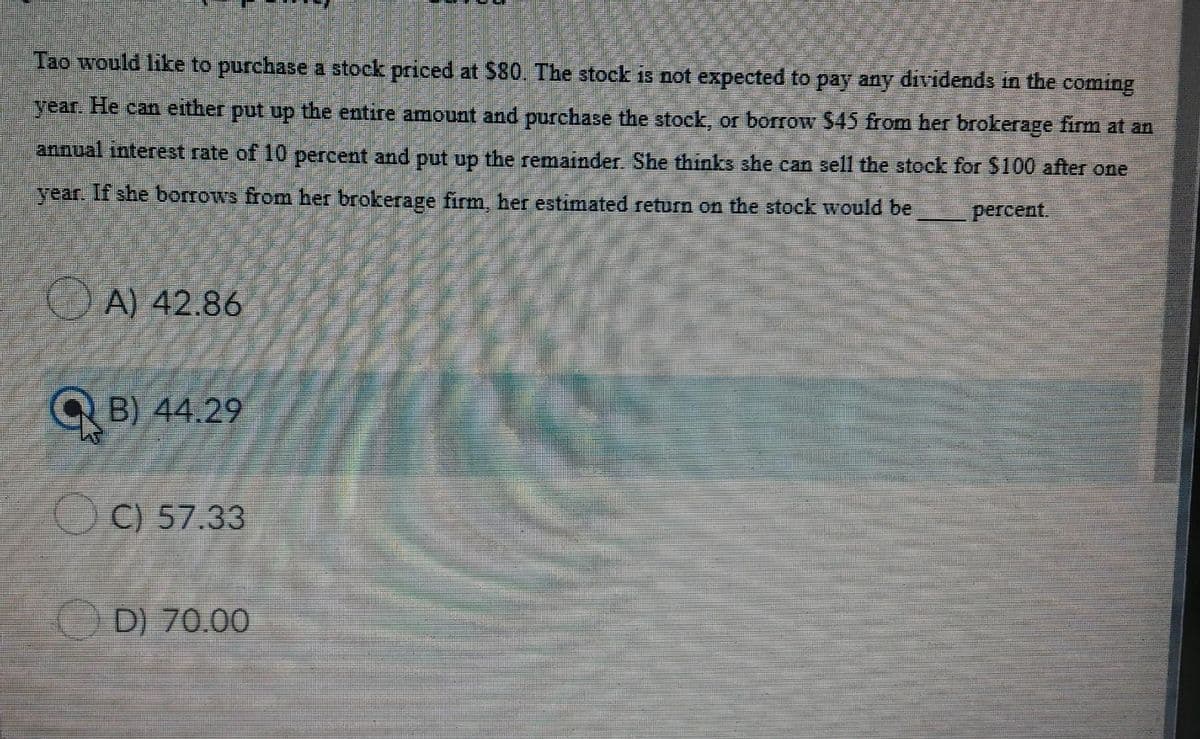

Tao would like to purchase a stock priced at $80. The stock is not expected to pay any dividends in the coming year. He can either put up the entire amount and purchase the stock, or borrow $45 from her brokerage firm at an annual interest rate of 10 percent and put up the remainder. She thinks she can sell the stock for $100 after one year. If she borrows from her brokerage firm, her estimated return on the stock would be percent. A) 42.86

Tao would like to purchase a stock priced at $80. The stock is not expected to pay any dividends in the coming year. He can either put up the entire amount and purchase the stock, or borrow $45 from her brokerage firm at an annual interest rate of 10 percent and put up the remainder. She thinks she can sell the stock for $100 after one year. If she borrows from her brokerage firm, her estimated return on the stock would be percent. A) 42.86

Chapter16: Property Transactions: Capital Gains And Losses

Section: Chapter Questions

Problem 24P

Related questions

Question

4

Transcribed Image Text:Tao would like to purchase a stock priced at $80. The stock is not expected to pay any dividends in the coming

year. He can either put up the entire amount and purchase the stock, or borrow S45 from her brokerage firm at an

annual interest rate of 10 percent and put up the remainder. She thinks she can sell the stock for $100 after one

year. If she borrows from her brokerage firm, her estimated return on the stock would be

percent.

O A) 42.86

QB) 44.29

C) 57.33

D) 70.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT