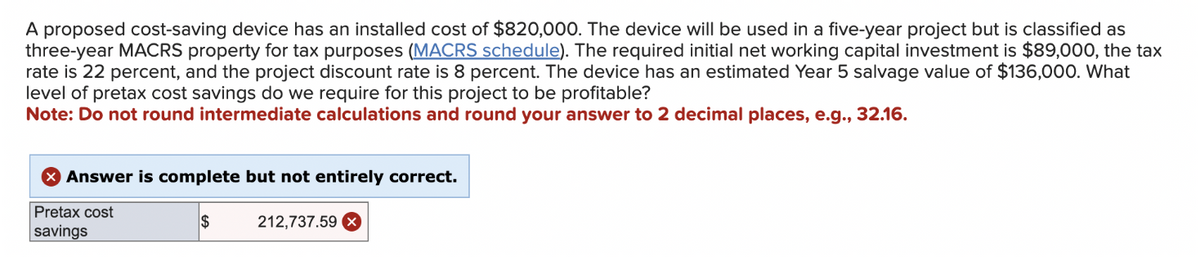

A proposed cost-saving device has an installed cost of $820,000. The device will be used in a five-year project but is classified as three-year MACRS property for tax purposes (MACRS schedule). The required initial net working capital investment is $89,000, the tax rate is 22 percent, and the project discount rate is 8 percent. The device has an estimated Year 5 salvage value of $136,000. What level of pretax cost savings do we require for this project to be profitable? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Answer is complete but not entirely correct. Pretax cost savings $ 212,737.59

A proposed cost-saving device has an installed cost of $820,000. The device will be used in a five-year project but is classified as three-year MACRS property for tax purposes (MACRS schedule). The required initial net working capital investment is $89,000, the tax rate is 22 percent, and the project discount rate is 8 percent. The device has an estimated Year 5 salvage value of $136,000. What level of pretax cost savings do we require for this project to be profitable? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Answer is complete but not entirely correct. Pretax cost savings $ 212,737.59

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 4P

Related questions

Question

Please make sure you have the right answer! I have asked this question too many times and all the answers were wrong!!!

Transcribed Image Text:A proposed cost-saving device has an installed cost of $820,000. The device will be used in a five-year project but is classified as

three-year MACRS property for tax purposes (MACRS schedule). The required initial net working capital investment is $89,000, the tax

rate is 22 percent, and the project discount rate is 8 percent. The device has an estimated Year 5 salvage value of $136,000. What

level of pretax cost savings do we require for this project to be profitable?

Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.

Answer is complete but not entirely correct.

Pretax cost

savings

$

212,737.59

Expert Solution

Step 1

The Company manufacture and sells goods after bearing lots of costs such as material labor, machinery, expenses, etc. The company should invest in those machines which control the company's cost so the Burdon of the cost will be low.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub