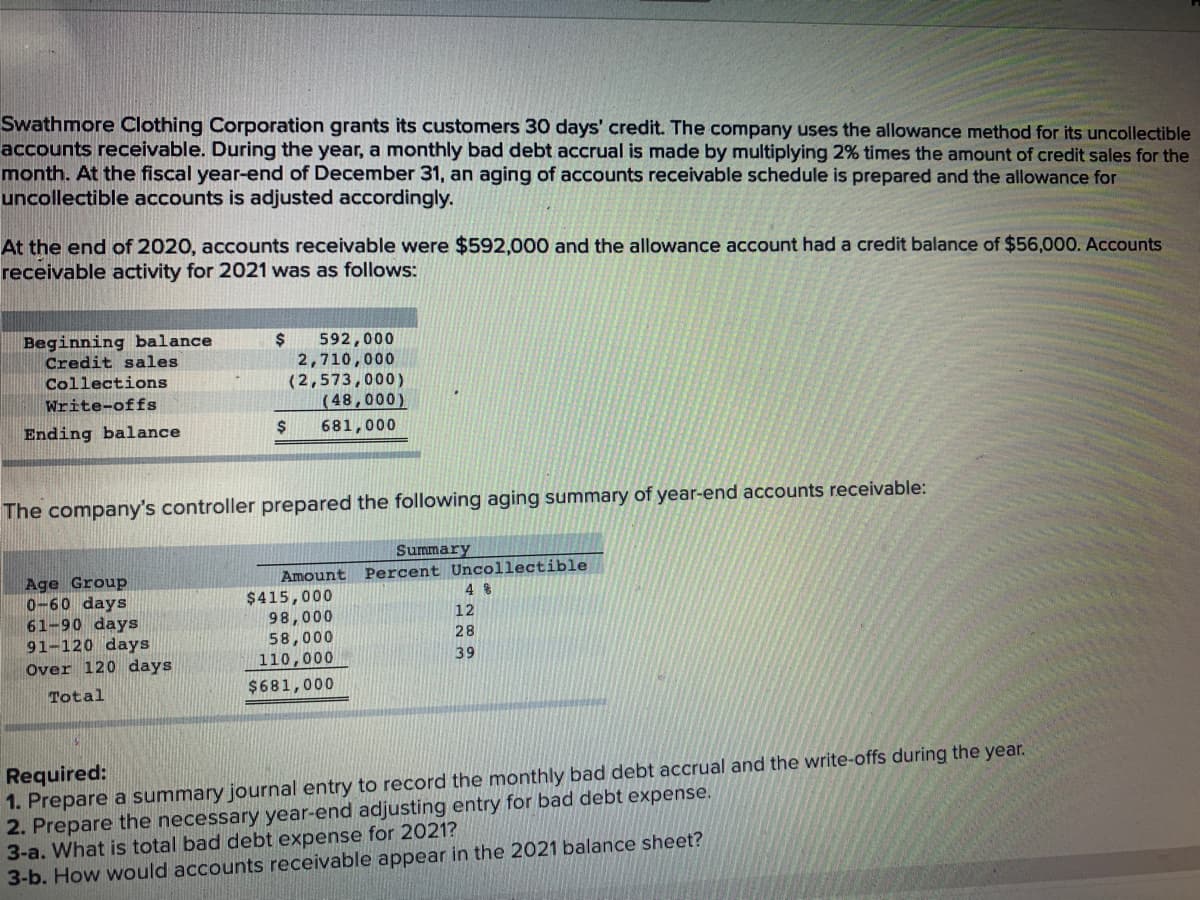

Swathmore Clothing Corporation grants its customers 30 days' credit. The company uses the allowance method for its uncollectible accounts receivable. During the year, a monthly bad debt accrual is made by multiplying 2% times the amount of credit sales for the month. At the fiscal year-end of December 31, an aging of accounts receivable schedule is prepared and the allowance for uncollectible accounts is adjusted accordingly. At the end of 2020, accounts receivable were $592,000 and the allowance account had a credit balance of $56,000. Accounts receivable activity for 2021 was as follows: Beginning balance Credit sales 24 592,000 2,710,000 (2,573,000) (48,000) Collections Write-offs Ending balance 681,000 The company's controller prepared the following aging summary of year-end accounts receivable: Summary Age Group 0-60 days 61-90 days 91-120 days Over 120 days Amount Percent Uncollectible $415,000 98,000 58,000 110,000 4 % 28 39 Total $681,000 Required: 1. Prepare a summary journal entry to record the monthly bad debt accrual and the write-offs during the year. 2. Prepare the necessary year-end adjusting entry for bad debt expense. 3-a. What is total bad debt expense for 2021? 3-b. How would accounts receivable appear in the 2021 balance sheet?

Swathmore Clothing Corporation grants its customers 30 days' credit. The company uses the allowance method for its uncollectible accounts receivable. During the year, a monthly bad debt accrual is made by multiplying 2% times the amount of credit sales for the month. At the fiscal year-end of December 31, an aging of accounts receivable schedule is prepared and the allowance for uncollectible accounts is adjusted accordingly. At the end of 2020, accounts receivable were $592,000 and the allowance account had a credit balance of $56,000. Accounts receivable activity for 2021 was as follows: Beginning balance Credit sales 24 592,000 2,710,000 (2,573,000) (48,000) Collections Write-offs Ending balance 681,000 The company's controller prepared the following aging summary of year-end accounts receivable: Summary Age Group 0-60 days 61-90 days 91-120 days Over 120 days Amount Percent Uncollectible $415,000 98,000 58,000 110,000 4 % 28 39 Total $681,000 Required: 1. Prepare a summary journal entry to record the monthly bad debt accrual and the write-offs during the year. 2. Prepare the necessary year-end adjusting entry for bad debt expense. 3-a. What is total bad debt expense for 2021? 3-b. How would accounts receivable appear in the 2021 balance sheet?

Chapter6: Business Expenses

Section: Chapter Questions

Problem 43P

Related questions

Question

Required 1-3 answers?

Transcribed Image Text:Swathmore Clothing Corporation grants its customers 30 days' credit. The company uses the allowance method for its uncollectible

accounts receivable. During the year, a monthly bad debt accrual is made by multiplying 2% times the amount of credit sales for the

month. At the fiscal year-end of December 31, an aging of accounts receivable schedule is prepared and the allowance for

uncollectible accounts is adjusted accordingly.

At the end of 2020, accounts receivable were $592,000 and the allowance account had a credit balance of $56,000. Accounts

receivable activity for 2021 was as follows:

Beginning balance

Credit sales

Collections

$

592,000

2,710,000

(2,573,000)

(48,000)

Write-offs

Ending balance

681,000

The company's controller prepared the following aging summary of year-end accounts receivable:

Summary

Age Group

0-60 days

61-90 days

91-120 days

Over 120 days

Amount Percent Uncollectible

$415,000

98,000

58,000

110,000

4 %

12

28

39

Total

$681,000

Required:

1. Prepare a summary journal entry to record the monthly bad debt accrual and the write-offs during the year.

2. Prepare the necessary year-end adjusting entry for bad debt expense.

3-a. What is total bad debt expense for 2021?

3-b. How would accounts receivable appear in the 2021 balance sheet?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 5 images

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage