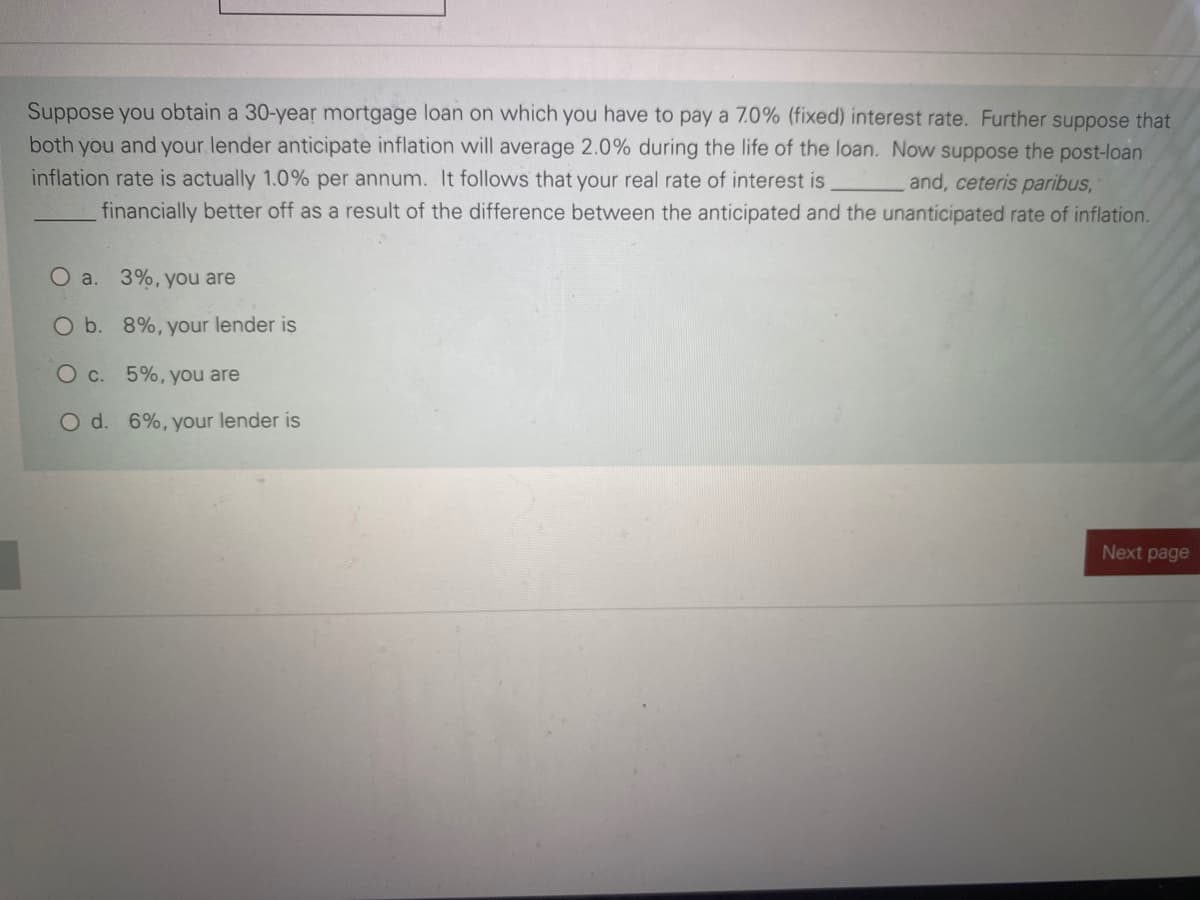

Suppose you obtain a 30-year mortgage loan on which you have to pay a 7.0% (fixed) interest rate. Further suppose that both you and your lender anticipate inflation will average 2.0% during the life of the loan. Now suppose the post-loan inflation rate is actually 1.0% per annum. It follows that your real rate of interest is financially better off as a result of the difference between the anticipated and the unanticipated rate of inflation. and, ceteris paribus, O a. 3%, you are O b. 8%, your lender is Oc. 5%, you are O d. 6%, your lender is

Suppose you obtain a 30-year mortgage loan on which you have to pay a 7.0% (fixed) interest rate. Further suppose that both you and your lender anticipate inflation will average 2.0% during the life of the loan. Now suppose the post-loan inflation rate is actually 1.0% per annum. It follows that your real rate of interest is financially better off as a result of the difference between the anticipated and the unanticipated rate of inflation. and, ceteris paribus, O a. 3%, you are O b. 8%, your lender is Oc. 5%, you are O d. 6%, your lender is

Principles of Economics 2e

2nd Edition

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:Steven A. Greenlaw; David Shapiro

Chapter22: Inflation

Section: Chapter Questions

Problem 10SCQ: A fixed-rate mortgage has the same interest rate over the life of the loan, whether the mortgage is...

Related questions

Question

Transcribed Image Text:Suppose you obtain a 30-year mortgage loan on which you have to pay a 7.0% (fixed) interest rate. Further suppose that

you and your lender anticipate inflation will average 2.0% during the life of the loan. Now suppose the post-loan

both

inflation rate is actually 1.0% per annum. It follows that your real rate of interest is

and, ceteris paribus,

financially better off as a result of the difference between the anticipated and the unanticipated rate of inflation.

O a. 3%, you are

O b. 8%, your lender is

Oc. 5%, you are

O d. 6%, your lender is

Next page

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax