Suppose you created a two-stock portfolio by investing $50,000 in High Tech and $50.000 in Collections. 1. Calculate the expected return (f.), the standard deviation (o.), the coefficient of variation (CV,), and the Sharpe ratio for this portfolio, and fill in the appropriate blanks in the table. 2. How dos the riskiness of this two-stock portfolio compare with the riskiness of the individual stocks if they were held in isolation?

Suppose you created a two-stock portfolio by investing $50,000 in High Tech and $50.000 in Collections. 1. Calculate the expected return (f.), the standard deviation (o.), the coefficient of variation (CV,), and the Sharpe ratio for this portfolio, and fill in the appropriate blanks in the table. 2. How dos the riskiness of this two-stock portfolio compare with the riskiness of the individual stocks if they were held in isolation?

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

part f 1,2

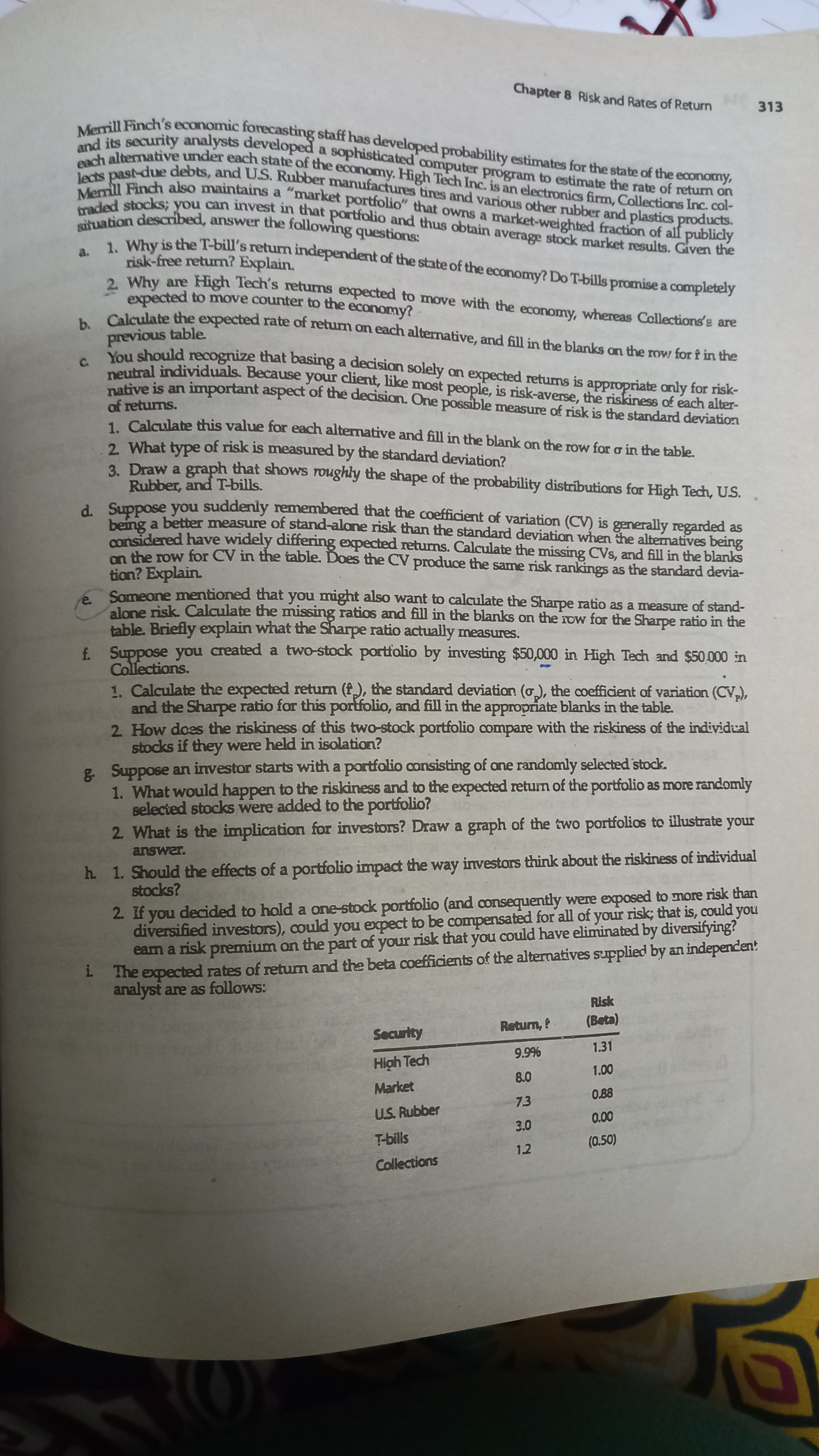

Transcribed Image Text:Chapter 8 Risk and Rates of Return

313

a

. Why is the T-bill's return independent of the state of the economy? Do T-bills promise a completely

risk-free return? Explain.

Why are High Tech's returns expected to move with the economy, whereas Collections'e are

expected to move counter to the economy?

previous table

u should recognize that basing a decision solely on expected returns is appropriate only for risk-

10 nal individuals. Because your client, like most people, is risk-averse, the riskiness of each alter-

tative is an important aspect of the decision. One possible measure of risk is the standard deviation

of returns.

1 Calgulate this value for each alternative and fill in the blank on the row for o in the table.

2. What type of risk is measured by the standard deviation?

3 Draw a graph that shows roughly the shape of the probability distributions for High Tech, U.S.

Rubber, and T-bills.

å Suppose you suddenly remembered that the coefficient of variation (CV) is generally regarded as

r a better measure of stand-alone risk than the standard deviation when the alternatives being

onsidered have widely differing expected returns. Calculate the missing CVs, and fill in the blanks

n the row for CV in the table. Does the CV produce the same risk rankings as the standard devia-

tion? Explain.

Someone mentioned that you might also want to calculate the Sharpe ratio as a measure of stand-

alone risk. Calculate the missing ratios and fill in the blanks on the row for the Sharpe ratio in the

table. Briefly explain what the Sharpe ratio actually measures.

f Suppose you created a two-stock portfolio by investing $50,000 in High Tech and $50.000 in

Collections.

1. Calculate the expected return (f), the standard deviation (o), the coefficient of variation (CV,),

and the Sharpe ratio for this portfolio, and fill in the appropriate blanks in the table.

2 How doss the riskiness of this two-stock portfolio compare with the riskiness of the individual

stocks if they were held in isolation?

g. Suppose an investor starts with a portfolio consisting of ane randomly selected stock.

1. What would happen to the riskiness and to the expected retum of the portfolio as more randomly

selected stocks were added to the portfolio?

2 What is the implication for investors? Draw a graph of the two portfolios to illustrate your

answer.

h 1. Should the effects of a portfolio impact the way investors think about the riskiness of individual

stocks?

2 If you decided to hold a one-stock portfolio (and consequently were exposed to more risk than

diversified investors), could you expect to be compensated for all of your risk; that is, could you

earn a risk premium on the part of your risk that you could have eliminated by diversifying?

1 The expected rates of retum and the beta coefficients of the alternatives supplied by an independen:

analyst are as follows:

Security

1.31

High Tech

%66

00 0

0.88

Market

7.3

U.S. Rubber

000

(0.50)

T-bills

1.2

Collections

Transcribed Image Text:百

Bartman, of Stock A, of Stock B, and 20% of C.

would the beta and return be?

a job as a with a Your f

RISK AND RETURN that you a major in just lande

end of 1 you have been to plan for a bossla

assignment is to a client. the are to be in a a

and (For now, the items at of you will fill it

bar

the SML equation

h If you formed a portfolio that cons

restricted you to the in the with their probablite

i an to stock in his portfolio.

Reynolds, what

pue c86

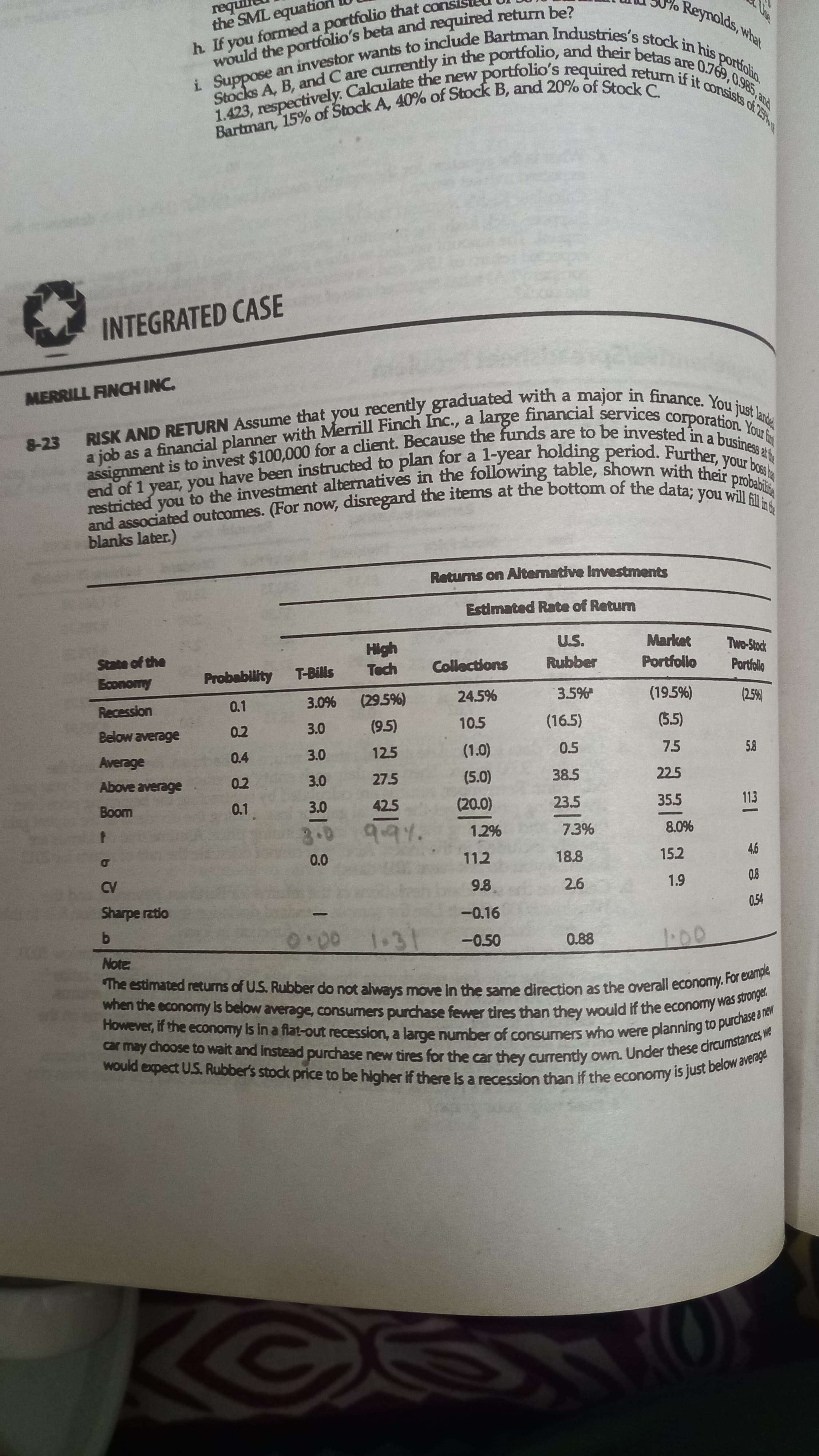

INTEGRATED CASE

MERRILL FINCH INC.

8-23

a job as a financial planner with Merrill Finch Inc., a large

a

restricted

nou,

blanks later.)

Returns on Alternative Investments

Estimated Rate of Retum

U.S.

Rubber

Market

State of the

Probability T-Bills

Collections

Portfolio

Portfollo

AsOucog

24.5%

Recession

0.1

(29.5%)

(195%)

10.5

(16.5)

(5.5)

(5)

125

0.2

0.4

3.0

0.5

7.5

(0')

Above average

0.2

3.0

27.5

38.5

225

(O'S)

0.1

42.5

23.5

35.5

113

woog

3.0

997.

1.2%

7.3%

112

18.8

15.2

00

9.8

2.6

Sharpe ratio

-0.16

50

-0.50

0.88

1000

13

1.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education