Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 3PA: Use the tables in Appendix B to answer the following questions. A. If you would like to accumulate...

Related questions

Question

Please help me to solve these questions in the picture below: I'm stucking on them :(

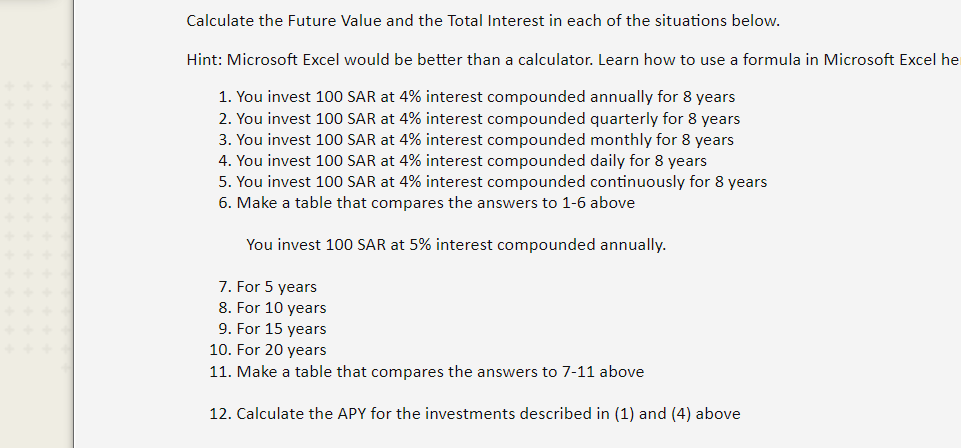

Transcribed Image Text:Calculate the Future Value and the Total Interest in each of the situations below.

Hint: Microsoft Excel would be better than a calculator. Learn how to use a formula in Microsoft Excel he

1. You invest 100 SAR at 4% interest compounded annually for 8 years

2. You invest 100 SAR at 4% interest compounded quarterly for 8 years

3. You invest 100 SAR at 4% interest compounded monthly for 8 years

4. You invest 100 SAR at 4% interest compounded daily for 8 years

5. You invest 100 SAR at 4% interest compounded continuously for 8 years

6. Make a table that compares the answers to 1-6 above

You invest 100 SAR at 5% interest compounded annually.

7. For 5 years

8. For 10 years

9. For 15 years

10. For 20 years

11. Make a table that compares the answers to 7-11 above

12. Calculate the APY for the investments described in (1) and (4) above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT