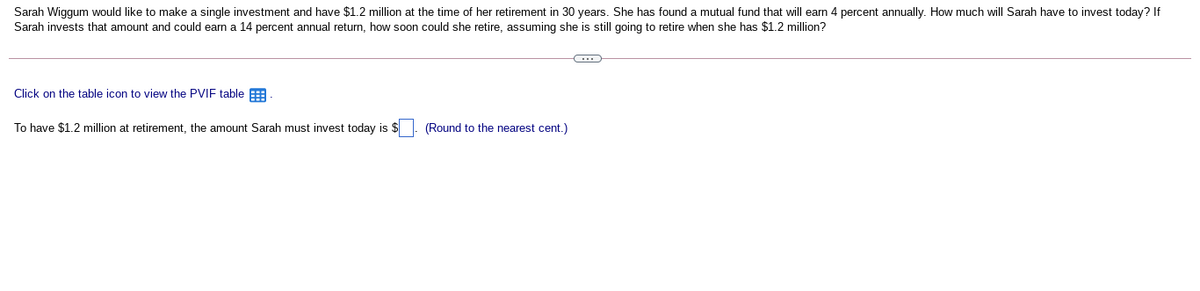

Sarah Wiggum would like to make a single investment and have $1.2 million at the time of her retirement in 30 years. She has found a mutual fund that will earn 4 percent annually. How much will Sarah have to invest today? If Sarah invests that amount and could ean a 14 percent annual return, how soon could she retire, assuming she is still going to retire when she has $1.2 million? Click on the table icon to view the PVIF table E To have $1.2 million at retirement, the amount Sarah must invest today is $| (Round to the nearest cent.)

Sarah Wiggum would like to make a single investment and have $1.2 million at the time of her retirement in 30 years. She has found a mutual fund that will earn 4 percent annually. How much will Sarah have to invest today? If Sarah invests that amount and could ean a 14 percent annual return, how soon could she retire, assuming she is still going to retire when she has $1.2 million? Click on the table icon to view the PVIF table E To have $1.2 million at retirement, the amount Sarah must invest today is $| (Round to the nearest cent.)

PFIN (with PFIN Online, 1 term (6 months) Printed Access Card) (New, Engaging Titles from 4LTR Press)

6th Edition

ISBN:9781337117005

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter2: Using Financial Statements And Budgets

Section: Chapter Questions

Problem 6FPE

Related questions

Question

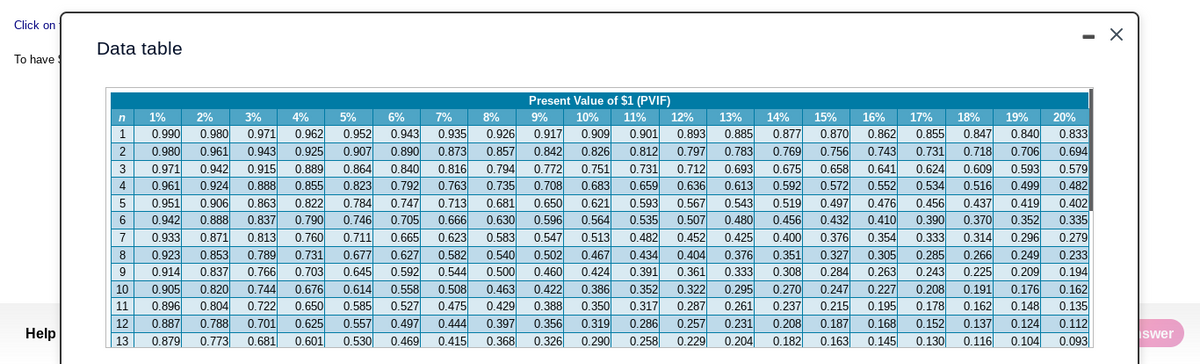

Transcribed Image Text:Click on

- X

Data table

To have

Present Value of $1 (PVIF)

11%

0.901

0.812

0.731

0.659

0.593

n

1%

2%

3%

4%

5%

6%

7%

8%

9%

10%

12%

13%

14%

15%

16%

17%

18%

19%

20%

0.971

0.943

0.915

0.888

0.909

0.826

0.751

0.683

0.990

0.893

0.862

0.855

0.840

0.962

0.925

0.889

0.855

0.952

0.943

0.890

0.935

0.926

0.857

0.794

0.735

0.917

0.885

0.870

0.756

0.847

0.718

0.609

0.516

0.437

1

0.980

0.877

0.833

2

0.980

0.961

0.907

0.873

0.842

0.797

0.783

0.769

0.743

0.731

0.706

0.694

0.971

0.961

0.942

0.924

0.772

0.708

0.624

0.534

0.840

0.792

0.747

0.705

0.665

0.627

0.592

0.558

0.527

0.497

0.469

0.816

0.693

0.675

0.658

0.572

0.641

0.552

0.579

0.482

3

0.864

0.712

0.593

4

0.823

0.763

0.636

0.613

0.592

0.499

0.822

0.784

0.746

0.906

0.863

0.681

0.621

0.564

0.951

0.713

0.650

0.567

0.543

0.519

0.497

0.476

0.456

0.419

0.402

0.535

0.482

0.790

0.596

0.432

0.410

0.354

0.305

0.263

0.370

0.314

0.266

0.225

6.

0.942

0.888

0.837

0.666

0.630

0.507

0.480

0.456

0.390

0.352

0.335

7

0.933

0.871

0.813

0.760

0.711

0.623

0.583

0.547

0.513

0.452

0.425

0.400

0.376

0.333

0.296

0.279

0.923

0.914

0.731

0.703

0.676

0.650

0.502

0.460

0.467

0.424

0.386

0.350

0.319

0.290

0.434

0.391

8

0.853

0.789

0.677

0.582

0.540

0.404

0.376

0.351

0.327

0.285

0.249

0.233

0.837

0.766

0.645

0.544

0.500

0.361

0.333

0.308

0.284

0.243

0.209

0.194

0.208

0.191

0.162

0.744

0.722

0.701

0.681

0.614

0.422

0.176

0.820

0.804

0.508

0.463

0.352

0.317

0.286

0.258

10

0.905

0.322

0.295

0.270

0.247

0.227

11

0.896

0.585

0.475

0.429

0.388

0.287

0.261

0.237

0.215

0.195

0.178

0.162

0.148

0.135

0.887

0.879

0.444

0.356

0.257

0.788

0.773

0.231

0.204

0.152

0.130

0.625

0.557

0.397

0.187

0.163

12

0.208

0.168

0.137

0.124

0.112

Help

0.601

0.368

0.326

0.182

0.145

0.116

Iswer

13

0.530

0.415

0.229

0.104

0.093

Transcribed Image Text:Sarah Wiggum would like to make a single investment and have $1.2 million at the time of her retirement in 30 years. She has found a mutual fund that will earn 4 percent annually. How much will Sarah have to invest today? If

Sarah invests that amount and could earn a 14 percent annual return, how soon could she retire, assuming she is still going to retire when she has $1.2 million?

Click on the table icon to view the PVIF table

To have $1.2 million at retirement, the amount Sarah must invest today is $

(Round to the nearest cent.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning