At 30 June 2002 a company had Klm 8% loan notes in issue, interest being paid half- yearly on 30 June and 31 December. On 30 September 2002 the company redeemed K250, 000 of these loan notes at par, paying interest due to that date. On 1 April 2003 the company issued K500, 000 7% loan notes, interest payable half-yearly on 31 March and 30 September. Calculate the figure should appear in the company's statement of comprehensive income for interest payable in the year ended 30 June 2003?

At 30 June 2002 a company had Klm 8% loan notes in issue, interest being paid half- yearly on 30 June and 31 December. On 30 September 2002 the company redeemed K250, 000 of these loan notes at par, paying interest due to that date. On 1 April 2003 the company issued K500, 000 7% loan notes, interest payable half-yearly on 31 March and 30 September. Calculate the figure should appear in the company's statement of comprehensive income for interest payable in the year ended 30 June 2003?

Chapter16: Working Capital Policy And Short-term Financing

Section: Chapter Questions

Problem 30P

Related questions

Question

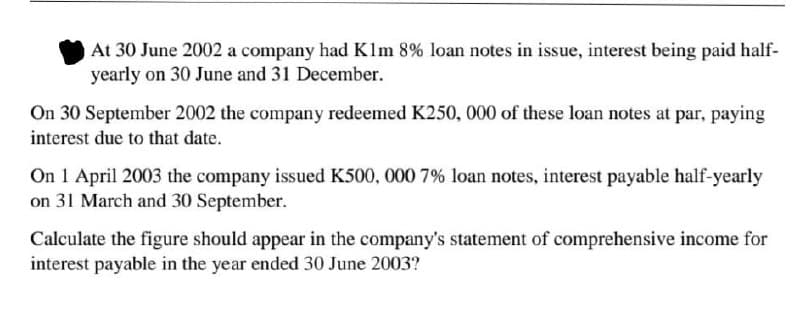

Transcribed Image Text:At 30 June 2002 a company had Klm 8% loan notes in issue, interest being paid half-

yearly on 30 June and 31 December.

On 30 September 2002 the company redeemed K250, 000 of these loan notes at par, paying

interest due to that date.

On 1 April 2003 the company issued K500, 000 7% loan notes, interest payable half-yearly

on 31 March and 30 September.

Calculate the figure should appear in the company's statement of comprehensive income for

interest payable in the year ended 30 June 2003?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning