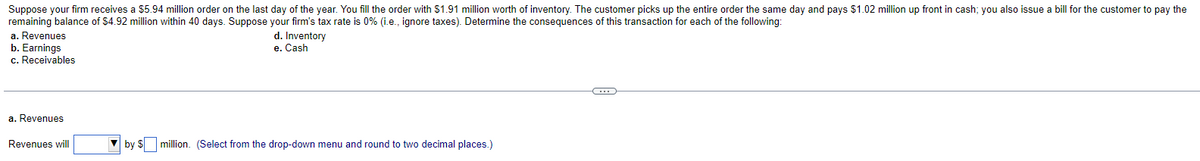

Suppose your firm receives a $5.94 million order on the last day of the year. You fill the order with $1.91 million worth of inventory. The customer picks up the entire order the same day and pays $1.02 million up front in cash; you also issue a bill for the customer to pay the remaining balance of $4.92 million within 40 days. Suppose your firm's tax rate is 0% (i.e., ignore taxes). Determine the consequences of this transaction for each of the following: a. Revenues b. Earnings c. Receivables a. Revenues Revenues will by S d. Inventory e. Cash million. (Select from the drop-down menu and round to two decimal places.)

Q: A firm is considering the following three alternatives, as well as a fourth choice: do nothing. Each…

A: We have given four alternatives, do nothing alternative, and A,B and C alternatives. The MARR is…

Q: Suppose the United States and Mexico both produce hamburgers and tacos. The combinations of the two…

A: US can produce maximum 243 tons of tacos or maximum 270 tons of hamburgers. Mexico can produce…

Q: A 1 Total Monthly Gross Income 2 Allowable Monthly Housing Expenditure 3 Total Non-Mortgage Housing…

A: Based on the information provided and the calculations required, the model will be presenting…

Q: A clothing manufacturer produced 5,000 sweaters, but sold only 4,000 of them. The remaining 1,000…

A: Any asset that is in a physical form and can be touched is known as tangible asset.

Q: As the accounting industry expands, the demand for certified public accountants (CPAs) also…

A: Demand refers to the desire or willingness of individuals or organizations to purchase a particular…

Q: Assume that the MBA education industry is constant-cost and is in long-run equilibrium. Discuss what…

A: A market is in long-run equilibrium if there are no incentives for profit-maximizing firms to enter…

Q: Why does the long run average cost curve decrease and then increase? Give some reasons that the…

A: In the long run, all the factors of production and costs are variable and the firm is able to adjust…

Q: The manager of a hyperrmarket accidentally mismarked the price of 10-killo bag of rice at BD4.38…

A: Elasticity of demand refers to the percentage change in the quantity demanded of a product with…

Q: Calculate the annual worth (years 1 through 7) of the following series of disbursements. Assume that…

A: Annual Worth refers to the discounted annual values of future cash flows . To find the annual worth…

Q: he graph below models an economy in equilibrium with a real GDP of $180 billion. Suppose that…

A: Planned Aggregate Expenditure (PAE) is a macroeconomic concept that represents the total planned…

Q: GIVE EXAMPLES ON DUAL TRACK

A: Two examples of Dual track policy are the world most populated countries namely India and China

Q: economics 1. Following Putin's initiation of a war with Ukraine, countries around the world…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Consider the diagram depicting the tradeoff faced by the Mars colony in production of spaceships or…

A: PPF is the production possibility frontier. PPF shows the production possibility of two goods in an…

Q: Alex and Mitch are two farmers who grow vegetables on common land. Each farmer gets a benefit from…

A: Alex's Benefit function : sa(60 - sa - sm ) Mitch's Benefit function : sm (60 - sm - sa ) Marginal…

Q: Refer to the figure at right. Which allocation is efficient? OA. A and B OB. B and C OC. C and D OD.…

A: Pareto efficiency, alternatively referred to as Pareto optimality, describes a condition where…

Q: The U.S. population has a bubble of individuals known as the baby boomers. As the group retires,…

A: Introduction: The question at hand pertains to the impact of the retirement of the baby boomer…

Q: Price (dolalrs per unit) 10 76 4 0 5 10 15 20 MC ATC Quantity (units) a. Find the perfectly…

A: In perfect competition, There exists a large number of buyers and sellers. The firm will produce…

Q: 5. Janet has the production function z = f (x, y) = 2√x + √y where x and y are inputs and z is the…

A: In this question, we are introduced to Janet's production function, which represents the…

Q: 4. A decision at the margin Suppose that Malika is a diligent third-year college student. One…

A: Additional gain or satisfaction which is derived from the increase in consumption of good by…

Q: Infrastructure, such as public works and public services, is also referred to as social capital.…

A: Public services refer to a wide range of essential services provided by the government or other…

Q: compare a perfect competitive and monolpoly market structures

A: Market structure refers to the organizational features that determine a particular market and…

Q: A market has an inverse demand function p = 100 - 2Q and four firms, each of which has a constant…

A: In the market, every firm wants to maximize profits for growth. The firms can do that by forming a…

Q: The City of San Antonio is considering various options for providing water in its 50-year plan,…

A: The concept of present worth is based on the principle that the value of money changes over time due…

Q: 4. Elastic, inelastic, and unit-elastic demand The following graph shows the demand for a good.…

A: The elasticity is an economic efficiency statistic that measures the adaptability of both demand and…

Q: Michael has the utility function u(x, y) = √x + √y. Michael's preferences are strongly increasing…

A: The utility function refers to all those commodity bundles that derive the same amount of utility…

Q: When each farmer plants the equilibrium number of seeds, each farmer gets a benefit of each farmer…

A: A market structure in which there are only two dominant firms that control a significant portion of…

Q: 1. Consider the following simple three-period addiction model. The three periods are "youth",…

A: The field of behavioural economics emerged as a response to the limitations of traditional…

Q: a. Demonstrate graphically the effect of a minimum wage law. Instructions: First use the tool 'EQ'…

A: Regulations from the government enormously influence and impact job markets. The regulations have…

Q: A soybean farmer sells soybeans in a perfectly competitive market and hires labor in a perfectly…

A: Marginal revenue product is an additional revenue generated by an addition resource or input is…

Q: A production possibilities table for DVDs and computers is shown below. Production Alternatives B 20…

A: Opportunity Cost- is a type of cost. It helps to study the sacrifice to be made of one commodity in…

Q: Walt Wallace Construction is investigating the purchase of a new dump truck with a 10 year useful…

A: Model Purchase price Annual Operating Cost Annual Income Salvage Value A $50,000 $2,000 $9,000…

Q: Analyze the SR and LR impact of a rise in Taxes (T) on the economy. Note that higher Taxes affect…

A: The IS-LM model is an economic framework used to analyze the relationship between interest rates and…

Q: 3. Consider a duopoly with a demand curve given by P = a-bQ, where a and b are positive constants…

A: Disclaimer- “Since you have asked multiple question, we will solve the first three question for you…

Q: A master student interested in pursuing a PhD is deciding between two courses: advanced game theory…

A: When one of the parties in an economic transaction possesses greater details or information than the…

Q: Which of the following is included in GDP check all correct answers government transfer payments…

A: GDP(Gross Domestic Product): It is a measure of the total value of all goods and services produced…

Q: Refer to the figure at right. Which allocation is efficient? OA. A and B OB. B and C OC. C and D OD.…

A: A situation in which resource distribution is optimized so that no one can be made better off…

Q: Consider two companies bidding to be at the top of a search engine's results for a given keyword.…

A: The consequence of an auction is the conclusion of the process of bidding, specifically when a…

Q: Consider the PPF for a Mars colony depicted in the picture. The PPF shows combinations of habitats…

A: PPF stands for Production Possibilities Frontier. It is a graphical representation that shows the…

Q: The following cash flows has an interest rate of 9% per year, compounded annually. Use Annual worth…

A: Annual Worth is the constant discounted values of all the future cash flows . To derive the annual…

Q: What impact does AI have in healthcare and how does it play a factor in the economy? Please provide…

A: Artificial Intelligence(AI) has been playing a vital role in shaping the economy. It has been a very…

Q: Suppose an economy consists of the Coal, Electric, and Steel sectors. Denote the prices (that is,…

A: In this question, we are exploring an economy consisting of the Coal, Electric, and Steel sectors.…

Q: Table 1 includes Price, Quantity, Average Total Cost, Average Revenue, Marginal Cost, and Marginal…

A: Revenue and cost assessments are important in economics because they give useful insight into the…

Q: Suppose that in the short-run (Labor is the only variable input) when output equals 50, (1) the firm…

A: Cost refers to the value or expenditure incurred in the production, acquisition, or consumption of…

Q: 12. Which of the following is a test of the null hypothesis of non-stationarity a) The Jarque-Bera…

A: In this question, we are discussing a test for the null hypothesis of non-stationarity. Stationarity…

Q: Number of CDs listened to in a week 1319 53 Reference: Figure 2-5 O % article. O2 articles. 4 O1…

A: Opportunity cost is an economic concept that refers to the value of the next best alternative…

Q: If you invest $4,000 at 3% interest compounded monthly, how long will it take you to reach $5,000 ?

A: Present value is the value of investment in today's dollar. Future value is the value of investment…

Q: graph showing the relationship etween the price of a good and the mount of it that sellers are…

A: When making daily decisions, you consider prices and the marginal utility of each commodity to…

Q: u = (x + 2)(y + 10),m =110,pX= 20, pY= 5. Next month the prices will be pX= 5, pY= 5. Provide a…

A: The utility function refers to all those commodity bundles that derive the same amount of utility…

Q: y is negotiating its accession to the European Union (EU). Make use of economic theory and diagrams…

A: Economic integration refers to the process of combining economic activities and policies among…

Q: A firm's long-run total cost curve is given by: C(q) = 40q - 10q² + q³. Over what range of output…

A: Total cost is the cost of producing all the units of good. Average cost is minimum where the…

Step by step

Solved in 3 steps

- Sunshine Smoothies Company (SSC) manufactures and distributes smoothies. It is considering the "weight loss" smoothies project. The project would require a $4 million investment outlay today The after-tax cash flows would depend on consumers’ demand. There is a 30% chance that demand will be good, and the project will produce after-tax cash flows of $2 million at the end of each year for the next 3 years. There is a 70% chance that demand will be poor, and the project will produce after-tax cash flows of $1 million at the end of each year for the next 3 years. The project is riskier than the firm's other projects, so it has a WACC of 12%. - The firm will know whether the project is success or not after receiving first year's cash flows from normal operating.. - After receiving the first year's cash flows (no matter what receive $1M or $2M in the first year), the firm will have the option to abandon the project. - If the firm decides to abandon the project, the company will no longer…A firm must decide whether to construct a small, medium or large stamping plant. A consultant’s report indicates a 0.20 probability that demand will be low and 0.80 that demand will be high. If the firm builds a small facility and demand turns out to be low, the Net Present Value (NPV) will be $42M. If demand turns out to be high, the firm can either subcontract and realize the NPV of $42M or expand greatly for a Net Present Value of $48M. The firm could build a medium-size facility as a hedge: if demand turns out to be low, its NPV is estimated at $22M; if demand turns out to be high, the firm could do nothing and realize a NPV of $46M, or could expand and realize a NPV of $50M. If the firm builds a large facility and demand is low, the NPV will be ($20M), whereas high demand will result in a NPV of $72M. Analyze and solve this problem using a decision tree What is the Maximin Alternative and Compute the EVPIThere are many tax rules and regulations you should be aware of when investing-whether it be in stocks; bonds; mutual funds; real estate; or collectibles such as artwork, antiques, gems, memorabilia, stamps, and coins. Capital gains are proceeds derived from these types of investments. Unless they are specified as being tax-free, such as municipal bonds, you must pay capital gains taxes on these proceeds. Capital gains are taxed in one of two ways. If the investment is held for one year or less, this is considered short-term and is taxed as ordinary income at your regular income tax rate. As this is written, if the investment is held for more than one year, it is considered long-term and qualifies for various tax discounts, as follows for single taxpayers with earnings as shown below. Stocks Held Capital Gains Rates Up to $38,700 $38,700–$426,700 Over $426,700 Over 1 year(long-term) 0% 15% 20% (a) If you are in the 25% tax bracket for ordinary income and have a 15% capital…

- Prominent Sdn Bhd produces furniture at several factories. Its Seberang Prai factoryproduces office chairs. Management aims to increase production in the coming year to 800units per month. Therefore, management is exploring two production strategies for thecoming year. The first strategy is to continue operations with the existing machine, MachineA, and the second strategy is to rent a new machine, Machine B, to produce the office chairs.The monthly rental of Machine B is RM14,000. Machine B takes half an hour to produce oneoffice chair. However, it requires a more skilled labour force with an hourly rate of RM30 perhour.Comparatively, continuing to use Machine A means that costs will remain the same. MachineA is 5 years old and is operating below capacity. The hourly labour rate is RM20 and thematerials required for each unit is RM30. Each office chair is assembled within an hour. Eachunit of the finished office chair is sold for RM120.The fixed monthly running costs of thefactory is…A local restaurateur who had been running a profitable business for many years, recently purchased a three-way liquor license. This on-premise license gives the owner the legal right to sell beer, wine, and spirits in her restaurant. The cost of obtaining the three-way license was about $90,000, since only 300 such licenses are issued by the state. While the license is transferable, only $75,000 is refundable if the owner chooses not to use the license. After selling alcoholic beverages for about one year, the restaurateur came to the realization that she was losing dining customers and that her profitable restaurant was turning into a noisy, unprofitable bar. Subsequently, she spent about $8,000 placing advertisements in various newspapers and restaurant magazines across the state offering to sell the license for $80,000. After a long wait, she finally received one offer to purchase her license for $77,000. a) Would you recommend that she accept the $77,000 offer? b) The restaurateur…A local restaurateur who had been running a profitable business for many years recently purchased a three-way liquor license. This license gives the owner the legal right to sell beer, wine, and spirits in her restaurant. The cost of obtaining the three-way license was about $90,000, since only 300 such licenses are issued by the state. While the license is transferable, only $75,000 is refundable if the owner chooses not to use the license. After selling alcoholic beverages for about one year, the restaurateur came to the realization that she was losing dinner customers and that her profitable restaurant was turning into a noisy, unprofitable bar. Subsequently, she spent about $8,000 placing advertisements in various newspapers and restaurant magazines across the state offering to sell the license for $80,000. After a long wait, she finally received one offer to purchase her license for $77,000. What is your opinion of the restaurateur’s decisions? Would you recommend that she accept…

- On September 2, 2021, the Malaysian government set a ceiling retail price of RM19.90 for COVID-19 Self-Test Kit, which would take effect on September 5, 2021. Discuss the advantages and disadvantages of the policy.Suppose you currently earn taxable income of $100,000 per year. You are subject to an MTR of 50 percent. Currently, your ATR is 35 percent. Calculate your annual tax. Calculate the extra tax that you would pay per year if your annual income increased to $110,000. What is your ATR when your annual income is $110,000?Your company has an opportunity to invest in a project that is expected to result in after-tax cash flows of $13,000 the first year, $15,000 the second year, $18,000 the third year, -$8,000 the fourth year, $25,000 the fifth year, $31,000 the sixth year, $34,000 the seventh year, and -$6,000 the eighth year. The project would cost the firm $67,100. If the firm's cost of capital is 12%, what is the modified internal rate of return?

- While studying for the engineering economy final exam, you and two friends find yourselves craving a fresh pizza. You can’t spare the time to pick up the pizza and must have it delivered. “Pizza Hut” offers a 1-1/4-inch-thick (including toppings), 20-inch square pizza with your choice of two toppings for $15 plus 5% sales tax and a $1.50 delivery charge (no sales tax on delivery charge). “Dominos” offers the round, deep-dish Sasquatch, which is 20 inches in diameter. It is 1-3/4 inches thick, includestwo toppings, and costs $17.25 plus 5% sales tax and free delivery. a. What is the problem in this situation? Please state it in an explicit and precise manner. b. Systematically apply the seven fundamental principles of engineering economy to the problem you have defined in Part (a).Burlington Motor Carriers, a trucking company, is considering the installation of a two-way mobile satellite messaging service on its 2,000 trucks. From tests done last year on 120 trucks, the company found that satellite messaging could cut 60% of its $5 million bill for long-distance communications with truck drivers. More importantly, the drivers who used this system reduced the number of "deadhead" miles-those driven without paying loads-by 0.5%. Applying that improvement to all 230 million miles covered by the Burlington fleet each year would produce an extra $1.25 million in savings. Equipping all 2,000 trucks with the satellite hookup will require an investment of $8 million and the construction of a message-relaying system costing $2 million. The equipment and onboard devices will have a service life of eight years and negligible salvage value; they will be depreciated under the five-year MACRS class. Burlington's marginal tax rate is about 38%, and its required minimum…During your first month as an employee at Greenfield Industries (a large drill-bit manufacturer), you are asked to evaluate alternatives for producing a newly designed drill bit on a turning machine. Your boss’ memorandum to you has practically no information about what the alternatives are and what criteria should be used. The same task was posed to a previous employee who could not finish the analysis, but she has given you the following information: An old turning machine valued at $350,000 exists (in the warehouse) that can be modified for the new drill bit. The in-house technicians have givenan estimate of $40,000 to modify this machine, and they assure you that they will have the machine ready before the projected start date (although they have never done any modifications of this type). It is hoped that the old turning machine will be able to meet production requirements at full capacity. An outside company, McDonald Inc., made the machine seven years ago and can easily do the…