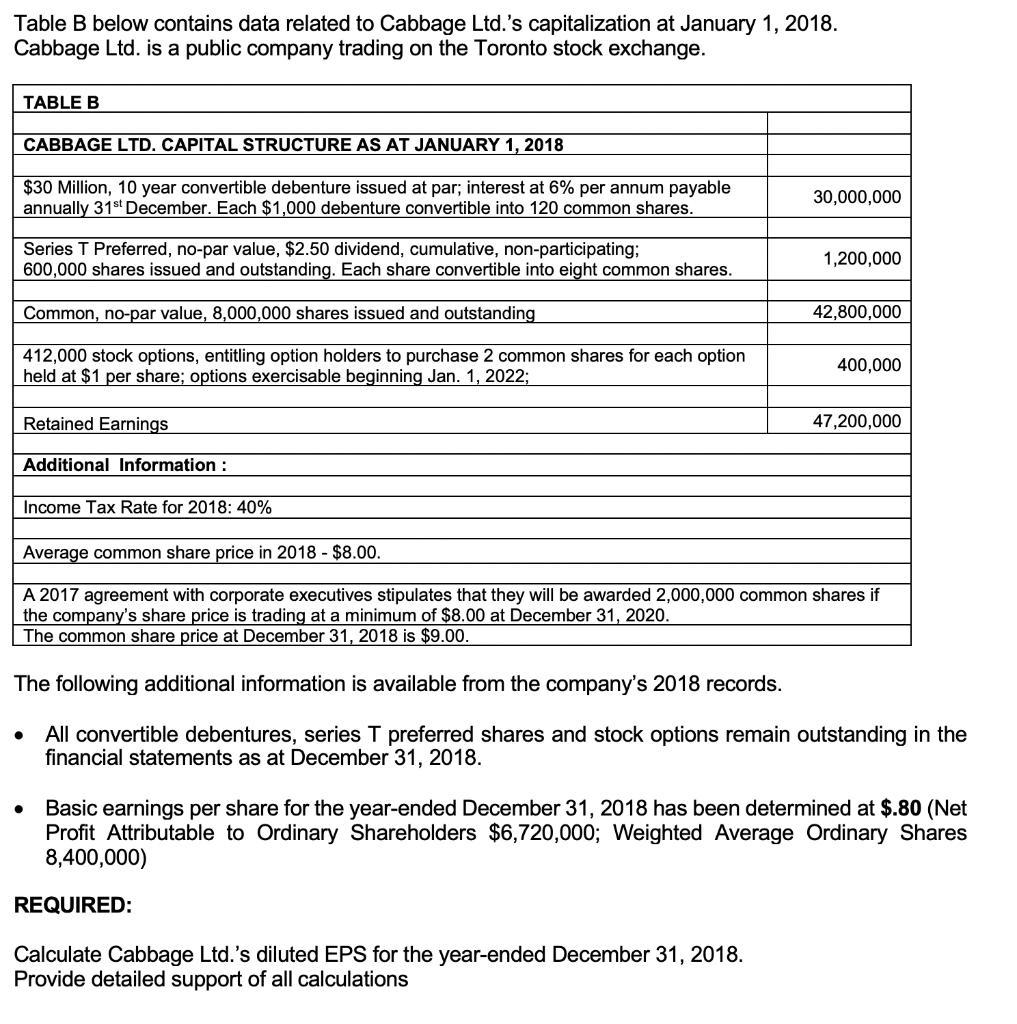

Table B below contains data related to Cabbage Ltd.'s capitalization at January 1, 2018. Cabbage Ltd. is a public company trading on the Toronto stock exchange. TABLE B CABBAGE LTD. CAPITAL STRUCTURE AS AT JANUARY 1, 2018 $30 Million, 10 year convertible debenture issued at par; interest at 6% per annum payable annually 31st December. Each $1,000 debenture convertible into 120 common shares. 30,000,000 Series T Preferred, no-par value, $2.50 dividend, cumulative, non-participating; 600,000 shares issued and outstanding. Each share convertible into eight common shares. 1,200,000 Common, no-par value, 8,000,000 shares issued and outstanding 42,800,000 412,000 stock options, entitling option holders to purchase 2 common shares for each option held at $1 per share; options exercisable beginning Jan. 1, 2022; 400,000 Retained Earnings 47,200,000 Additional Information : Income Tax Rate for 2018: 40% Average common share price in 2018 - $8.00. A 2017 agreement with corporate executives stipulates that they will be awarded 2,000,000 common shares if the company's share price is trading at a minimum of $8.00 at December 31, 2020. The common share price at December 31, 2018 is $9.00. The following additional information is available from the company's 2018 records. All convertible debentures, series T preferred shares and stock options remain outstanding in the financial statements as at December 31, 2018. Basic earnings per share for the year-ended December 31, 2018 has been determined at $.80 (Net Profit Attributable to Ordinary Shareholders $6,720,000; Weighted Average Ordinary Shares 8,400,000) REQUIRED: Calculate Cabbage Ltd.'s diluted EPS for the year-ended December 31, 2018. Provide detailed support of all calculations

Table B below contains data related to Cabbage Ltd.'s capitalization at January 1, 2018. Cabbage Ltd. is a public company trading on the Toronto stock exchange. TABLE B CABBAGE LTD. CAPITAL STRUCTURE AS AT JANUARY 1, 2018 $30 Million, 10 year convertible debenture issued at par; interest at 6% per annum payable annually 31st December. Each $1,000 debenture convertible into 120 common shares. 30,000,000 Series T Preferred, no-par value, $2.50 dividend, cumulative, non-participating; 600,000 shares issued and outstanding. Each share convertible into eight common shares. 1,200,000 Common, no-par value, 8,000,000 shares issued and outstanding 42,800,000 412,000 stock options, entitling option holders to purchase 2 common shares for each option held at $1 per share; options exercisable beginning Jan. 1, 2022; 400,000 Retained Earnings 47,200,000 Additional Information : Income Tax Rate for 2018: 40% Average common share price in 2018 - $8.00. A 2017 agreement with corporate executives stipulates that they will be awarded 2,000,000 common shares if the company's share price is trading at a minimum of $8.00 at December 31, 2020. The common share price at December 31, 2018 is $9.00. The following additional information is available from the company's 2018 records. All convertible debentures, series T preferred shares and stock options remain outstanding in the financial statements as at December 31, 2018. Basic earnings per share for the year-ended December 31, 2018 has been determined at $.80 (Net Profit Attributable to Ordinary Shareholders $6,720,000; Weighted Average Ordinary Shares 8,400,000) REQUIRED: Calculate Cabbage Ltd.'s diluted EPS for the year-ended December 31, 2018. Provide detailed support of all calculations

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 14P

Related questions

Question

Transcribed Image Text:Table B below contains data related to Cabbage Ltd.'s capitalization at January 1, 2018.

Cabbage Ltd. is a public company trading on the Toronto stock exchange.

TABLE B

CABBAGE LTD. CAPITAL STRUCTURE AS AT JANUARY 1, 2018

$30 Million, 10 year convertible debenture issued at par; interest at 6% per annum payable

annually 31st December. Each $1,000 debenture convertible into 120 common shares.

30,000,000

Series T Preferred, no-par value, $2.50 dividend, cumulative, non-participating;

600,000 shares issued and outstanding. Each share convertible into eight common shares.

1,200,000

Common, no-par value, 8,000,000 shares issued and outstanding

42,800,000

412,000 stock options, entitling option holders to purchase 2 common shares for each option

held at $1 per share; options exercisable beginning Jan. 1, 2022;

400,000

Retained Earnings

47,200,000

Additional Information :

Income Tax Rate for 2018: 40%

Average common share price in 2018 - $8.00.

A 2017 agreement with corporate executives stipulates that they will be awarded 2,000,000 common shares

the company's share price is trading at a minimum of $8.00 at December 31, 2020.

The common share price at December 31, 2018 is $9.00.

The following additional information is available from the company's 2018 records.

All convertible debentures, series T preferred shares and stock options remain outstanding in the

financial statements as at December 31, 2018.

Basic earnings per share for the year-ended December 31, 2018 has been determined at $.80 (Net

Profit Attributable to Ordinary Shareholders $6,720,000; Weighted Average Ordinary Shares

8,400,000)

REQUIRED:

Calculate Cabbage Ltd.'s diluted EPS for the year-ended December 31, 2018.

Provide detailed support of all calculations

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning