Suppose you start saving today for a $25.000 down payment that you plan to make on a house in 5 years. Assume that you make no deposits into the account after the initial deposit. For the account described below, how much would you have to deposit now to reach your $25,000 goal i years An account with daily compounding and an APR of 6% You should invest $ 20767.15 (Do not round until the final answer. Then round to two decimal places as needed.) That's incorrect. * Use the compound interest formula, where A is accumulated balance after Y years, Pis starting principal, APR is annual percentage rate (as a decimal), nis number of compounding periods per year, and Y is number of years, to determine the amount, P, that you will have to invest A=P(1. APR OK X

Suppose you start saving today for a $25.000 down payment that you plan to make on a house in 5 years. Assume that you make no deposits into the account after the initial deposit. For the account described below, how much would you have to deposit now to reach your $25,000 goal i years An account with daily compounding and an APR of 6% You should invest $ 20767.15 (Do not round until the final answer. Then round to two decimal places as needed.) That's incorrect. * Use the compound interest formula, where A is accumulated balance after Y years, Pis starting principal, APR is annual percentage rate (as a decimal), nis number of compounding periods per year, and Y is number of years, to determine the amount, P, that you will have to invest A=P(1. APR OK X

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 3PB: Use the tables in Appendix B to answer the following questions. A. If you would like to accumulate...

Related questions

Question

Transcribed Image Text:K-

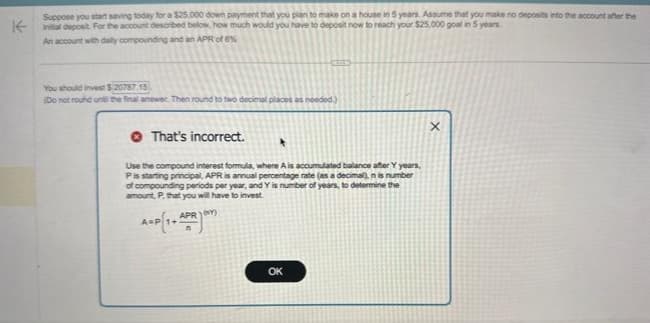

Suppose you start saving today for a $25.000 down payment that you plan to make on a house in 5 years. Assume that you make no deposits into the account after the

initial deposit. For the account described below, how much would you have to deposit now to reach your $25,000 goal in 5 years

An account with daily compounding and an APR of 6%

You should invest $20787.15

(Do not round on the final answer. Then round to two decimal places as needed.)

That's incorrect.

Use the compound interest formula, where A is accumulated balance after Y years,

P is starting principal, APR is annual percentage rate (as a decimal), nis number

of compounding periods per year, and Y is number of years, to determine the

amount, P, that you will have to invest

APRY)

A=P 1+

OK

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning