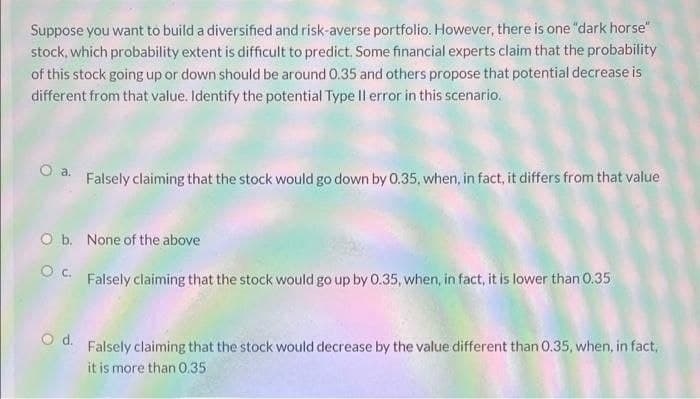

Suppose you want to build a diversified and risk-averse portfolio. However, there is one "dark horse" stock, which probability extent is difficult to predict. Some financial experts claim that the probability of this stock going up or down should be around 0.35 and others propose that potential decrease is different from that value. Identify the potential Type Il error in this scenario. a. Falsely claiming that the stock would go down by 0.35, when, in fact, it differs from that value O b. None of the above Oc. Falsely claiming that the stock would go up by 0.35, when, in fact, it is lower than 0.35 O d. Falsely claiming that the stock would decrease by the value different than 0.35, when, in fact, it is more than 0.35

Suppose you want to build a diversified and risk-averse portfolio. However, there is one "dark horse" stock, which probability extent is difficult to predict. Some financial experts claim that the probability of this stock going up or down should be around 0.35 and others propose that potential decrease is different from that value. Identify the potential Type Il error in this scenario. a. Falsely claiming that the stock would go down by 0.35, when, in fact, it differs from that value O b. None of the above Oc. Falsely claiming that the stock would go up by 0.35, when, in fact, it is lower than 0.35 O d. Falsely claiming that the stock would decrease by the value different than 0.35, when, in fact, it is more than 0.35

College Algebra

7th Edition

ISBN:9781305115545

Author:James Stewart, Lothar Redlin, Saleem Watson

Publisher:James Stewart, Lothar Redlin, Saleem Watson

Chapter9: Counting And Probability

Section9.4: Expected Value

Problem 1E: If a game gives payoffs of $10 and $100 with probabilities 0.9 and 0.1, respectively, then the...

Related questions

Question

Transcribed Image Text:Suppose you want to build a diversified and risk-averse portfolio. However, there is one "dark horse"

stock, which probability extent is difficult to predict. Some financial experts claim that the probability

of this stock going up or down should be around 0.35 and others propose that potential decrease is

different from that value. Identify the potential Type Il error in this scenario.

Oa.

Falsely claiming that the stock would go down by 0.35, when, in fact, it differs from that value

O b. None of the above

Oc.

Falsely claiming that the stock would go up by 0.35, when, in fact, it is lower than 0.35

O d.

Falsely claiming that the stock would decrease by the value different than 0.35, when, in fact,

it is more than 0.35

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning