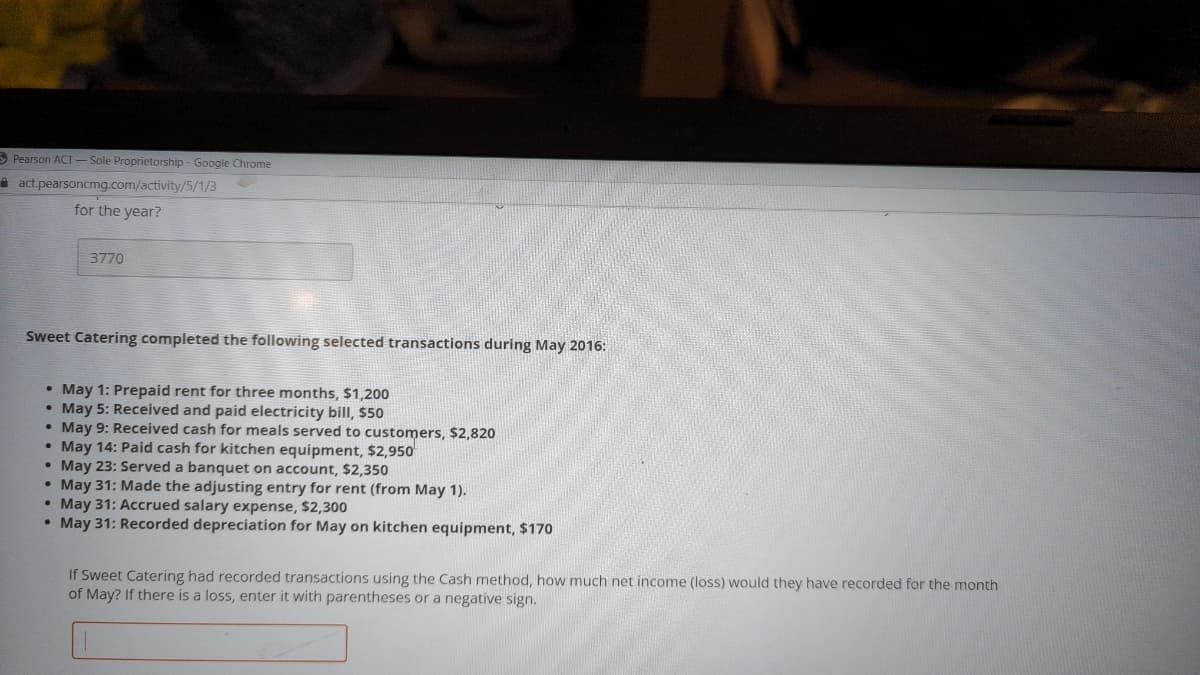

Sweet Catering completed the following selected transactions during May 2016: • May 1: Prepaid rent for three months, $1,200 • May 5: Received and paid electricity bill, $50 May 9: Received cash for meals served to customers, $2,820 • May 14: Paid cash for kitchen equipment, $2,950 • May 23: Served a banquet on account, $2,350 • May 31: Made the adjusting entry for rent (from May 1). • May 31: Accrued salary expense, $2,300 • May 31: Recorded depreciation for May on kitchen equipment, $170 If Sweet Catering had recorded transactions using the Cash method, how much net income (loss) would they have recorded for the month of May? If there is a loss, enter it with parentheses or a negative sign.

Q: A. Would either Mendoza or Cope violate the Code of Ethics for Professional Accountants by offering…

A: The "Code of Ethics for Professional Accountants" sets forth the principles and values that guide…

Q: Classify each of these transactions by type of cash flow activity.

A: There are Three types of Activities under Cash Flow Operating Activity: The activities performed by…

Q: Units Cost Beginning inventory Purchase (April 3) Sale (April 10) Purchase (April 18) Purchase…

A: LIFO is last in first out inventory valuation method which says that inventory which is purchased…

Q: At December 31, Hawke Company reports the following results for its calendar year. Cash sales:…

A: Whenever a business makes credit sales, it will generate accounts receivables for the business.…

Q: Operating Budget, Comprehensive Analysis Ponderosa, Inc., produces wiring harness assemblies used…

A: Hi student Since there are multiple subparts, we will answer only first three subparts. Budgets are…

Q: Assume that the prior period error effect is considered to be material.

A: Errors do happen while preparing financial statements. Some errors in financial statements can…

Q: The following information is taken from the annual report of Coca-Cola Enterprises, Inc.: (amounts…

A: Accounts receivable turnover is calculated by dividing the Net credit sales by the Average accounts…

Q: Minstrel Manufacturing uses a job order costing system. During the month, Minstrel purchased…

A: Total manufacturing costs comprises of direct material, direct labour and manufacturing overheads.…

Q: March 31 is the end of PDT Co.'s monthly pay period. PDT Co. has one sole employee, Sally, with a…

A: Journal Entry: It the act through which economic or non-economic transactions are recorded .…

Q: Beginning inventory Purchase (April 3) Sale (April 10) Purchase (April 18) Purchase (April 23) Sale…

A: Introduction: LIFO: LIFO stands for Last in First out. Which means last received inventory to be…

Q: Power Corp. makes 2 products: blades for table saws and blades for handsaws. Each product passes…

A: As per our guidelines we are supposed to answer only 3 parts of the question only.

Q: ABC Company acquired all of XYZ Corporation's assets and liabilities on June 30, 20X1. XYZ reported…

A: Book value and fair value The book value is based on the old old purchase price, from which yearly…

Q: 1 3:05 Forrester Company is considering buying new equipment that would decrease monthly fixed costs…

A: Break-Even point in dollars = Fixed cost/Contribution margin ratio

Q: Accounts receivable arising from sales to customers amounted to $77000 and $76000 at the beginning…

A: Cash flow from operating activities indicates the cash inflow or outflow transactions related to the…

Q: An all-equity business has 150 million shares outstanding selling for $20 a share. Management…

A: Equity, also known as shareholders' equity (or owners' equity for privately held businesses), is the…

Q: On January 1, 2015, ML Company grants 100 cash share appreciation rights to each of its 500…

A: Number of employees who can exercise their option in 2018 or 2019 = 140+ 150 = 290 Since the…

Q: Units 100 50 80 40 60 120 Cost $10 12 Beginning inventory Purchase (April 3) Sale (April 10)…

A: LIFO is last in first out inventory valuation method which says that inventory which is purchased…

Q: A man is paid on a salary-plus-commission basis. He receives $275 weekly in salary and a commission…

A: Given information Weekly salary = $275 Commission = 5% over Sales of $2020 Weekly sales = $7825

Q: Given the following: January 1 inventory April 1 June 1 November 1 Number purchased 34 54 44 Cost of…

A: The cost of goods sold refers to the direct costs of making products sold by a company (COGS). This…

Q: The general ledger of Grumpy Corporation as of December 31, 2021, includes the following accounts…

A: Intangible assets are the non physical assets the benefit of which can be reaped in more than a…

Q: 20. The order in which accounting procedures are performed is OA. 1) recording in the journal. 2)…

A: The transactions are first recorded in the journal, then posted to the individual accounts. The…

Q: 4. The process of entering journal page numbers of transactions in the ledger and then entering the…

A: The journal entries which are recorded in the books to maintain daily records are posted to ledger…

Q: Jackson Corp. (a US-based company) sold parts to a Korean customer on December 16, 2021, with…

A:

Q: You own 30,000 shares of National Corporation stock. The company is planning to issue a stock…

A: Calculation of Market value of shares owned after stock dividend Particulars Amount (P) Market…

Q: The manager of Dukey's Shoe Station estimates operating costs for the year will include $465,000 in…

A: Breakeven sales is that level of sales revenue at which business is only recovering it's fixed costs…

Q: Dimitri Designs has capacity to produce 30,000 desk chairs per year and is currently selling all…

A: Introduction: In the decision making, incremental cost plays a vital role in assessing whether a…

Q: Required information [The following information applies to the questions displayed below.] Shown…

A: In order to determine the net income earned during the year, the business entities prepare the…

Q: Units 100 50 80 40 60 120 Cost Beginning inventory Purchase (April 3) Sale (April 10) Purchase…

A: LIFO method is the method of inventory valuation where the goods which are purchased lately are sold…

Q: Starbucks financial statements provided, calculate and interpret the long-term liabilities ratios we…

A: Long-term liabilities ratios or long-term debt ratio refers to the ratio which reflects the number…

Q: A company reports the following amounts at the end of the year: Total sales revenue = $560,000;…

A: Sales revenue is the amount of revenue earned from sale of goods and services. Net sales revenue…

Q: The Nelson Company has a taxation year end of December 31. On January 1, 2021, the UCC of Class 8…

A: Here discuss about the calculation of Capital cost allowance for purchase of class 8 Assets and its…

Q: The following selected accounts and their current balances appear in the ledger of Fernandez Co. at…

A: Introduction: Income statement: All revenues and expenses are to be shown in income statement. It…

Q: Krespy Corp. has a cash balance of $7,500 before the following transactions occur: received…

A: Cash: The term "cash" refers to any kind of money or coin that is recognized by the government as…

Q: On January 1, 2015, ML Company grants 100 cash share appreciation rights to each of its 500…

A: As per our guidelines we are supposed to answer only 1 question. so the solution of first question…

Q: e following was extracted from the accounting records of a trader on 28 February 2015: Extracts from…

A: Solvency Ratio: This ratio is measuring the long term solvency position of the business concern. The…

Q: Question 1: Which statement about budgets is incorrect? Answer: A. B. C. D. O They determine the…

A: “Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: Cash $655,500 Marketable securities 759,000 Accounts and notes receivable (net) 310,500 Inventories…

A: Working capital is the amount of capital needed for daily operations of the business. This is…

Q: a. Determine the amount of adjusting entry uncollectible accoun b. Determine the adjusted balances…

A: This question belongs to the topic analysis of the receivables method. The amount of the…

Q: A domestic corporation in its 8th year of operations as of January MSME under CREATE law, has the…

A: In the context of the given question, we are required to income tax payable for the year 2021 and…

Q: Calculate the taxable value of the fringe benefit using the statutory formula in the following case…

A: It is given that : Purchase value - $ 45000 Days of use – 196 days Distance travelled – 15000 km…

Q: Kring and Kong are partners who share profits and losses equally and have capital balances of…

A: The partnership comes into existence when two or more persons agree to do the business and further…

Q: er type of account name for gift card lia

A: Gift card liability refers to the concept that reflects that the company has the obligation to…

Q: Classify each of these items as an asset, liability, or equity. "Share Capital - Ordinary" Choose...…

A: The balance sheet represents the financial position of the business with assets, liabilities and…

Q: The net income of the Jason and Browning partnership is $445000. The partnership agreement specifies…

A: Partnership is a contract or arrangement between two or more than two persons, in which they invest…

Q: Employee Gross Pay Karine 3,700 Kelsey 2,100 Dani 3,400 Brooke 2,600 11,800 Total Claim Code 5 4 1…

A: The primary reporting of the business transactions in the books of accounts on daily basis is…

Q: 25 An entity provided the following data for the current year: Net Income – P 4,000,000 Ordinary…

A: In the context of the given question, we are required to compute the basic earnings per share for…

Q: REQUIRED: Prepare the journal entries relating to the reversal of the impairment loss in the 2021…

A: The formula used for calculating the impairment loss is as under: Impairment loss = Carrying cost -…

Q: Eric Williams is a cost accountant and business analyst for Diamond Design Company (DDC), which…

A: Lets understand the basics. Direct material price variance is a variance between the rate at which…

Q: Analyze the following: I – An entity shall classify a noncurrent asset as held for sale when the…

A: Non-Current Asset: Non-Current Asset is an asset which is acquired by a company in hoping to get…

Q: Liang Company began operations in Year 1. During its first two years, the company completed a number…

A: The allowance for doubtful accounts is created to maintain the balance for estimated bad debt…

Step by step

Solved in 3 steps

- The transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the businesss operations: July 1.Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Musics checking account. 1.Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music store. Paid rent for July, 1,750. 1.Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2.Received 1,000 cash from customers on account. 3.On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for 80 hours per month for a monthly fee of 3,600. Any additional hours beyond 80 will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3.Paid 250 to creditors on account. 4.Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5.Purchased office equipment on account from Office Mart, 7,500. 8.Paid for a newspaper advertisement, 200. 11.Received 1,000 for serving as a disc jockey for a party. 13.Paid 700 to a local audio electronics store for rental of digital recording equipment. 14.Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16.Received 2,000 for serving as a disc jockey for a wedding reception. 18.Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22.Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23.Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27.Paid electric bill, 915. 28.Paid wages of 1,200 to receptionist and part-time assistant. 29.Paid miscellaneous expenses, 540. 30.Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31.Received 3,000 for serving as a disc jockey for a party. 31.Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists music during July. 31.Withdrew 1,250 cash from PS Music for personal use. PS Musics chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: Instructions 1. Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2. Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3. Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance as of July 31, 2019.The transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the business's operations: July 1. Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Music's checking account. 1. Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music: store. Paid rent for July, 1,750. 1. Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2. Received 1,000 cash from customers on account. 3. On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for SO hours per month for a monthly fee of 3,600. Any additional hours beyond SO will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3. Paid 250 to creditors on account. 4. Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5. Purchased office equipment on account from Office Mart, 7,500. 8. Paid for a newspaper advertisement, 200. 11. Received 1,000 for serving as a disc jockey for a party. 13. Paid 700 to a local audio electronics store for rental of digital recording equipment. 11. Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16. Received 2,000 for serving as a disc jockey for a wedding reception. 18. Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22. Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23. Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27. Paid electric bill, 915. 28. Paid wages of 1,200 to receptionist and part-time assistant. 29. Paid miscellaneous expenses, 540. 30. Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31. Received 3,000 for serving as a disc jockey for a party. 31. Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists' music during July. 31. Withdrew l,250 cash from PS Music for personal use. PS Music's chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: 11 Cash 3,920 12 Accounts receivable 1,000 14 Supplies 170 15 Prepaid insurance 17 Office Equipment 21 Accounts payable 250 23 Unearned Revenue 31 Peyton smith, Drawing 4,000 32 Fees Earned 500 41 Wages Expense 6,200 50 Office Rent Expense 400 51 Equipment Rent Expense 800 52 Utilities Expense 675 53 Supplies Expense 300 54 music Expense 1,590 55 Advertising Expense 500 56 Supplies Expense 180 59 Miscellaneous Expense 415 Instructions 1.Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2.Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3.Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4.Prepare an unadjusted trial balance as of July 31, 2019.Journal Entries Castle Consulting Agency began business in February. The transactions entered into by Castle during its first month of operations are as follows: Acquired articles of incorporation from the state and issued 10,000 shares of capital stock in exchange for $150,000 in cash. Paid monthly rent of $400. Signed a five-year promissory note for $100,000 at the bank. Purchased software to be used on future jobs. The software costs $950 and is expected to be used on five to eight jobs over the next two years. Billed customers $12,500 for work performed during the month. Paid office personnel $3,000 for the month of February. Received a utility bill of $100. The total amount is due in 30 days. Required Prepare in journal form, the entry to record each transaction.

- On October 1, 2019, Jay Pryor established an interior decorating business, Pioneer Designs. During the month, Jay completed the following transactions related to the business: Oct. 1. Jay transferred cash from a personal bank account to an account to be used for the business, 18,000. 4.Paid rent for period of October 4 to end of month, 3,000. 10.Purchased a used truck for 23,750, paying 3,750 cash and giving a note payable for the remainder. 13.Purchased equipment on account, 10,500. 14.Purchased supplies for cash, 2,100. 15.Paid annual premiums on property and casualty insurance, 3,600. 15.Received cash for job completed, 8,950. Enter the following transactions on Page 2 of the two-column journal: 21.Paid creditor a portion of the amount owed for equipment purchased on October 13, 2,000. 24.Recorded jobs completed on account and sent invoices to customers, 14,150. 26.Received an invoice for truck expenses, to be paid in November, 700. 27.Paid utilities expense, 2,240. 27.Paid miscellaneous expenses, 1,100. Oct. 29. Received cash from customers on account, 7,600. 30.Paid wages of employees, 4,800. 31.Withdrew cash for personal use, 3,500. Instructions 1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Journal entry explanations may be omitted. 2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted. 3. Prepare an unadjusted trial balance for Pioneer Designs as of October 31, 2019. 4. Determine the excess of revenues over expenses for October. 5. Can you think of any reason why the amount determined in (4) might not be the net income for October?Problem 2-62B Comprehensive Problem Mulberry Services sells electronic data processing services to firms too Email to own their own computing equipment. Mulberry had the following amounts and amount balances as of January 1, 2019: During 2019, the following transactions occurred (the events described below are aggregations of many individual events): During 2019, Mulberry sold $690,000 of computing services, all on credit. Mulberry collected $570,000 from the credit sales in Transaction a and an additional $129,000 from the accounts receivable outstanding at the beginning of the year. Mulberry paid the interest payable of $8,000. A Wages of $379,000 were paid in cash. Repairs and maintenance of $9,000 were incurred and paid. The prepaid rent at the beginning of the year was used in 2019. In addition, $28,000 of computer rental costs were incurred and paid. There is no prepaid rent or rent payable at year-end. Mulberry purchased computer paper for $13,000 cash in late December. None of the paper was used by year-end. Advertising expense of $26,000 was incurred and paid. Income tax of $10,300 was incurred and paid in 2019. Interest of $5,000 was paid on the long-term loan. (Continued) Required: 1. Establish a ledger for the accounts listed above and enter the beginning balances. Use a chart of accounts to order the ledger accounts. 2. Analyze each transaction, Journalize as appropriate. (Note: Ignore the date because these events are aggregations of individual events.) 3. Post your journal entries to T-accounts, Add additional T-accounts when needed. 4. Use the ending balances in the T-accounts to prepare a trial balanceKelly Pitney began her consulting business, Kelly Consulting, on April 1, 2019. The accounting cycle for Kelly Consulting for April, including financial statements, was illustrated in this chapter. During May, Kelly Consulting entered into the following transactions: May 3. Received cash from clients as an advance payment for services to be provided and recorded it as unearned fees, 4,500. 5. Received cash from clients on account, 2,450. 9. Paid cash for a newspaper advertisement, 225. 13. Paid Office Station Co. for part of the debt incurred on April 5, 640. 15. Provided services on account for the period May 115, 9,180. 16. Paid part-time receptionist for two weeks' salary including the amount owed on April 30, 750. 17. Received cash from cash clients for fees earned during the period May 116, 8,360. Record the following transactions on Page 6 of the journal: 20. Purchased supplies on account, 735. 21. Provided services on account for the period May 1620, 4,820. 25. Received cash from cash clients for fees earned for the period May 1723, 7,900. 27. Received cash from clients on account, 9,520. 28. Paid part-time receptionist for two weeks' salary, 750. 30. Paid telephone bill for May, 260. 31. Paid electricity bill for May, 810. 31. Received cash from cash clients for fees earned for the period May 2631, 3,300. 31. Provided services on account for the remainder of May, 2,650. 31. Kelly withdrew 10,500 for personal use. Instructions 1.The chart of accounts for Kelly Consulting is shown in Exhibit 9, and the post-closing trial balance as of April 30, 2019, is shown in Exhibit 17. For each account in the post-closing trial balance, enter the balance in the appropriate Balance column of a four-column account. Date the balances May 1, 2019, and place a check mark () in the Posting Reference column Journalize each of the May transactions in a two column Journal starting on Page 5 of the journal and using Kelly Consulting's chart of accounts. (Do not insert the account numbers in the journal at this time.) 2.Post the journal to a ledger of four-column accounts. 3Prepare an unadjusted trial balance. 4.At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). a.Insurance expired during May is 275. b.Supplies on hand on May 3 1 are 715. c.Depreciation of office equipment for May is 330. d.Accrued receptionist salary on May 31 is 325. e.Rent expired during May is 1,600. f.Unearned fees on May 31 are 3,210. 5.(Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6.Journalize and post the adjusting entries. Record the adjusting entries on Page 7 of the journal. 7.Prepare an adjusted trial balance. 8.Prepare an income statement, a statement of owner's equity, and a balance sheet. 9.Prepare and post the closing entries. Record the closing entries on Page 8 of the journal. Indicate closed accounts by inserting a line in both Balance columns opposite the closing entry. 10.Prepare a post-closing trial balance.

- Unearned Revenue Jennifers Landscaping Services signed a $400-per-month contract on November 1, 2019, to provide plant watering services for Lola Inc.s office buildings. Jennifers received 4 months' service fees in advance on signing the contract. Required: 1. Prepare Jennifers journal entry to record the cash receipt for the first 4 months. 2. Prepare Jennifers adjusting entry at December 31, 2019. 3. CONCEPTUAL CONNECTION How would the advance payment (account(s) and amounts(s)] be reported in Jennifers December 31, 2019, balance sheet? How would the advance payment [account(s) and amount(s)] be reported in Lolas December 31, 2019, balance sheet?Lavender Company started its business on April 1, 2019. The following are the transactions that happened during the month of April. Prepare the journal entries in the journal on Page 1. A. The owners invested $7,500 from their personal account to the business account. B. Paid rent $600 with check #101. C. Initiated a petty cash fund $250 check #102. D. Received $350 cash for services rendered. E. Purchased office supplies for $125 with check #103. F. Purchased computer equipment $1,500, paid $500 with check #104, and will pay the remainder in 30 days. G. Received $750 cash for services rendered. H. Paid wages $375, check #105. I. Petty cash reimbursement Office Supplies $50, Maintenance Expense $80, Miscellaneous Expense $60. Cash on hand $8. Check #106. J. Increased Petty Cash by $70, check #107.e answer The following trial balance was extracted from the ledger accounts of William Enterprise, a sole proprietor as at 31 December 2019. Trial Balance as at 31 December 2019DRCR GH¢GH¢ Building, at cost650,000 Office equipment at cost135,000 Plant and Machinery263,500 Purchases248,000 Sales500,000 Inventory 1 January 201927,500 Discount allowed4,800 Returns inwards3,200 Wages and Salaries64,885 Rent5,580 Insurance6,000 Trade receivables145,000 Trade payables132,750 Bank overdraft58,956 Cash in hand5,400 Long term loan350,000 Capital 1 January 2018________517,159 1,558,8651,558,865 The following additional information as at 31 December 2019 is available:Inventory as at December 2019 was valued at GH¢24,000. Required:1.Prepare william Enterprise’s Income Statement (Profit or loss account) for the year ended 31 December 2019.2. Prepare Statement financial position as at that date

- Can you help me with part B, #7-9 please! Roth Contractors Corporation was incorporated on December 1, 2019 and had the following transactions during December:Part Aa.Issued common stock for $5,000 cashb.Paid $1,200 cash for three months’ rent: December 2019; January and February 2020c.Purchased a used truck for $10,000 on credit (recorded as an account payable)d.Purchased $1,000 of supplies on credit. These are expected to be used during the month (recorded as expense)e.Paid $1,800 for a one-year truck insurance policy, effective December 1f.Billed a customer $4,500 for work completed to dateg.Collected $800 for work completed to dateh.Paid the following expenses in cash: advertising, $350; interest, $100; telephone, $75; truck operating, $425; wages, $2,500i.Collected $2,000 of the amount billed in f abovej.Billed customers $6,500 for work completed to datek.Signed a $9,000 contract for work to be performed in January 2020l.Paid the following expenses in cash: advertising, $200;…Part A: Journalize the following transactions for June.Dean Winchester opened Ghost Cleaners on June 1, 2021. He is the sole owner of the corporation.During June, the following transactions were completed by Dean.1-Jun Invested $65,000 in exchange for common stock in Ghost Cleaners, Inc.1-Jun Purchased a used van for $12,000, paying $3,000 cash and the taking out a note payable for the rest.He plans to pay off the remaining balance on the van by June 1, 2022. The note has a 10% APRwith interest being payable at the end of every month. No principle payments are due until August 1, 2021.1-Jun Paid $1,800 cash on a 12-month insurance policy effective June 1, 2021.1-Jun Hired his brother, Sam, to help with the corporation. He will be paid $1,000 per month for now.5-Jun Purchased cleaning supplies for $1,500 on account.7-Jun Billed a client, F. Crowley, for services performed on June 7 in the amount of $3,000.8-Jun Paid $100 for gasoline for the van.12-Jun Paid $200 for maintenance on the…Part A: Journalize the following transactions for June.Dean Winchester opened Ghost Cleaners on June 1, 2021. He is the sole owner of the corporation. During June, the following transactions were completed by Dean.1-Jun Invested $65,000 in exchange for common stock in Ghost Cleaners, Inc.1-Jun Purchased a used van for $12,000, paying $3,000 cash and the taking out a note payable for the rest.He plans to pay off the remaining balance on the van by June 1, 2022. The note has a 10% APRwith interest being payable at the end of every month. No principle payments are due until August 1, 2021.1-Jun Paid $1,800 cash on a 12-month insurance policy effective June 1, 2021.1-Jun Hired his brother, Sam, to help with the corporation. He will be paid $1,000 per month for now.5-Jun Purchased cleaning supplies for $1,500 on account.7-Jun Billed a client, F. Crowley, for services performed on June 7 in the amount of $3,000.8-Jun Paid $100 for gasoline for the van.12-Jun Paid $200 for maintenance on the…