings" fund be worth (in $) in 30 years? (Round your answer to the nearest cent.) $

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

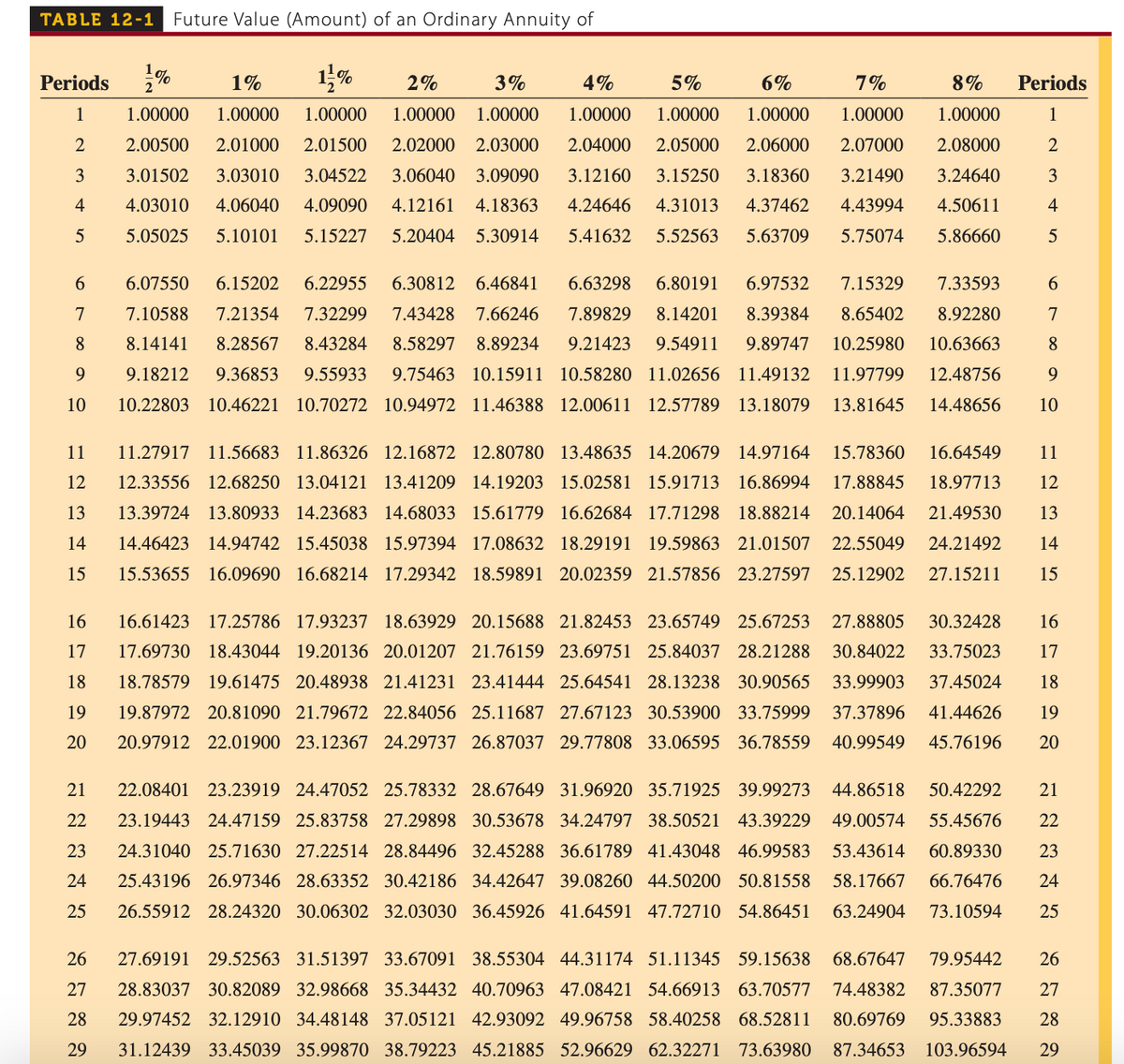

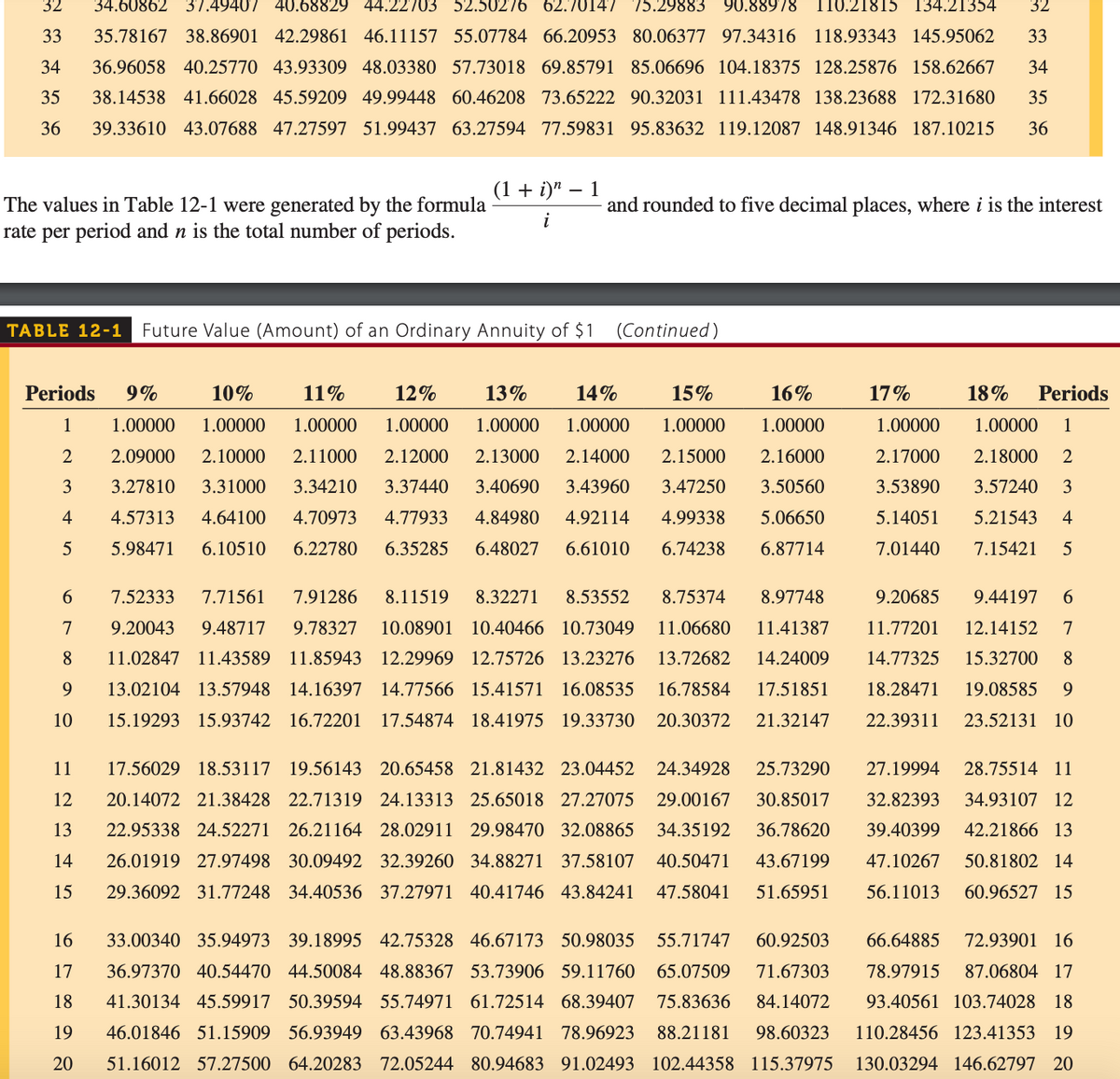

Suppose you are a manager for a certain company. You earn $50,000 per year and are in the 28% federal income tax bracket. Each year you contribute $4,500 tax free to your individual retirement account, IRA. The account earns 6% annual interest. In addition, the amount of tax that you save each year by making these "pre-tax" contributions is invested in a taxable aggressive growth mutual fund averaging 16%.

(c)Although the income from this investment is taxable each year, using Table 12-1, how much will the "tax savings" fund be worth (in $) in 30 years? (Round your answer to the nearest cent.)

$

Transcribed Image Text:TABLE 12-1

Future Value (Amount) of an Ordinary Annuity of

Periods

1%

2%

3%

4%

5%

6%

7%

8%

Periods

1

1.00000

1.00000

1.00000

1.00000

1.00000

1.00000

1.00000

1.00000

1.00000

1.00000

1

2

2.00500

2.01000

2.01500

2.02000 2.03000

2.04000

2.05000

2.06000

2.07000

2.08000

2

3

3.01502

3.03010

3.04522

3.06040 3.09090

3.12160

3.15250

3.18360

3.21490

3.24640

3

4

4.03010

4.06040

4.09090

4.12161

4.18363

4.24646

4.31013

4.37462

4.43994

4.50611

4

5.05025

5.10101

5.15227

5.20404

5.30914

5.41632

5.52563

5.63709

5.75074

5.86660

5

6.

6.07550

6.15202

6.22955

6.30812 6.46841

6.63298

6.80191

6.97532

7.15329

7.33593

6

7

7.10588

7.21354

7.32299

7.43428

7.66246

7.89829

8.14201

8.39384

8.65402

8.92280

7

8

8.14141

8.28567

8.43284

8.58297

8.89234

9.21423

9.54911

9.89747

10.25980

10.63663

8

9.

9.18212

9.36853

9.55933

9.75463 10.15911 10.58280 11.02656 11.49132

11.97799

12.48756

9.

10

10.22803 10.46221 10.70272 10.94972 11.46388 12.00611 12.57789 13.18079

13.81645

14.48656

10

11

11.27917

11.56683 11.86326 12.16872 12.80780 13.48635 14.20679 14.97164

15.78360

16.64549

11

12

12.33556 12.68250 13.04121 13.41209 14.19203 15.02581 15.91713 16.86994

17.88845

18.97713

12

13

13.39724 13.80933 14.23683 14.68033 15.61779 16.62684 17.71298 18.88214

20.14064

21.49530

13

14

14.46423

14.94742 15.45038 15.97394 17.08632 18.29191 19.59863 21.01507

22.55049

24.21492

14

15

15.53655 16.09690 16.68214 17.29342 18.59891 20.02359 21.57856 23.27597

25.12902

27.15211

15

16

16.61423 17.25786 17.93237 18.63929 20.15688 21.82453 23.65749 25.67253

27.88805

30.32428

16

17

17.69730 18.43044 19.20136 20.01207 21.76159 23.69751 25.84037 28.21288

30.84022

33.75023

17

18

18.78579

19.61475 20.48938 21.41231 23.41444 25.64541 28.13238 30.90565

33.99903

37.45024

18

19

19.87972 20.81090 21.79672 22.84056 25.11687 27.67123 30.53900 33.75999

37.37896

41.44626

19

20.97912 22.01900 23.12367 24.29737 26.87037 29.77808 33.06595 36.78559

40.99549

45.76196

20

21

22.08401 23.23919 24.47052 25.78332 28.67649 31.96920 35.71925 39.99273

44.86518

50.42292

21

22

23.19443 24.47159 25.83758 27.29898 30.53678 34.24797 38.50521 43.39229

49.00574

55.45676

22

23

24.31040 25.71630 27.22514 28.84496 32.45288 36.61789 41.43048 46.99583

53.43614

60.89330

23

24

25.43196 26.97346 28.63352 30.42186 34.42647 39.08260 44.50200 50.81558

58.17667

66.76476

24

25

26.55912 28.24320 30.06302 32.03030 36.45926 41.64591 47.72710 54.86451

63.24904

73.10594

25

26

27.69191 29.52563 31.51397 33.67091 38.55304 44.31174 51.11345 59.15638

68.67647

79.95442

26

27

28.83037 30.82089 32.98668 35.34432 40.70963 47.08421 54.66913 63.70577

74.48382

87.35077

27

28

29.97452 32.12910 34.48148 37.05121 42.93092 49.96758 58.40258 68.52811

80.69769

95.33883

28

29

31.12439 33.45039 35.99870 38.79223 45.21885 52.96629 62.32271 73.63980

87.34653

103.96594

29

20

Transcribed Image Text:32

34.60862

37.49407 40.68829 44.22703 52.50276 62.70147 75.29883 90.88978

110.21815 134.21354

32

33

35.78167 38.86901 42.29861 46.11157 55.07784 66.20953 80.06377 97.34316 118.93343 145.95062

33

34

36.96058 40.25770 43.93309 48.03380 57.73018 69.85791 85.06696 104.18375 128.25876 158.62667

34

35

38.14538 41.66028 45.59209 49.99448 60.46208 73.65222 90.32031 111.43478 138.23688 172.31680

35

36

39.33610 43.07688 47.27597 51.99437 63.27594 77.59831 95.83632 119.12087 148.91346 187.10215

36

(1 + i)" – 1

The values in Table 12-1 were generated by the formula

rate per period and n is the total number of periods.

and rounded to five decimal places, where i is the interest

TABLE 12-1

Future Value (Amount) of an Ordinary Annuity of $1

(Continued)

Periods

9%

10%

11%

12%

13%

14%

15%

16%

17%

18%

Periods

1

1.00000

1.00000

1.00000

1.00000

1.00000

1.00000

1.00000

1.00000

1.00000

1.00000

1

2.09000

2.10000

2.11000

2.12000

2.13000

2.14000

2.15000

2.16000

2.17000

2.18000

3

3.27810

3.31000

3.34210

3.37440

3.40690

3.43960

3.47250

3.50560

3.53890

3.57240

3

4

4.57313

4.64100

4.70973

4.77933

4.84980

4.92114

4.99338

5.06650

5.14051

5.21543

4

5

5.98471

6.10510

6.22780

6.35285

6.48027

6.61010

6.74238

6.87714

7.01440

7.15421

5

7.52333

7.71561

7.91286

8.11519

8.32271

8.53552

8.75374

8.97748

9.20685

9.44197

7

9.20043

9.48717

9.78327

10.08901

10.40466 10.73049

11.06680

11.41387

11.77201

12.14152

7

8

11.02847 11.43589 11.85943 12.29969 12.75726 13.23276

13.72682

14.24009

14.77325

15.32700

8

13.02104 13.57948 14.16397 14.77566 15.41571 16.08535

16.78584

17.51851

18.28471

19.08585

9.

10

15.19293 15.93742 16.72201 17.54874 18.41975 19.33730

20.30372

21.32147

22.39311

23.52131 10

11

17.56029 18.53117 19.56143 20.65458 21.81432 23.04452

24.34928

25.73290

27.19994

28.75514 11

12

20.14072 21.38428 22.71319 24.13313 25.65018 27.27075

29.00167

30.85017

32.82393

34.93107 12

13

22.95338 24.52271 26.21164 28.02911 29.98470 32.08865

34.35192

36.78620

39.40399

42.21866 13

14

26.01919 27.97498 30.09492 32.39260 34.88271 37.58107

40.50471

43.67199

47.10267

50.81802 14

15

29.36092 31.77248 34.40536 37.27971 40.41746 43.84241

47.58041

51.65951

56.11013

60.96527 15

16

33.00340 35.94973 39.18995 42.75328 46.67173 50.98035 55.71747

60.92503

66.64885

72.93901 16

17

36.97370 40.54470 44.50084 48.88367 53.73906 59.11760

65.07509

71.67303

78.97915

87.06804 17

18

41.30134 45.59917 50.39594 55.74971 61.72514 68.39407

75.83636

84.14072

93.40561 103.74028 18

19

46.01846 51.15909 56.93949 63.43968 70.74941 78.96923

88.21181

98.60323

110.28456 123.41353 19

51.16012 57.27500 64.20283 72.05244 80.94683 91.02493 102.44358 115.37975

130.03294 146.62797 20

20

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education