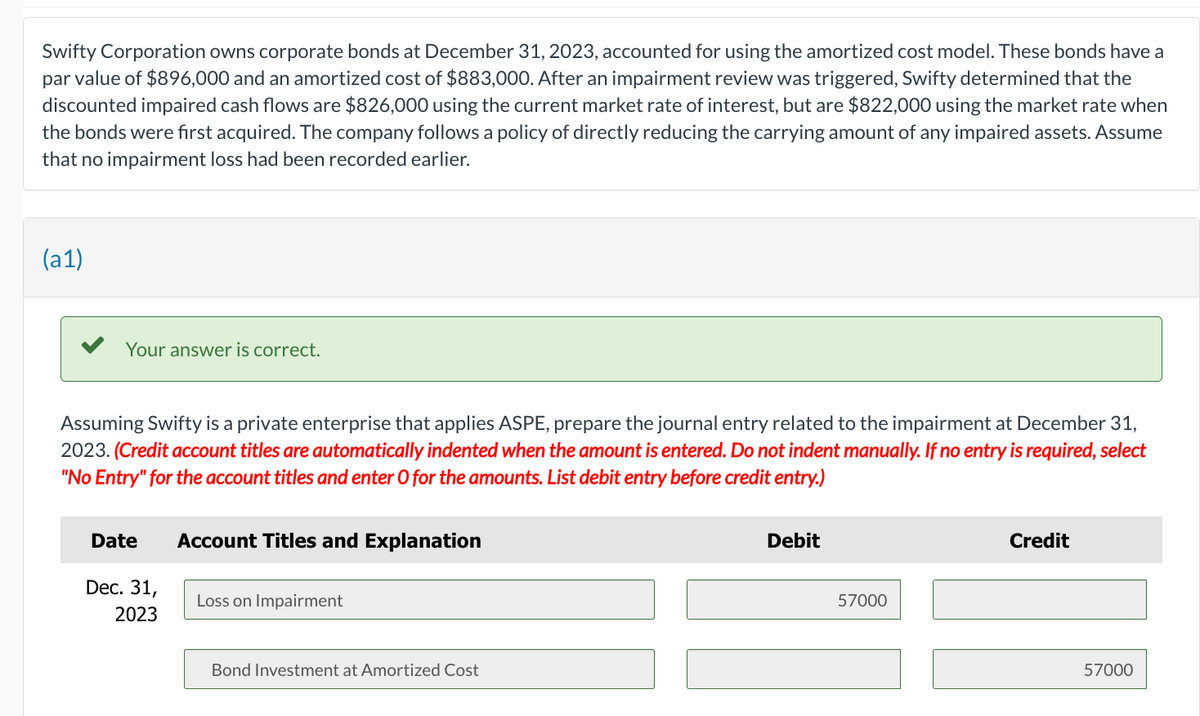

Swifty Corporation owns corporate bonds at December 31, 2023, accounted for using the amortized cost model. These bonds have a par value of $896,000 and an amortized cost of $883,000. After an impairment review was triggered, Swifty determined that the discounted impaired cash flows are $826,000 using the current market rate of interest, but are $822,000 using the market rate when the bonds were first acquired. The company follows a policy of directly reducing the carrying amount of any impaired assets. Assume that no impairment loss had been recorded earlier.

Swifty Corporation owns corporate bonds at December 31, 2023, accounted for using the amortized cost model. These bonds have a par value of $896,000 and an amortized cost of $883,000. After an impairment review was triggered, Swifty determined that the discounted impaired cash flows are $826,000 using the current market rate of interest, but are $822,000 using the market rate when the bonds were first acquired. The company follows a policy of directly reducing the carrying amount of any impaired assets. Assume that no impairment loss had been recorded earlier.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 7MCQ

Related questions

Question

14, please answer the question. thanks

Transcribed Image Text:Swifty Corporation owns corporate bonds at December 31, 2023, accounted for using the amortized cost model. These bonds have a

par value of $896,000 and an amortized cost of $883,000. After an impairment review was triggered, Swifty determined that the

discounted impaired cash flows are $826,000 using the current market rate of interest, but are $822,000 using the market rate when

the bonds were first acquired. The company follows a policy of directly reducing the carrying amount of any impaired assets. Assume

that no impairment loss had been recorded earlier.

(a1)

Your answer is correct.

Assuming Swifty is a private enterprise that applies ASPE, prepare the journal entry related to the impairment at December 31,

2023. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select

"No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.)

Date

Dec. 31,

2023

Account Titles and Explanation

Loss on Impairment

Bond Investment at Amortized Cost

Debit

57000

Credit

57000

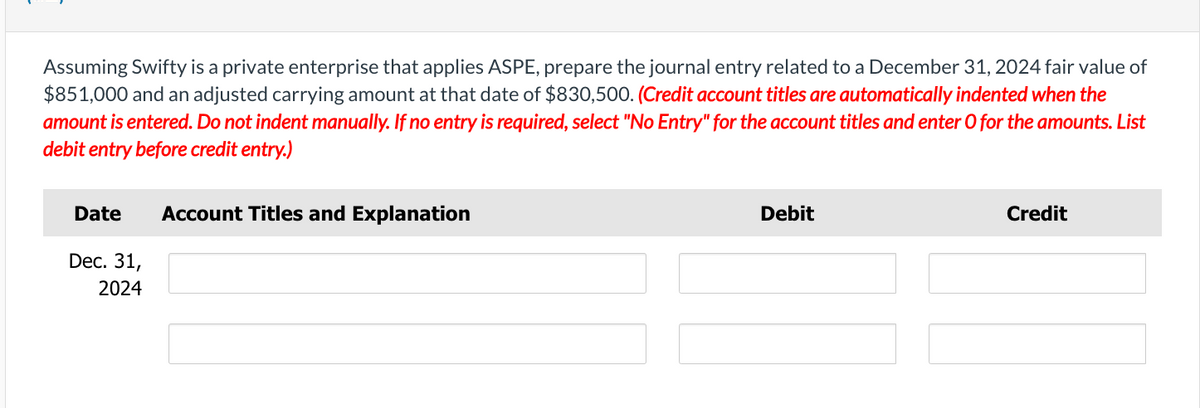

Transcribed Image Text:Assuming Swifty is a private enterprise that applies ASPE, prepare the journal entry related to a December 31, 2024 fair value of

$851,000 and an adjusted carrying amount at that date of $830,500. (Credit account titles are automatically indented when the

amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List

debit entry before credit entry.)

Date

Dec. 31,

2024

Account Titles and Explanation

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning