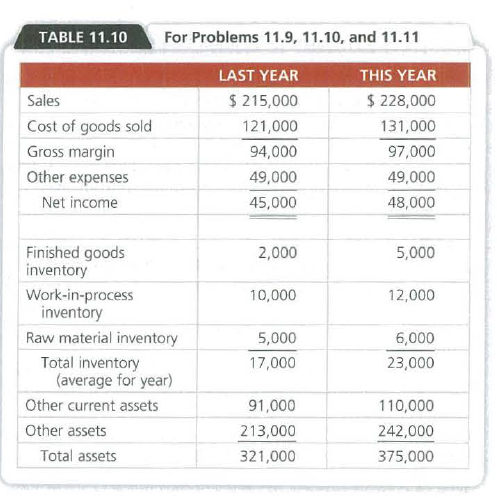

TABLE 11.10 For Problems 11.9, 11.10, and 11.11 LAST YEAR THIS YEAR Sales $ 215,000 $ 228,000 Cost of goods sold 121,000 131,000 Gross margin 94,000 97,000 Other expenses 49,000 49,000 Net income 45,000 48,000 Finished goods inventory 2,000 5,000 Work-in-process inventory 10,000 12,000 Raw material inventory 5,000 6,000 23,000 Total inventory (average for year) 17,000 Other current assets 91,000 110,000 Other assets 213,000 242,000 Total assets 321,000 375,000

Q: If Jill’s salary increases at a 6% uniform rate per year, and she continues to invest 5% of it each ...

A: The present value of annuity is computed by discounting the future payments using the specified disc...

Q: Glbson Company makes and sells lawn mowers for which it currently makes the engines, It has an oppor...

A: a) Maximum price per unit = $709800/14700 =$48.26 per engine

Q: Listed below are items that are commonly accounted for differently for financial reporting purposes ...

A: (a) The MACRS depreciation system is used for tax purposes, and the straight-line depreciation metho...

Q: Ash Traynor opened a Pokèmon dress shop called PokèShoppe. During the first month of operations, the...

A: Worksheet - Worksheet includes unadjusted Trial Balance, Adjustments and Adjusted Trial Balance. All...

Q: 24. $ The total amount of subtractions from the company cash account during the reconciliation (DO N...

A: Bank reconciliation statement is prepared to adjust for the differences between bank balance and the...

Q: counts receivable subsidiary ledger 6. At the begini Accounts Receivable in the general ledger shoul...

A: "We’ll answer the first question since the exact one wasn’t specified. Please submit a new question ...

Q: On December 1, the Accounts Receivable account had a $22.000 debit balance. During December the busi...

A: Ending Account receivable = Beginning account receivable + Revenue on account - Collection from cust...

Q: instruction: Encircie the letter of your choice. 1. A journal designed for entering only sales on ac...

A: Invoice - It is the written documentary evidence issued by the seller to the buyer. Sales Journal - ...

Q: On October 1, 2021, FDN Company paid an insurance premium covering the period from October 1, 2021 t...

A: Adjusting entries are prepared at the end of the accounting year to ensure the accrual base accounti...

Q: Calculate the Payback Period (PBP) for Machine B assuming cash flows are received evenly throughout ...

A: Solution Given ARR Payback period NPV @ 6% IRR pa Machine A 25% 2.9 years 1...

Q: On January 1, 2021, the balance of Owner's Capital of FDN Company is P520,000. During the year the c...

A: Owners capital means net assets of the company. To calculate owners capital at the end of the year a...

Q: Below is a summary of all transactions of KEV Consulting for the month of October. Cash transactions...

A: Cash flow statement includes: Cash flows from operating activities Cash flows from investing activi...

Q: Required: 1. Compute the company's net sales for the year. 2. Compute the company's total cost of me...

A: The income statement is one of the financial statements that shows the financial performance of the ...

Q: Exercise 3-6 (Division of Profit; Interest on Capital, Salary Allowance, and Bonus to Managing Partn...

A: In the given question, profit has been shown after deducting salary, interest and bonus. For calcula...

Q: Gerald Company had the following account balances for 2021. December 31 January 1 Accounts pay...

A: SOLUTION NET INCOME REFERS TO THE AMOUNT AN INDIVIDUALS AND BUSINESS MAKES AFTER DEDUCTING COSTS , A...

Q: Retail Cost 500,000.00 1,285,000.00 Inventory, 12/31/2021 725,000.00 Purchases 2,220,000.00 Purchase...

A: The conventional retail inventory method refers to a method mostly calculated to estimate ending inv...

Q: Headland Corporation was formed 5 years ago through a public subscription of common stock. Daniel Br...

A: Note:- Since you have posted a question with multiple sub-parts, we will solve first three sub-parts...

Q: Based on information in photo: Prepare a schedule showing the division of net income under assumpti...

A: A partnership seems to be a category of business in which 2 or more individuals split ownership and ...

Q: Modified cash basis or hybrid basis differs from accrual basis in the computation of Gross profit ...

A: solution concept accrual basis of accounting This concept of accounting means that t...

Q: 15. Headland Corporation was formed 5 years ago through a public subscription of common stock. Dani...

A: Solution:- 1)Calculation of current ratio as follows under:- Current ratio =Current assets / Current...

Q: expense, and advertising expense. It categorizes the remaining expenses a Adjusted Account Balances ...

A: Working Notes :- Cost of Goods Sold Particulars Amoun...

Q: Which of the following statements related to multiple-step Statement of Profit or Loss is not true? ...

A: A multiple-step income statement reports a company's revenues, expenses and overall profit or loss f...

Q: 41. A pension liability is reported when the pension expense reported for the period is greater t...

A: Solution Concept Funded status Funded status of the pension is calculated as =fair value of the plan...

Q: Which of these accounts can be found in the post-clo: O Assets and liabilities O Assets, liabilities...

A: Post-closing trial balance show the all debit and credit balance of assets and liabilities and owner...

Q: Sheridan Company received the following selected information from its pension plan trustee concernin...

A: Answer - A defined benefit plan, more commonly known as a pension plan, where you know the pensio...

Q: 24. At the end of Year 3, Shore Co. held trading securities that cost $17,500 and had a year-end ma...

A: During the year end 3 we held securities for purpose of investment. Now the during the year 4 beginn...

Q: Last year. Abner Company incurred the following costs host P 50,000 20,000 130,000 40,000 36,000 Dir...

A: 13) Prime cost per unit = (Direct material + Direct labor)/Total units = (50,000 + 20...

Q: Martyr Company paid or collected during 2021 the following items: Interest revenue 75,500 Insuran...

A: The cash received for interest during 2021 :- = Interest revenue during the year 2021 + Decrease in ...

Q: for $1988, a returned(dishonoured) cheque for $500 and account fees for $16. Rita has also notice th...

A: Cash payments journal is journal used to record all the cash payments in the business. Cash receipts...

Q: Below is a summary of all transactions of KEV Consulting for the month of October. Cash transactions...

A: Answer) KEV Consulting Cash Flow Statement Cash Flow from Operating Activities Amoun...

Q: Please answer this question with brief solution. I need the answer ASAP thank you!

A: Depreciation is a cost charged over the fixed assets for over a period of time. Fixed Assets are the...

Q: Sandhill Corp. sponsors a defined benefit pension plan for its employees. On January 1, 2020, the fo...

A: GIVEN Sandhill Corp. sponsors a defined benefit pension plan for its employees. On January 1, 2020...

Q: 3. A one-column sales journal may be used to record a. sales of supplies on account. b. sales of goo...

A: solution one column sales journal One column sales journal is a journal which is used to record the ...

Q: Average Cost per Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing o...

A: Incremental manufacturing cost is the additional direct cost incurred on producing one additional un...

Q: Attribute Sampling and Monetary-Unit Sampling are two sampling techniques designed to help an audito...

A: Monetary-Unit Sampling and Attribute Sampling are two different type of sampling techniques widely u...

Q: On September 1, 2015, Johnas, Inc. acquired a patent for $600,000. The patent has 16 years remaining...

A: Patents are intangible assets acquired as a right to use any formula, method or process. These are r...

Q: Wright Lighting Fixtures forecasts its sales in units for the next four months as follows: Ma...

A: The budgets are prepared to estimate the requirements for the future period. the production budget t...

Q: Discuss whether the following situations are improper segregation functions. Support your answer wit...

A:

Q: On July 1, 2020, FDN Company purchased an equipment for P47,100,000. After 5 years of its estimated ...

A: Carrying Value = Original Value of the asset - Accumulated depreciation Depreciation = ( Cost of the...

Q: Journal entry 1. You buy a computer for $1,500.00 on credit DR: $1,500.00 CR: $1,500.00 2. You nurch...

A: Answer: Journal entry are booked as double entry having debit and credit.

Q: (2) Bank Reconciliation of Company ABCDEFU Balances as of December 31, 2022 Bank balance : Php 1,020...

A: Ideally cash balance as per cashbook and bank balance as per bank statement must reconcile with each...

Q: 11. BTS Company reported the following increase(decrease) in the account balances for the current ye...

A: Effect on equity, increase in all current assets is an increasing effect on equity, and a decrease i...

Q: 3. An invoice, dated May 8, for $549.38 has terms of 3/15, 2/20, 1/30, n/45. If you make a payment o...

A: Average due date is the date on which if payment is made then interest paid and received will be nul...

Q: FDN Company received a four-month note receivable in the amount of PHP41,000,000 on September 1. The...

A: Accrued Income : Accrued Incomes are those incomes which have been earned during the accounting peri...

Q: what is the cost of its ending inventory at cost? *

A: Retail inventory method refers to an accounting method which is used by the companies to compute the...

Q: What is the carrying value of Land after the recognition of the impairment loss?

A:

Q: Empress Company provided the following data for the current year: Retained earnings, January 1 ...

A: Income Statement - This statement shows the income earned and loss incurred by the organization in t...

Q: FDN Company shows the following balances on December 31, 2021: Accounts receivable P250,000 Accumula...

A: Current assets: Current assets are all those assets that are expected to be sold or used as a result...

Q: PROBLEM IV. On January 2, 2019, Klaus Company (qualified as SME) acquired 80% interest in Marcel Com...

A: SOLUTION- WORKING NOTE - 4125000 / 0.8=5156250 1312000 + 3187500 +210000+127500=4837000. ESTIMATED F...

Q: My question is on auditing where I want to know whether the audit evidence is sufficient and appropr...

A: Answer: There is one standards on audit for audit evidences which describes that audit evidence shou...

| Based on the data in Table 11.10, you have been asked to determine: a) The company's percentage of assets committed to inventory last year. b) The company's percentage of assets committed to inventory this year. c) The change in the percentage of assets committed to inventory. |

Step by step

Solved in 2 steps

- Inventory (01/10/18)Raw materials 28800Work in progress 37000Finished goods 33600Sales (114000 @c5) 57000Carriage on raw materials 1470General expenses 25200Selling expenses 51840Plant and machinery 250280Land 50000Bank overdraft 32120Retained earnings 816Ordinary share capital 2000008% preference share 22000Goodwill 40000Bad debts 830Trade receivables 36433Discount allowed 1440Sundry payable 56636Trade investment 8840Advertising 2250Return inwards 9000Discount received 1920Carriage outwards 2280Production wages 126000Office salaries 4860Purchases of raw materials 168000Noodles 15000Factory rent 13600Office insurance 40800Depreciation on plant and machinery 4920InventoryRaw materials 35400Work in progress 39120Loose tools 3000Additional informationDuring the year, 129000 pieces were completed. The closing inventory of finished goods is valued at the cost price per nose mask produced.Goods manufactured during the year are to be transferred to the trading account at GHc 390000.Provide…SCRUMPTIOUS CUPCAKESProfit and loss accountfor the year ended 30 April 20202020£SalesSales 220,000Cost of sales 120,000Gross Profit 100,000ExpensesSalaries 24,000Other Fixed cost 4,800Distribution 3,000Advertising 4,500Rent 13,200AHUtilities 3,600Other Cost 4,00057,100Operating Profit 42,900 SCRUMPTIOUS CUPCAKESBalance Sheetas at 30 April 20202020£Fixed assetsIntangible assets -Tangible assets 35,000Investments -35,000Current assetsStocks 3,000Debtors 10,000Cash at bank and in hand 6,30019,300Written ReportsCreditors: amounts falling duewithin one year (11,300)Net Current Assets 8,000Total assets less currentliabilities 43,000Net Assets 43,000Capital and reservesCalled up share capital 100Profit and loss account 42,900Shareholders' funds 43,000 please calculate the folliwing ratios: Profitability Ratios – Gross Profit Margin, Net Profit Margin and ROCE● Liquidity – Current Test and Acid Test● Gearing● Activity/Performance – Stock Turnover, Debtors’ Collection Period and AssetTurnover…Twenty Twenty One Corp.Income StatementFor the month ended December 31, 2020Sales (P10/unit) ...................................................................................................... P900,000Variable Costs:Variable Cost of Goods Sold:Beginning Inventory ............................................................. P125,000Variable Cost of Goods Manufactured ............................... 400,000----------------Total Goods Available for Sale ........................................... 525,000Ending Inventory ................................................................. 75,000----------------Variable Cost of Goods Sold .............................................. 450,000Variable Selling Expense ....................................................... 90,000 540,000----------------- -------------------Contribution Margin ................................................................................................ P360,000Fixed Costs:Manufacturing…

- Twenty Twenty One Corp.Income StatementFor the month ended December 31, 2020Sales (P10/unit) ...................................................................................................... P900,000Variable Costs:Variable Cost of Goods Sold:Beginning Inventory ............................................................. P125,000Variable Cost of Goods Manufactured ............................... 400,000----------------Total Goods Available for Sale ........................................... 525,000Ending Inventory ................................................................. 75,000----------------Variable Cost of Goods Sold .............................................. 450,000Variable Selling Expense ....................................................... 90,000 540,000----------------- -------------------Contribution Margin ................................................................................................ P360,000Fixed Costs:Manufacturing…Problem 11-3B Calculate operating activities—indirect method (LO11-3) Portions of the financial statements for Software Associates are provided below. SOFTWARE ASSOCIATESIncome StatementFor the year ended December 31, 2021 Net sales $ 710,000 Expenses: Cost of goods sold $ 420,000 Operating expenses 130,000 Depreciation expense 33,000 Income tax expense 49,000 Total expenses 632,000 Net income $ 78,000 SOFTWARE ASSOCIATES Selected Balance Sheet Data December 31, 2021, compared to December 31, 2020 Decrease in accounts receivable $ 10,000 Decrease in inventory 13,000 Increase in prepaid rent 3,000 Decrease in salaries payable 4,000 Increase in accounts payable 7,000 Increase in income tax payable 8,000 Required: Prepare the operating activities section of the statement of cash flows for Software…vi) If cost of goods sold increases 20%, fixed selling expense decreases RM10,000 and selling price decreases 10%, calculate the profit/loss for DSRSB. (CLO3, C4) vii) Calculate the additional sales volume required to meet RM 10,500 additional administrative expenses to maintain the original profit. (CLO3, C4)

- Q # 1: The income statement for the Stylo Company for the past year is: Sales (150000 units @ $30) $4,500,000 Cost of Goods Sold: Materials $1,050,000 Labour 1,500,000 Variable FOH 450,000 Fixed FOH 500,000 3,500,000 Gross Profit $1,000,000 Variable Marketing Expenses $ 135,000 Fixed Marketing Expenses 185,000 Fixed Administrative Expenses 180,000 500,000 Income before Tax $ 500,000 Income Tax 250,000 Net Inco me $ 250,000 Woodstock is preparing its budget for the coming year and has made the following predictions about cost increases: material 5%, labour 8%, all other costs including fixed 6%. Productive capacity is 200,000 units. The president has been offered various proposals by the division managers as follows: Maintain the present volume and sales price Produce and sell at capacity and reduce the unit price $28. Raise the unit price to $32,…CP 13–5The following data are taken from the records of Cronkite Corp.:2019$2,5201,890630510$ 1202018$1,440960480430$ 50SalesCost of goods soldGross profitOther expensesNet incomeRequired: Perform horizontal analysis on the above date and interpretyour resultsYear 1 Year 2 Year 3 Year 4 $ % $ % $ % $ % Net Sales $ 500,000.00 100.00% $ 540,000.00 100.00% $ 577,800.00 100.00% $ 612,468.00 100.00% Cost of goods 265,000.00 53.00% $ 283,500.00 52.50% $ 300,456.00 52.00% $ 321,545.70 52.50% Gross Margin 235,000.00 47.00% $ 256,500.00 47.50% $ 277,344.00 48.00% $ 290,922.30 47.50% Operating expenses 210,000.00 42.00% $ 226,800.00 42.00% $ 245,565.00 42.50% $ 257,236.56 42.00% Operating proft 25,000.00 5.00% $ 29,700.00 5.50% $ 31,779.00 5.50% $ 33,685.74 5.50% Supposing that Mr. Ptolemy achieved his Year 3 and Year 4 performance goals as planned, compare the Year 1 through Year 4 yearly results. Hint: Calculate ‘ trends’ from Year 1 to Year 2, from Year 2 to Year 3, and from Year 3 to Year 4 in terms of NS, COGS, GM,OE and profit. Show your calculations and interpret the meaning of the obtained trend figures. Year 1-2…

- roblem 12 (10 points)Compute the Cost of Goods Sold for 2020 of Pillows Company considering the following information: Raw materials purchased was P2,500,000 with freight-in of P120,000 Purchase returns was P50,000 and purchase discount is 60% of purchase returns Raw materials beginning was P460,000 Raw materials end was P40,000 more than the beginning inventory Direct labor is P1,000,000 Factory overhead is 50% of direct labor Total goods placed in process is 150% of manufacturing cost WIP, end is 75% of WIP, beg Finished goods beginning balance is lesser by P100,000 than the ending balance which was P600,000Problem 12 Compute the Cost of Goods Sold for 2020 of Pillows Company considering the followinginformation: Raw materials purchased was P2,500,000 with freight-in of P120,000 Purchase returns was P50,000 and purchase discount is 60% of purchase returns Raw materials beginning was P460,000 Raw materials end was P40,000 more than the beginning inventory Direct labor is P1,000,000 Factory overhead is 50% of direct labor Total goods placed in process is 150% of manufacturing cost WIP, end is 75% of WIP, beg Finished goods beginning balance is lesser by P100,000 than the ending balance whichwas P600,000Problem 13-02A (Video) The comparative statements of Cullumber Company are presented here: Cullumber CompanyIncome StatementsFor the Years Ended December 31 2020 2019 Net sales $1,891,640 $1,751,600 Cost of goods sold 1,059,640 1,007,100 Gross profit 832,000 744,500 Selling and administrative expenses 501,100 480,100 Income from operations 330,900 264,400 Other expenses and losses Interest expense 23,700 21,700 Income before income taxes 307,200 242,700 Income tax expense 93,700 74,700 Net income $213,500 $168,000 Cullumber CompanyBalance SheetsDecember 31 Assets 2020 2019 Current assets Cash $60,100 $64,200 Debt investments (short-term) 74,000 50,000 Accounts receivable 118,900 103,900 Inventory 127,700 117,200 Total current assets 380,700 335,300 Plant assets (net)…