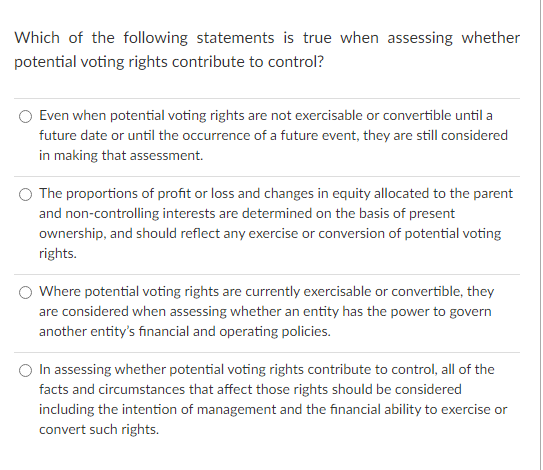

Which of the following statements is true when assessing whether potential voting rights contribute to control? Even when potential voting rights are not exercisable or convertible until a future date or until the occurrence of a future event, they are still considered in making that assessment. O The proportions of profit or loss and changes in equity allocated to the parent and non-controlling interests are determined on the basis of present ownership, and should reflect any exercise or conversion of potential voting rights. Where potential voting rights are currently exercisable or convertible, they are considered when assessing whether an entity has the power to govern another entity's financial and operating policies. In assessing whether potential voting rights contribute to control, all of the facts and circumstances that affect those rights should be considered including the intention of management and the financial ability to exercise or convert such rights.

Which of the following statements is true when assessing whether potential voting rights contribute to control? Even when potential voting rights are not exercisable or convertible until a future date or until the occurrence of a future event, they are still considered in making that assessment. O The proportions of profit or loss and changes in equity allocated to the parent and non-controlling interests are determined on the basis of present ownership, and should reflect any exercise or conversion of potential voting rights. Where potential voting rights are currently exercisable or convertible, they are considered when assessing whether an entity has the power to govern another entity's financial and operating policies. In assessing whether potential voting rights contribute to control, all of the facts and circumstances that affect those rights should be considered including the intention of management and the financial ability to exercise or convert such rights.

Chapter11: The Corporate Income Tax

Section: Chapter Questions

Problem 17MCQ

Related questions

Question

Transcribed Image Text:Which of the following statements is true when assessing whether

potential voting rights contribute to control?

Even when potential voting rights are not exercisable or convertible until a

future date or until the occurrence of a future event, they are still considered

in making that assessment.

The proportions of profit or loss and changes in equity allocated to the parent

and non-controlling interests are determined on the basis of present

ownership, and should reflect any exercise or conversion of potential voting

rights.

Where potential voting rights are currently exercisable or convertible, they

are considered when assessing whether an entity has the power to govern

another entity's financial and operating policies.

In assessing whether potential voting rights contribute to control, all of the

facts and circumstances that affect those rights should be considered

including the intention of management and the financial ability to exercise or

convert such rights.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you