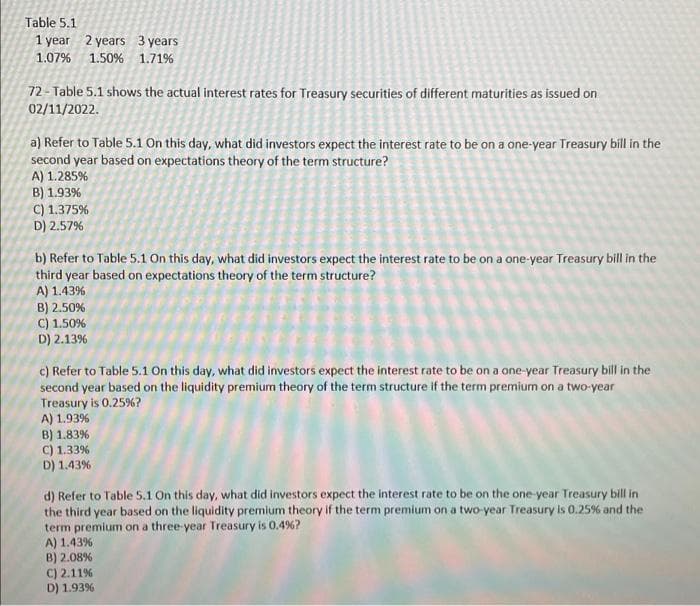

Table 5.1 1 year 2 years 3 years 1.07% 1.50% 1.71% 72- Table 5.1 shows the actual interest rates for Treasury securities of different maturities as issued on 02/11/2022. a) Refer to Table 5.1 On this day, what did investors expect the interest rate to be on a one-year Treasury bill in the second year based on expectations theory of the term structure? A) 1.285% B) 1.93% C) 1.375% D) 2.57% b) Refer to Table 5.1 On this day, what did investors expect the interest rate to be on a one-year Treasury bill in the third year based on expectations theory of the term structure? A) 1.43% B) 2.50% C) 1.50% D) 2.13% c) Refer to Table 5.1 On this day, what did investors expect the interest rate to be on a one-year Treasury bill in the second year based on the liquidity premium theory of the term structure if the term premium on a two-year Treasury is 0.25%? A) 1.93% B) 1.83% C) 1.33% D) 1.43%

Table 5.1 1 year 2 years 3 years 1.07% 1.50% 1.71% 72- Table 5.1 shows the actual interest rates for Treasury securities of different maturities as issued on 02/11/2022. a) Refer to Table 5.1 On this day, what did investors expect the interest rate to be on a one-year Treasury bill in the second year based on expectations theory of the term structure? A) 1.285% B) 1.93% C) 1.375% D) 2.57% b) Refer to Table 5.1 On this day, what did investors expect the interest rate to be on a one-year Treasury bill in the third year based on expectations theory of the term structure? A) 1.43% B) 2.50% C) 1.50% D) 2.13% c) Refer to Table 5.1 On this day, what did investors expect the interest rate to be on a one-year Treasury bill in the second year based on the liquidity premium theory of the term structure if the term premium on a two-year Treasury is 0.25%? A) 1.93% B) 1.83% C) 1.33% D) 1.43%

Chapter5: The Cost Of Money (interest Rates)

Section: Chapter Questions

Problem 11PROB

Related questions

Question

Transcribed Image Text:Table 5.1

1 year 2 years 3 years

1.07% 1.50% 1.71%

72- Table 5.1 shows the actual interest rates for Treasury securities of different maturities as issued on

02/11/2022.

a) Refer to Table 5.1 On this day, what did investors expect the interest rate to be on a one-year Treasury bill in the

second year based on expectations theory of the term structure?

A) 1.285%

B) 1.93%

C) 1.375%

D) 2.57%

b) Refer to Table 5.1 On this day, what did investors expect the interest rate to be on a one-year Treasury bill in the

third year based on expectations theory of the term structure?

A) 1.43%

B) 2.50%

C) 1.50%

D) 2.13%

c) Refer to Table 5.1 On this day, what did investors expect the interest rate to be on a one-year Treasury bill in the

second year based on the liquidity premium theory of the term structure if the term premium on a two-year

Treasury is 0.25%?

A) 1.93%

B) 1.83%

C) 1.33%

D) 1.43%

d) Refer to Table 5.1 On this day, what did investors expect the interest rate to be on the one-year Treasury bill in

the third year based on the liquidity premium theory if the term premium on a two-year Treasury is 0.25% and the

term premium on a three-year Treasury is 0.4%?

A) 1.43%

B) 2.08%

C) 2.11%

D) 1.93%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 7 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,