Suppose you are evaluating a project with the expected future cash inflows shown in the following table. Your boss has asked you to calculate the project's net present value (NPV). You don't know the project's initial cost, but you do know the project's regular, or conventional, payback period is 2.50 years. If the project's ~WACC~ is 7%, the project's NPV Year Cash Flow (rounded to the nearest dollar) is: Year 1 $350,000 O $375,173 O $416,859 O $479,388 O $333,487 Year 2 $425,000 Year 3 $475,000 Year 4 $450,000 Which of the following statements indicate a disadvantage of using the regular payback period (not the discounted payback period) for capital budgeting decisions? Check all that apply. O The payback period does not take the project's entire life into account. The payback period is calculated using net income instead of cash flows. The payback period does not take the time value of money into account. O00

Suppose you are evaluating a project with the expected future cash inflows shown in the following table. Your boss has asked you to calculate the project's net present value (NPV). You don't know the project's initial cost, but you do know the project's regular, or conventional, payback period is 2.50 years. If the project's ~WACC~ is 7%, the project's NPV Year Cash Flow (rounded to the nearest dollar) is: Year 1 $350,000 O $375,173 O $416,859 O $479,388 O $333,487 Year 2 $425,000 Year 3 $475,000 Year 4 $450,000 Which of the following statements indicate a disadvantage of using the regular payback period (not the discounted payback period) for capital budgeting decisions? Check all that apply. O The payback period does not take the project's entire life into account. The payback period is calculated using net income instead of cash flows. The payback period does not take the time value of money into account. O00

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter12: Capital Investment Decisions

Section: Chapter Questions

Problem 37E

Related questions

Question

Please answer all questions

Transcribed Image Text:11. The NPV and payback period

Aa Aa

What information does the payback period provide?

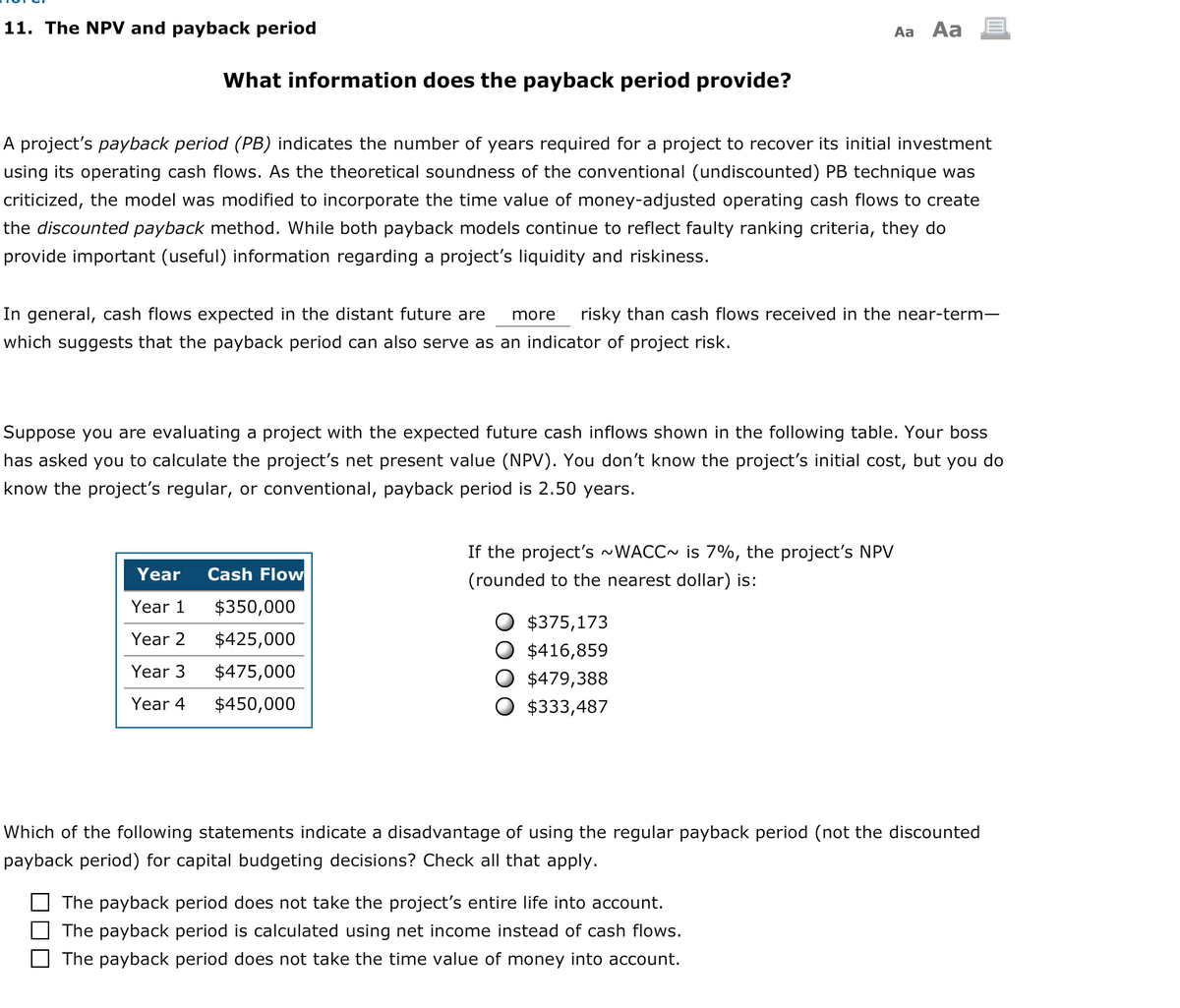

A project's payback period (PB) indicates the number of years required for a project to recover its initial investment

using its operating cash flows. As the theoretical soundness of the conventional (undiscounted) PB technique was

criticized, the model was modified to incorporate the time value of money-adjusted operating cash flows to create

the discounted payback method. While both payback models continue to reflect faulty ranking criteria, they do

provide important (useful) information regarding a project's liquidity and riskiness.

In general, cash flows expected in the distant future are

risky than cash flows received in the near-term-

more

which suggests that the payback period can also serve as an indicator of project risk.

Suppose you are evaluating a project with the expected future cash inflows shown in the following table. Your boss

has asked you to calculate the project's net present value (NPV). You don't know the project's initial cost, but you do

know the project's regular, or conventional, payback period is 2.50 years.

If the project's ~WACC~ is 7%, the project's NPV

Year

Cash Flow

(rounded to the nearest dollar) is:

Year 1

$350,000

$375,173

Year 2

$425,000

$416,859

Year 3

$475,000

$479,388

Year 4

$450,000

$333,487

Which of the following statements indicate a disadvantage of using the regular payback period (not the discounted

payback period) for capital budgeting decisions? Check all that apply.

The payback period does not take the project's entire life into account.

The payback period is calculated using net income instead of cash flows.

The payback period does not take the time value of money into account.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning