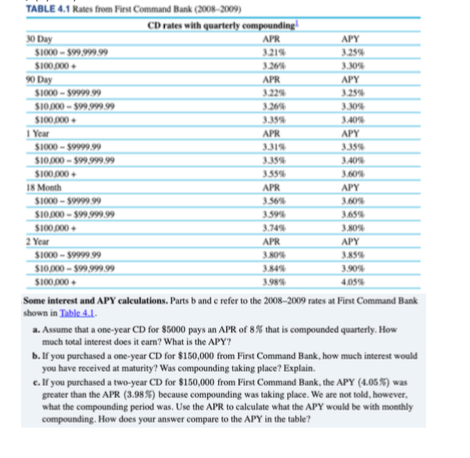

TABLE 4.1 Rates from First Command Bank (2008-2009) CD rates with quarterly compounding 30 Day SI000 - S99.9999) APR APY 321% 325% S100000 + 3.26% 3.30% 90 Day S1000 - S9999.99 APR APY 3.22% 3.25% SI0000 - S99999.99 3.26% 3.30% S100000 + 3.35% 3.40% I Year APR APY SI000 - S9999.99 331% 3.35% SIO000 - S999999.99 3.35% 3.40% S100 000 + 3.55% 3.60% I8 Month APR APY S1000 - 59999.99 3.56% 3.60% SI0000 - S99.999.99 3.59% 3.65% SI00000 2 Year 3.74% 3.80% APR APY S1000 - 59999.99 3.80% 3.85% SIO000 - S99.999.99 384% 3.90% S100 000+ 3.98% 4.05% Some interest and APY calculations. Parts b and e refer to the 2008–2009 rates at First Command Bank shown in Table 4L. a. Assume that a one-year CD for $5000 pays an APR of 8% that is compounded quarterly. How much total interest does it earn? What is the APY? b. If you purchased a one-year CD for $150,000 from First Command Bank, how much interest would you have received at maturity? Was compounding taking place? Explain. e. If you purchased a two-year CD for $150,000 from First Command Bank, the APY (4.05%) was greater than the APR (3.98%) because compounding was taking place. We are not told, however, what the compounding period was. Use the APR to calculate what the APY would be with monthly compounding. How does your answer compare to the APY in the table ?

TABLE 4.1 Rates from First Command Bank (2008-2009) CD rates with quarterly compounding 30 Day SI000 - S99.9999) APR APY 321% 325% S100000 + 3.26% 3.30% 90 Day S1000 - S9999.99 APR APY 3.22% 3.25% SI0000 - S99999.99 3.26% 3.30% S100000 + 3.35% 3.40% I Year APR APY SI000 - S9999.99 331% 3.35% SIO000 - S999999.99 3.35% 3.40% S100 000 + 3.55% 3.60% I8 Month APR APY S1000 - 59999.99 3.56% 3.60% SI0000 - S99.999.99 3.59% 3.65% SI00000 2 Year 3.74% 3.80% APR APY S1000 - 59999.99 3.80% 3.85% SIO000 - S99.999.99 384% 3.90% S100 000+ 3.98% 4.05% Some interest and APY calculations. Parts b and e refer to the 2008–2009 rates at First Command Bank shown in Table 4L. a. Assume that a one-year CD for $5000 pays an APR of 8% that is compounded quarterly. How much total interest does it earn? What is the APY? b. If you purchased a one-year CD for $150,000 from First Command Bank, how much interest would you have received at maturity? Was compounding taking place? Explain. e. If you purchased a two-year CD for $150,000 from First Command Bank, the APY (4.05%) was greater than the APR (3.98%) because compounding was taking place. We are not told, however, what the compounding period was. Use the APR to calculate what the APY would be with monthly compounding. How does your answer compare to the APY in the table ?

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter4: Profitability Analysis

Section: Chapter Questions

Problem 22PC: Selected data for General Mills for 2007, 2008, and 2009 appear below (amounts in millions)....

Related questions

Question

Transcribed Image Text:TABLE 4.1 Rates from First Command Bank (2008–2009)

CD rates with quarterly compounding

APR

30 Day

S1000 - 599.999.99

APY

321%

3.25%

S100.000 +

3.26%

3.30%

90 Day

APR

APY

SI000 - S9999.99

3.22%

3.25%

SI0,000 - 599.99999

3.26%

3.30%

S100000

I Year

335%

3.40%

APR

APY

S1000 - $9999.99

3.31%

3.35%

SI0,00 - 599.999.99

335%

3.40%

S100.000 +

3.55%

3.60%

I8 Month

APR

APY

SI000 - $9999.99

3.56%

3.60%

SI0000 - $99,999.99

3.59%

3.74%

3.65%

S100,000 +

3.80%

2 Year

SI000 - $9999 99

APR

APY

3.80%

3.85%

SI0,000 - 599.999.99

3.84%

3.90%

S100.000 +

3.98%

4.05%

Some interest and APY calculations. Parts b and e refer to the 2008–2009 rates at First Command Bank

shown in Table 4.1.

a. Assume that a one-year CD for $5000 pays an APR of 8% that is compounded quarterly. How

much total interest does it earn? What is the APY?

b. If you purchased a one-year CD for $150,000 from First Command Bank, how much interest would

you have received at maturity? Was compounding taking place? Explain.

e. If you purchased a two-year CD for $150,000 from First Command Bank, the APY (4.05%) was

greater than the APR (3.98%) because compounding was taking place. We are not told, however,

what the compounding period was. Use the APR to calculate what the APY would be with monthly

compounding. How does your answer compare to the APY in the table?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning