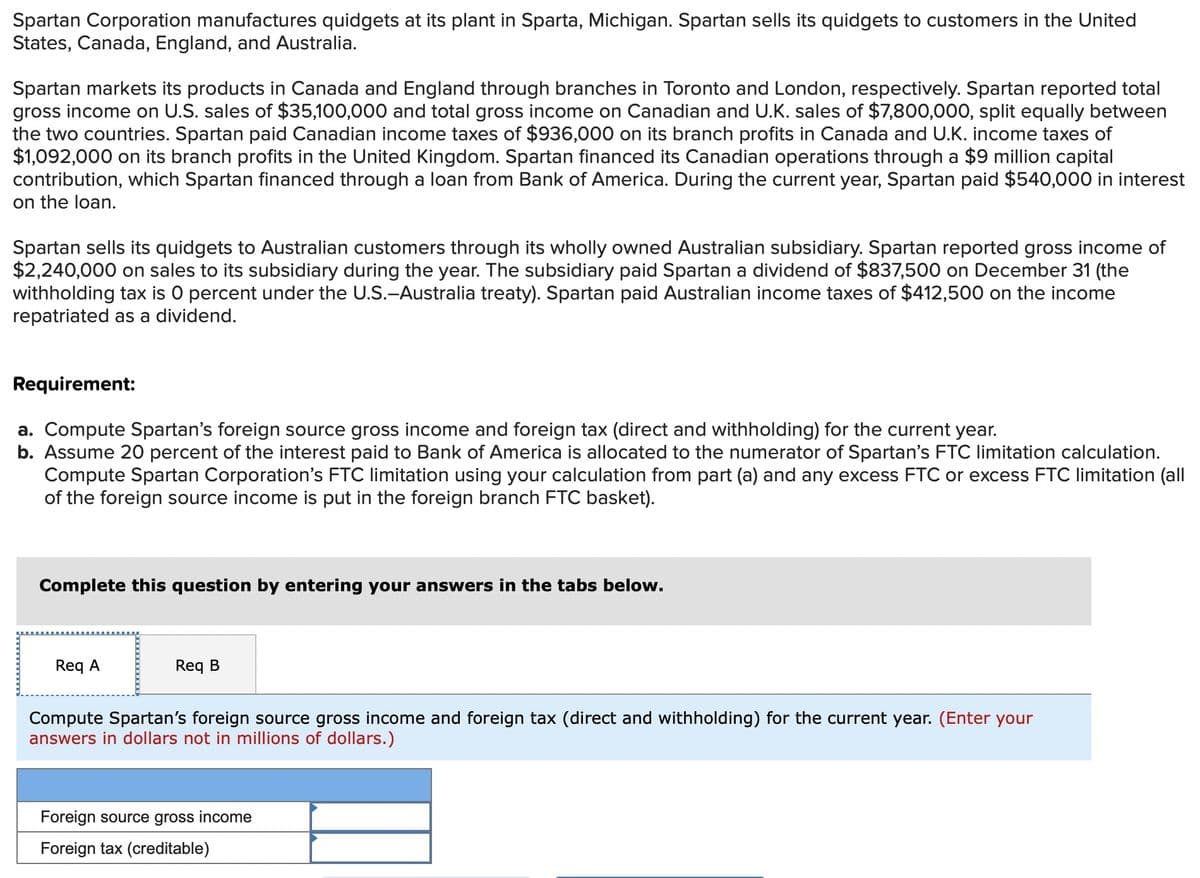

Spartan Corporation manufactures quidgets at its plant in Sparta, Michigan. Spartan sells its quidgets to customers in the United States, Canada, England, and Australia. Spartan markets its products in Canada and England through branches in Toronto and London, respectively. Spartan reported total gross income on U.S. sales of $35,100,000 and total gross income on Canadian and U.K. sales of $7,800,000, split equally between he two countries. Spartan paid Canadian income taxes of $936,000 on its branch profits in Canada and U.K. income taxes of $1,092,000 on its branch profits in the United Kingdom. Spartan financed its Canadian operations through a $9 million capital contribution, which Spartan financed through a loan from Bank of America. During the current year, Spartan paid $540,000 in interest on the loan. Spartan sells its quidgets to Australian customers through its wholly owned Australian subsidiary. Spartan reported gross income of $2,240,000 on sales to its subsidiary during the year. The subsidiary paid Spartan a dividend of $837,500 on December 31 (the withholding tax is 0 percent under the U.S.-Australia treaty). Spartan paid Australian income taxes of $412,500 on the income repatriated as a dividend. Requirement: a. Compute Spartan's foreign source gross income and foreign tax (direct and withholding) for the current year. b. Assume 20 percent of the interest paid to Bank of America is allocated to the numerator of Spartan's FTC limitation calculation. Compute Spartan Corporation's FTC limitation using your calculation from part (a) and any excess FTC or excess FTC limitation (all of the foreign source income is put in the foreign branch FTC basket). Complete this question by entering your answers in the tabs below. Reg A Req B Compute Spartan's foreign source gross income and foreign tax (direct and withholding) for the current year. (Enter your answers in dollars not in millions of dollars.) Foreign source gross income Foreign tax (creditable)

Spartan Corporation manufactures quidgets at its plant in Sparta, Michigan. Spartan sells its quidgets to customers in the United States, Canada, England, and Australia. Spartan markets its products in Canada and England through branches in Toronto and London, respectively. Spartan reported total gross income on U.S. sales of $35,100,000 and total gross income on Canadian and U.K. sales of $7,800,000, split equally between he two countries. Spartan paid Canadian income taxes of $936,000 on its branch profits in Canada and U.K. income taxes of $1,092,000 on its branch profits in the United Kingdom. Spartan financed its Canadian operations through a $9 million capital contribution, which Spartan financed through a loan from Bank of America. During the current year, Spartan paid $540,000 in interest on the loan. Spartan sells its quidgets to Australian customers through its wholly owned Australian subsidiary. Spartan reported gross income of $2,240,000 on sales to its subsidiary during the year. The subsidiary paid Spartan a dividend of $837,500 on December 31 (the withholding tax is 0 percent under the U.S.-Australia treaty). Spartan paid Australian income taxes of $412,500 on the income repatriated as a dividend. Requirement: a. Compute Spartan's foreign source gross income and foreign tax (direct and withholding) for the current year. b. Assume 20 percent of the interest paid to Bank of America is allocated to the numerator of Spartan's FTC limitation calculation. Compute Spartan Corporation's FTC limitation using your calculation from part (a) and any excess FTC or excess FTC limitation (all of the foreign source income is put in the foreign branch FTC basket). Complete this question by entering your answers in the tabs below. Reg A Req B Compute Spartan's foreign source gross income and foreign tax (direct and withholding) for the current year. (Enter your answers in dollars not in millions of dollars.) Foreign source gross income Foreign tax (creditable)

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter13: Emerging Topics In Managerial Accounting

Section: Chapter Questions

Problem 48E

Related questions

Question

Transcribed Image Text:Spartan Corporation manufactures quidgets at its plant in Sparta, Michigan. Spartan sells its quidgets to customers in the United

States, Canada, England, and Australia.

Spartan markets its products in Canada and England through branches in Toronto and London, respectively. Spartan reported total

gross income on U.S. sales of $35,100,000 and total gross income on Canadian and U.K. sales of $7,800,000, split equally between

the two countries. Spartan paid Canadian income taxes of $936,000 on its branch profits in Canada and U.K. income taxes of

$1,092,000 on its branch profits in the United Kingdom. Spartan financed its Canadian operations through a $9 million capital

contribution, which Spartan financed through a loan from Bank of America. During the current year, Spartan paid $540,000 in interest

on the loan.

Spartan sells its quidgets to Australian customers through its wholly owned Australian subsidiary. Spartan reported gross income of

$2,240,000 on sales to its subsidiary during the year. The subsidiary paid Spartan a dividend of $837,500 on December 31 (the

withholding tax is O percent under the U.S.-Australia treaty). Spartan paid Australian income taxes of $412,500 on the income

repatriated as a dividend.

Requirement:

a. Compute Spartan's foreign source gross income and foreign tax (direct and withholding) for the current year.

b. Assume 20 percent of the interest paid to Bank of America is allocated to the numerator of Spartan's FTC limitation calculation.

Compute Spartan Corporation's FTC limitation using your calculation from part (a) and any excess FTC or excess FTC limitation (all

of the foreign source income is put in the foreign branch FTC basket).

Complete this question by entering your answers in the tabs below.

Req A

Req B

Compute Spartan's foreign source gross income and foreign tax (direct and withholding) for the current year. (Enter your

answers in dollars not in millions of dollars.)

Foreign source gross income

Foreign tax (creditable)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning