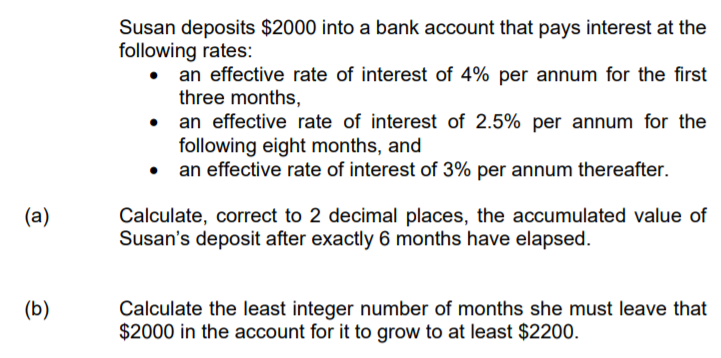

Susan deposits $2000 into a bank account that pays interest at the following rates: • an effective rate of interest of 4% per annum for the first three months, • an effective rate of interest of 2.5% per annum for the following eight months, and • an effective rate of interest of 3% per annum thereafter. Calculate, correct to 2 decimal places, the accumulated value of Susan's deposit after exactly 6 months have elapsed. (a) (b) Calculate the least integer number of months she must leave that $2000 in the account for it to grow to at least $2200.

Susan deposits $2000 into a bank account that pays interest at the following rates: • an effective rate of interest of 4% per annum for the first three months, • an effective rate of interest of 2.5% per annum for the following eight months, and • an effective rate of interest of 3% per annum thereafter. Calculate, correct to 2 decimal places, the accumulated value of Susan's deposit after exactly 6 months have elapsed. (a) (b) Calculate the least integer number of months she must leave that $2000 in the account for it to grow to at least $2200.

Chapter5: Introduction To Business Expenses

Section: Chapter Questions

Problem 61P

Related questions

Question

Help me solve a and b, thank you

Transcribed Image Text:Susan deposits $2000 into a bank account that pays interest at the

following rates:

an effective rate of interest of 4% per annum for the first

three months,

an effective rate of interest of 2.5% per annum for the

following eight months, and

• an effective rate of interest of 3% per annum thereafter.

(a)

Calculate, correct to 2 decimal places, the accumulated value of

Susan's deposit after exactly 6 months have elapsed.

(b)

Calculate the least integer number of months she must leave that

$2000 in the account for it to grow to at least $2200.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning