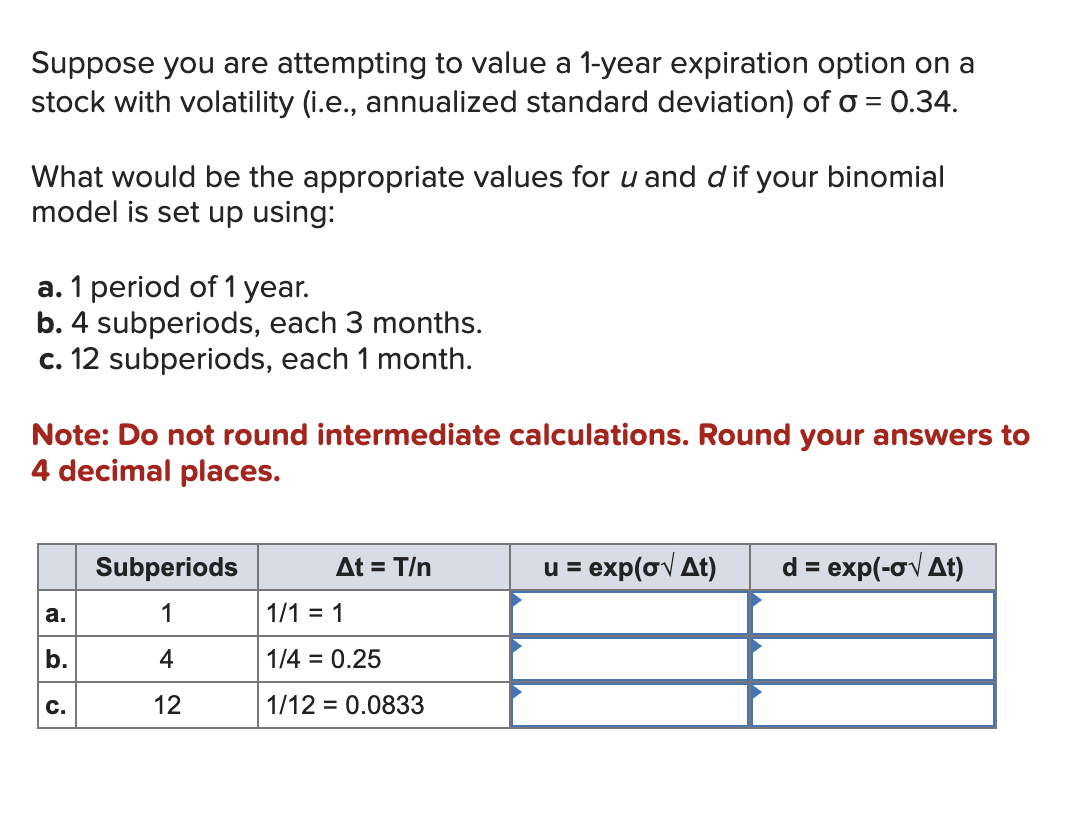

Suppose you are attempting to value a 1-year expiration option on a stock with volatility (i.e., annualized standard deviation) of σ = 0.34. What would be the appropriate values for u and d if your binomial model is set up using: a. 1 period of 1 year. b. 4 subperiods, each 3 months. c. 12 subperiods, each 1 month. Note: Do not round intermediate calculations. Round your answers to 4 decimal places. Subperiods At = T/n u = exp(σ√ At) d = exp(-σ√ At) a. 1 1/1 = 1 b. 4 1/4 = 0.25 C. 12 1/12 0.0833

Suppose you are attempting to value a 1-year expiration option on a stock with volatility (i.e., annualized standard deviation) of σ = 0.34. What would be the appropriate values for u and d if your binomial model is set up using: a. 1 period of 1 year. b. 4 subperiods, each 3 months. c. 12 subperiods, each 1 month. Note: Do not round intermediate calculations. Round your answers to 4 decimal places. Subperiods At = T/n u = exp(σ√ At) d = exp(-σ√ At) a. 1 1/1 = 1 b. 4 1/4 = 0.25 C. 12 1/12 0.0833

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter5: Financial Options

Section: Chapter Questions

Problem 5P

Related questions

Question

Transcribed Image Text:Suppose you are attempting to value a 1-year expiration option on a

stock with volatility (i.e., annualized standard deviation) of σ = 0.34.

What would be the appropriate values for u and d if your binomial

model is set up using:

a. 1 period of 1 year.

b. 4 subperiods, each 3 months.

c. 12 subperiods, each 1 month.

Note: Do not round intermediate calculations. Round your answers to

4 decimal places.

Subperiods

At = T/n

u = exp(σ√ At)

d = exp(-σ√ At)

a.

1

1/1 = 1

b.

4

1/4 = 0.25

C.

12

1/12 0.0833

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning