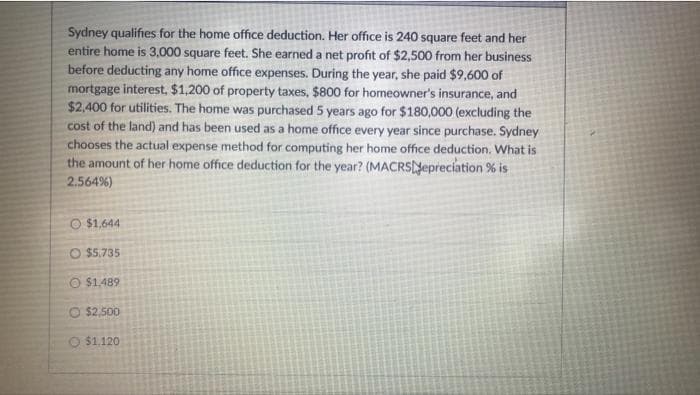

Sydney qualifies for the home office deduction. Her office is 240 square feet and her entire home is 3,000 square feet. She earned a net profit of $2,500 from her business before deducting any home office expenses. During the year, she paid $9,600 of mortgage interest, $1,200 of property taxes, $800 for homeowner's insurance, and $2,400 for utilities. The home was purchased 5 years ago for $180,000 (excluding the cost of the land) and has been used as a home office every year since purchase. Sydney chooses the actual expense method for computing her home office deduction. What is the amount of her home office deduction for the year? (MACRSNepreciation % is 2.564%) O $1.644 O $5.735 O $1.489 O $2.500

Sydney qualifies for the home office deduction. Her office is 240 square feet and her entire home is 3,000 square feet. She earned a net profit of $2,500 from her business before deducting any home office expenses. During the year, she paid $9,600 of mortgage interest, $1,200 of property taxes, $800 for homeowner's insurance, and $2,400 for utilities. The home was purchased 5 years ago for $180,000 (excluding the cost of the land) and has been used as a home office every year since purchase. Sydney chooses the actual expense method for computing her home office deduction. What is the amount of her home office deduction for the year? (MACRSNepreciation % is 2.564%) O $1.644 O $5.735 O $1.489 O $2.500

Chapter3: Business Income And Expenses

Section: Chapter Questions

Problem 20MCQ

Related questions

Question

Transcribed Image Text:Sydney qualifies for the home office deduction. Her office is 240 square feet and her

entire home is 3,000 square feet. She earned a net profit of $2,500 from her business

before deducting any home office expenses. During the year, she paid $9,600 of

mortgage interest, $1,200 of property taxes, $800 for homeowner's insurance, and

$2,400 for utilities. The home was purchased 5 years ago for $180,000 (excluding the

cost of the land) and has been used as a home office every year since purchase. Sydney

chooses the actual expense method for computing her home office deduction. What is

the amount of her home office deduction for the year? (MACRSNepreciation % is

2.564%)

O $1,644

O $5.735

O $1.489

O $2,500

O $1,120

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT