Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 26, Problem 2MAD

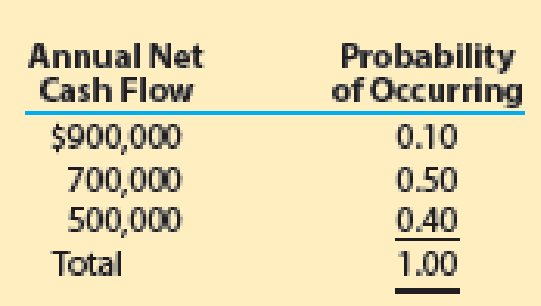

Assume San Lucas Corporation in MAD 26-1 assigns the following probabilities to the estimated annual net cash flows:

- a. Compute the expected value of the annual net cash flows.

- b. Determine the expected

net present value of the equipment, assuming a desiredrate of return of 10% and the expected annual net cash flows computed in part (a). Use the present value tables (Exhibits 2 and 5) provided in the chapter in determining your answer. - c.

Based on your results in parts (a) and (b), should San Lucas Corporation invest in the equipment?

Based on your results in parts (a) and (b), should San Lucas Corporation invest in the equipment?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

PAR Ltd is considering an investment and has determined the following:

Expected net cash flows:

– Year 1

$65,967

– Year 2

$70,290

– Year 3

$135,391

– Year 4

$103,435

– Year 5

$100,998

Annual depreciation

$20,660

Period of investment

5 years

Initial investment

$611,246

Value at end of the investment period

$124,671

Calculate the Accounting Rate of Return. Express your answer in a percentage with 2 decimal places.

Xander Inc. has prepared the following sensitivity analysis:

Line Item Description

Amount

Amount

Amount

Estimated Annual Net Cash Flow

$500,000

$600,000

$700,000

Present value of annual net cash flows (× 4.487)

$2,243,500

$2,692,200

$3,140,900

Present value of residual value

50,000

50,000

50,000

Total present value

$2,293,500

$2,742,200

$3,190,900

Amount to be invested

(3,000,000)

(3,000,000)

(3,000,000)

Net present value

$(706,500)

$(257,800)

$190,900

In addition, it has assigned the following likelihoods to the three possible annual net cash flows: $500,000, 70%; $600,000, 20%; and $700,000, 10%. Based on an expected value analysis, which of the following statements is accurate?

a. The expected value of the annual net cash flow is $540,000, and the project should be accepted.

b. The expected value of the annual net cash flow is $660,000, and the project should be accepted.

c. The expected value of the annual net cash flow is $660,000, and the project…

Chapter 26 Solutions

Financial And Managerial Accounting

Ch. 26 - What are the principal objections to the use of...Ch. 26 - Discuss the principal limitations of the cash...Ch. 26 - Why would the average rate of return differ from...Ch. 26 - Prob. 4DQCh. 26 - Prob. 5DQCh. 26 - Prob. 6DQCh. 26 - Prob. 7DQCh. 26 - Two projects have an identical net present value...Ch. 26 - Prob. 9DQCh. 26 - What are the major disadvantages of the use of the...

Ch. 26 - Prob. 11DQCh. 26 - Prob. 12DQCh. 26 - Average rate of return Determine the average rate...Ch. 26 - Cash payback period A project has estimated annual...Ch. 26 - Prob. 3BECh. 26 - Internal rate of return A project is estimated to...Ch. 26 - Net present valueunequal lives Project 1 requires...Ch. 26 - Average rate of return The following data are...Ch. 26 - Average rate of returncost savings Maui...Ch. 26 - Average rate of returnnew product Hana Inc. is...Ch. 26 - Determine cash flows Natural Foods Inc. is...Ch. 26 - Prob. 5ECh. 26 - Cash payback method Lily Products Company is...Ch. 26 - Prob. 7ECh. 26 - Prob. 8ECh. 26 - Net present value methodannuity for a service...Ch. 26 - Net present value methodannuity Jones Excavation...Ch. 26 - Prob. 11ECh. 26 - Prob. 12ECh. 26 - Net present value method and present value index...Ch. 26 - Average rate of return, cash payback period, net...Ch. 26 - Prob. 15ECh. 26 - Internal rate of return method The internal rate...Ch. 26 - Prob. 17ECh. 26 - Internal rate of return methodtwo projects Munch N...Ch. 26 - Net present value method and internal rate of...Ch. 26 - Identify error in capital investment analysis...Ch. 26 - Prob. 21ECh. 26 - Prob. 22ECh. 26 - Prob. 1PACh. 26 - Cash payback period, net present value method, and...Ch. 26 - Prob. 3PACh. 26 - Net present value method, internal rate of return...Ch. 26 - Alternative capital investments The investment...Ch. 26 - Capital rationing decision for a service company...Ch. 26 - Prob. 1PBCh. 26 - Prob. 2PBCh. 26 - Net present value method, present value index, and...Ch. 26 - Net present value method, internal rate of return...Ch. 26 - Prob. 5PBCh. 26 - Clearcast Communications Inc. is considering...Ch. 26 - San Lucas Corporation is considering investment in...Ch. 26 - Assume San Lucas Corporation in MAD 26-1 assigns...Ch. 26 - Prob. 3MADCh. 26 - Prob. 4MADCh. 26 - Home Garden Inc. is considering the construction...Ch. 26 - Assume Home Garden Inc. in MAD 26-5 assigns the...Ch. 26 - Ethics in Action Danielle Hastings was recently...Ch. 26 - Prob. 4TIFCh. 26 - Prob. 5TIFCh. 26 - Prob. 6TIFCh. 26 - Foster Manufacturing is analyzing a capital...Ch. 26 - Staten Corporation is considering two mutually...Ch. 26 - Prob. 3CMACh. 26 - Prob. 4CMA

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assume Home Garden Inc. in MAD 26-5 assigns the following probabilities to the estimated construction cost of the warehouse and annual net cash flows: a. Compute the expected value of the construction cost. b. Compute the expected value of the annual net cash flows. c. Determine the expected net present value of building the distribution warehouse, assuming a desired rate of return of 14% and using the expected values computed in parts (a) and (b). Use the present value tables provided in Appendix A. Round to the nearest dollar. d. Based on your results in part (c), should Home Garden Inc. build the distribution warehouse?arrow_forwardAssume a company is going to make an investment in a machine of $825,000 and the following are the cash flows that two different products would bring. Which of the two options would you choose based on the payback method?arrow_forwardStart with the partial model in the file Ch07 P25 Build a Model.xlsx on the textbook’s Web site. Selected data for the Derby Corporation are shown here. Use the data to answer the following questions. Calculate the estimated horizon value (i.e., the value of operations at the end of the forecast period immediately after the Year-4 free cash flow). Assume growth becomes constant after Year 3. Calculate the present value of the horizon value, the present value of the free cash flows, and the estimated Year-0 value of operations. Calculate the estimated Year-0 price per share of common equity.arrow_forward

- Assume a company is going to make an investment of $450,000 in a machine and the following are the cash flows that two different products would bring in years one through four. Which of the two options would you choose based on the payback method?arrow_forwardSan Lucas Corporation is considering investment in robotic machinery based upon the following estimates: a. Determine the net present value of the equipment, assuming a desired rate of return of 10% and annual net cash flows of 700,000. Use the present value tables appearing in Exhibits 2 and 5 of this chapter. b. Determine the net present value of the equipment, assuming a desired rate of return of 10% and annual net cash flows of 500,000, 700,000, and 900,000. Use the present value tables (Exhibits 2 and 5) provided in the chapter in determining your answer. c. Determine the minimum annual net cash flow necessary to generate a positive net present value, assuming a desired rate of return of 10%. Round to the nearest dollar. d. Interpret the results of parts (a), (b), and (c).arrow_forwardThe expected period of time that will elapse between the date of a capital investment and thecomplete recovery of the amount of cash investedis called: A.The average rate of return period B.The cash payback period C.The net present value period D.The internal rate of return periodarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License