expense, and advertising expense. It categorizes the remaining expenses a Adjusted Account Balances Merchandise inventory (ending) Other (non-inventory) assets Total liabilities Common stock Retained earnings Dividends Sales Debit $ 33,500 134,000 Credit $ 38,693 67,029 45,095 8,000

expense, and advertising expense. It categorizes the remaining expenses a Adjusted Account Balances Merchandise inventory (ending) Other (non-inventory) assets Total liabilities Common stock Retained earnings Dividends Sales Debit $ 33,500 134,000 Credit $ 38,693 67,029 45,095 8,000

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter5: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 5.5APR: Multiple-step income statement and balance sheet The following selected accounts and their current...

Related questions

Question

Please answer

Transcribed Image Text:ucation.com

MQuestion 5 - HOMEWORK CHAPTER 4 - Connect

C Use The May 31 Fi

RK CHAPTER 4

Saved

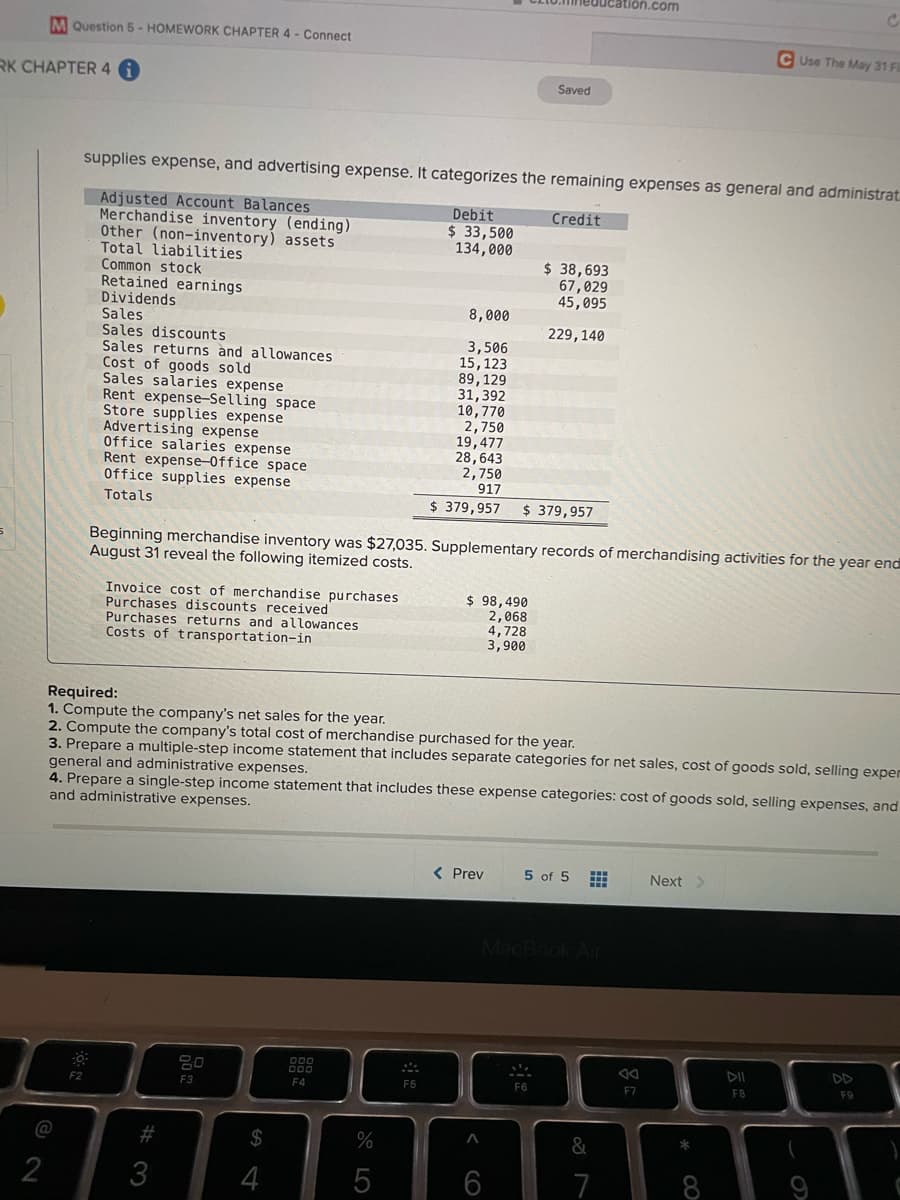

supplies expense, and advertising expense. It categorizes the remaining expenses as general and administrat

Adjusted Account Balances

Merchandise inventory (ending)

Other (non-inventory) assets

Total liabilities

Common stock

Retained earnings

Dividends

Debit

$ 33,500

134,000

Credit

$ 38,693

67,029

45,095

8,000

Sales

229,140

Sales discounts

Sales returns ànd allowances

Cost of

Sales salaries expense

Rent expense-Selling space

Store supplies expense

Advertising expense

Office salaries expense

Rent expense-Office space

Office supplies expense

3,506

15,123

89,129

31,392

10,770

2,750

19,477

28,643

2,750

917

goods sold

Totals

$ 379,957

$ 379,957

Beginning merchandise inventory was $27,035. Supplementary records of merchandising activities for the year end

August 31 reveal the following itemized costs.

Invoice cost of merchandise purchases

Purchases discounts received

Purchases returns and allowances

Costs of transportation-in

$ 98,490

2,068

4,728

3,900

Required:

1. Compute the company's net sales for the year.

2. Compute the company's total cost of merchandise purchased for the year.

3. Prepare a multiple-step income statement that includes separate categories for net sales, cost of goods sold, selling exper

general and administrative expenses.

4. Prepare a single-step income statement that includes these expense categories: cost of goods sold, selling expenses, and

and administrative expenses.

< Prev

5 of 5

Next

DD

000

F2

F3

F4

F6

F6

F7

FB

F9

@

%23

2$

&

2

3

4

5

7

CO

Transcribed Image Text:Saved

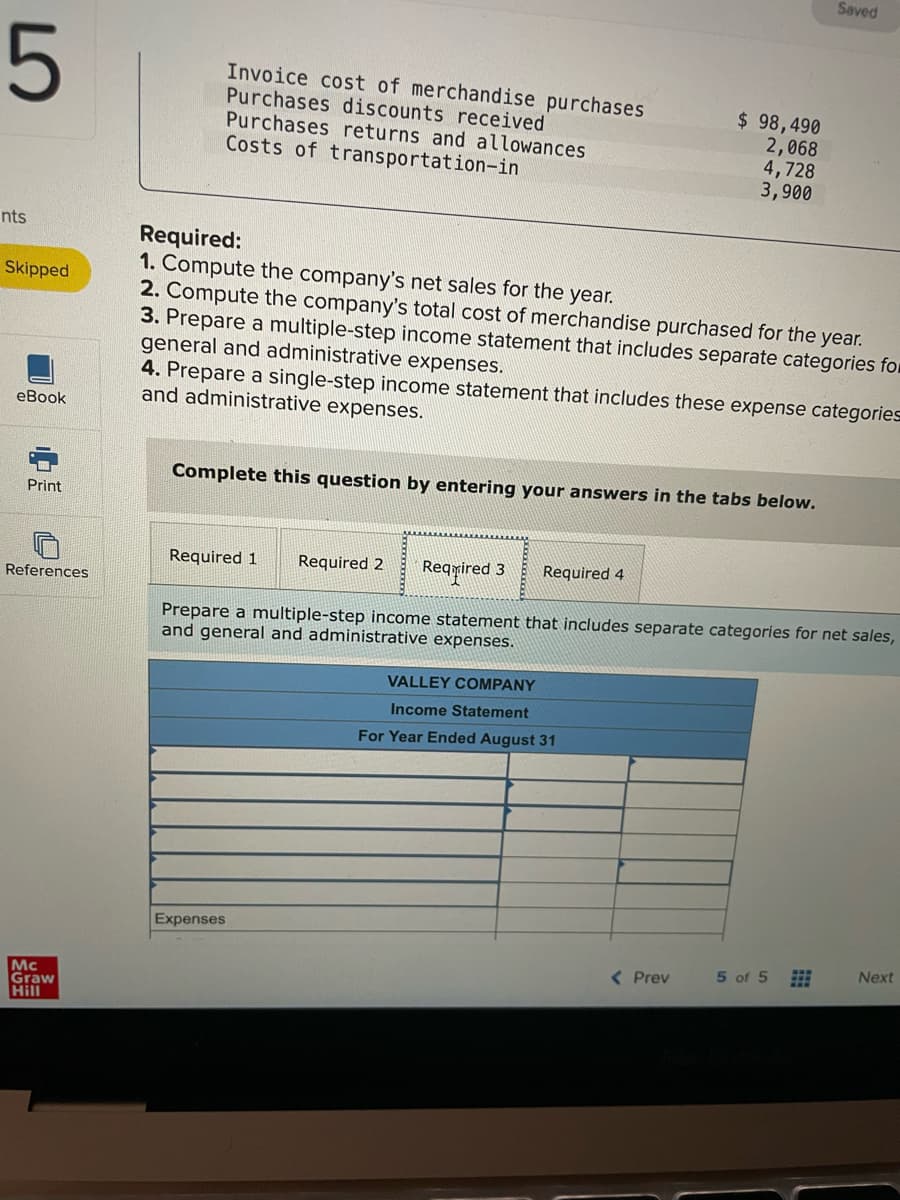

Invoice cost of merchandise purchases

Purchases discounts received

$ 98,490

2,068

4,728

3,900

Purchases returns and allowances

Costs of transportation-in

nts

Required:

1. Compute the company's net sales for the year.

2. Compute the company's total cost of merchandise purchased for the year.

3. Prepare a multiple-step income statement that includes separate categories for

general and administrative expenses.

4. Prepare a single-step income statement that includes these expense categories

and administrative expenses.

Skipped

eBook

Complete this question by entering your answers in the tabs below.

Print

Rearired 3

Required 4

Required 1

Required 2

References

Prepare a multiple-step income statement that includes separate categories for net sales,

and general and administrative expenses.

VALLEY COMPANY

Income Statement

For Year Ended August 31

Expenses

( Prev

5 of 5

Next

Mc

Graw

Hill

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning