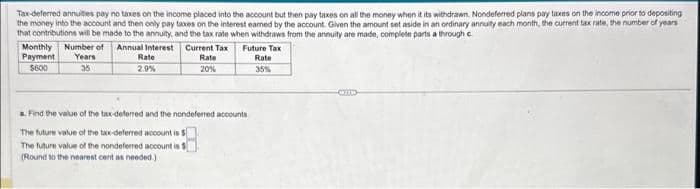

Tax-deferred annutes pay no taxes

Q: Navigator sells GPS trackers for $60 each. It expects sales of 5,200 units in quarter 1 and a 5%…

A: SALES BUDGET Sales Budget is the quantitative & Financial statement of Sales, Prepared prior to…

Q: At the beginning of the year, Golden Gopher Company reports a balance in Supplies of $330. During…

A: The journal entries are prepared to record the transactions on regular basis. The adjustment entries…

Q: Fortin Limited produces and sells a single product, a wearable LED light for runners and cyclists.…

A: The direct material purchase budget is the statement which is prepared by the entity for the purpose…

Q: Compute taxable income for 20x1. Show your computation. No credit if not. Prepare the journal…

A: Deferred Tax asset/liability is created due to temporary differences arising between accounting…

Q: You have a credit card that charges an interest rate of 17.9% compounded monthly. The table below…

A: When credit is used or extended, there is a finance fee applied, such as an interest rate. Finance…

Q: Seattle Adventures, Incorporated, is trying to decide between the following two alternatives to…

A: Earnings per share (EPS) is a measure of a company's profitability, calculated by dividing quarterly…

Q: Give an example of accounting problem, For that problem, there should be 5 requirements or questions…

A: Accounting problem: ABC Company has leased a building for 10 years with an annual rent of $100,000.…

Q: Rand Company computed the following activity rates using activity-based costing. Activity…

A: Activity-based costing (ABC) is a method of assigning overhead and indirect costs to products and…

Q: Cullumber Inc. had the following transactions pertaining to investments in common stock. Jan. 1…

A: The journal entries are prepared to record the transactions on regular basis. The dividend received…

Q: Southwest Milling Company purchased a front-end loader to move stacks of lumber. The loader had a…

A: Capitalization refers to an amount that is incurred in the long-term debt, stock, and retained…

Q: Crane's Candles will be producing a new line of dripless candles in the coming years and has the…

A: Break-even point refers to the level of sales or revenue at which a company's total costs and…

Q: Jane and Greg are married and file a joint return. They expect to have $520,000 of taxable income in…

A: We have, Taxable income = $520,000 Additional deduction, if residence is purchased = $104,000* Net…

Q: Explain the difference between IFRS and GAAP in the accounting of litigation costs to successfully…

A: Litigation costs are an important consideration for companies, as they can have a significant impact…

Q: The income statement comparison for Forklift Material Handling shows the income statement for the…

A: Operating income :— It is the difference between operating revenue and total operating expenses.…

Q: Required information [The following information applies to the questions displayed below.] Homestead…

A: The dividend is declared to the shareholders from the retained earnings of the business. The net…

Q: Calculate the Accounts Receivable Turnover for 2021 using the following information: Net Sales…

A: The ratio analysis helps to analyze the financial statements of the business on the basis of…

Q: What is Net Income

A: Income refers to the revenue which is received by the business when goods and services are sold or…

Q: Lampierre makes brass and gold frames. The company computed this information to decide whether to…

A: Activity-based costing (ABC): It is a costing method in which overhead and indirect costs are…

Q: Basu Adventures has 15 employees each working 40 hours per week and earning $30 an hour. Federal…

A: To calculate the actual payroll payment for the first week of January, we need to calculate the…

Q: Electro Company manufactures transmissions for electric cars. Management reports ending finished…

A: Production Budget :— This budget is prepared to estimate the units required to be produced for…

Q: Assume the following information for Western Sales, Inc Common Stock, $1.00 par, 206,000 shares…

A: Outstanding share can be calculated by deducting treasury stock from total share . briefly…

Q: Required information [The following information applies to the questions displayed below.] Hulme…

A: Journal entries are used to record accounting transactions under double entry accounting system with…

Q: nings account balance at the end of the period (as mentioned before no Dividend has been declared)…

A: Balance Sheet Amount Amount Assets Cash (30000-1200+4000) $ 32,800…

Q: 2. Prepare the stockholders' equity section of the balance sheet as of December 31, 2024. Net income…

A: The dividend will be paid on the Outstanding Number of Shares and does not include treasury stock.

Q: Current Attempt in Progress * Your answer is incorrect. Sunland Ltd. estimates sales for the second…

A: Material cost refers to the total cost of the raw materials and other supplies needed to produce a…

Q: D sold capital property in the current year for net proceeds of $800,000. The property has an…

A: Capital gain means the gain arises from the transfer of the capital asset or increase in the price…

Q: Henrich is a single taxpayer. In 2022

A: Taxable income refers to the sum value of money earned by a taxpayer that is subject to a compulsory…

Q: Here are comparative balance sheets for Crane Company. Prepare a statement of cash flows-indirect…

A: In cash flow from operating activities under Indirect Method - The profit is considered & all…

Q: Hoopla Ltd. is a Canada Business Corporation and has 17,860 Class A voting (common) shares and 6,120…

A: Dividend is paid to shareholders in consideration of their investments. Preference shareholders have…

Q: 1. When should Ski West recognize revenue from the sale of its season passes? 2. Prepare the…

A: Introduction: - Journal entry is the first stage of accounting process. Journal entry used to record…

Q: Adams Manufacturing Co. expects to make 30,800 chairs during the year 1 accounting period. The…

A: The overhead rate is computed by dividing total estimated cost with the estimated total units to be…

Q: Kirsten belleves her company's overhead costs are driven (affected) by the number of direct labor…

A: Overhead is applied to the production cost on the basis of various activity cost pools like direct…

Q: Garcia Company has 10,400 units of its product that were produced at a cost of $156,000. The units…

A: The incremental analysis is performed to compare the different alternatives available to the…

Q: Marin Company makes several products, including canoes. The company reports a loss from its canoe…

A: The variable costs can be avoided completed on the elimination of any segment. The fixed costs can…

Q: Information relating to Waukegan Company for the current year is as follows: Income…

A: Discontinued Operations - Discontinued operations are those operations which are permanently closed…

Q: Engbery Company installs lawn sod in hone yards. The company's most recent monthly contribution…

A: Note: We’ll answer the first question since the first one is opinion based hence I solved Exercise…

Q: If the material price variance is favorable but the material quantity variance is unfavorable, what…

A: Variance analysis is method of analysis of actual data and budgeted data. This helps an organisation…

Q: What is the ending balance in the deferred tax liability account related to these installment sales…

A: The idea previously covered is connected to the idea of deferred tax obligation, which describes…

Q: Radar Company sells bikes for $540 each. The company currently sells 4,400 bikes per year and could…

A: The incremental income can be calculated by the subtracting incremental variable cost and fixed cost…

Q: A manufacturing company applies factory overhead based on direct labor hours. At the beginning of…

A: It is not possible for a firm to trace overhead costs to a particular jobs.Therefore company may…

Q: What is a static planning budget? Is it useful? Why or why not? What is a flexible budget? How does…

A: In accounting, budgeting refers to the process of creating a financial plan for a specific period,…

Q: Explain the principles of accounting and their relevance in financial reporting.

A: Principles of accounting refer to a set of guidelines and concepts that provide a framework for…

Q: Required information [The following information applies to the questions displayed below] Sparrow…

A: According to the retail inventory accounting technique, the opening stock, purchases, and closing…

Q: A debit balance in a company's Pension Asset/Liability account implies that the company has funded…

A: The Pension Asset/Liability account is used to track the funded status of a company's defined…

Q: Give an example of accounting problem about the use of degree of operating leverage, For that…

A: Example accounting problem: A company is considering a project that would require an initial…

Q: hat is the total Cash payments to suppliers when the direct method is used to prepare the cash flow…

A: The cash flow statement is prepared to record the cash flow from various activities during the…

Q: The following example is given Beginning Inventory sale purchase sale purchase Ending Inventory…

A: Cost of sale means the amount of cost incurred on the goods that are being sold in the market.…

Q: Whirly Corporation's contribution format income statement for the most recent month is shown below:…

A: Net operating income is the amount of income earned by the entity after deducting all the operating…

Q: d Fixed Variable Tota $337,5

A: Answer : a) Contribution margin ratio = Contribution margin / Sales Contribution margin = Sales -…

Q: Cash Accounts receivable Allowance for doubtful accounts Inventory Accounts payable Common stock…

A: Journal Entry :— It is an act of recording transaction in books of account when transaction…

Step by step

Solved in 3 steps

- Consider the following accounts and determine if the account is a current liability, a noncurrent liability, or neither. A. cash B. federal income tax payable this year C. long-term note payable D. current portion of a long-term note payable E. note payable due in four years F. interest expense G. state income taxAn individual earns an extra $2000 each year and places this money at the end of each year into an Individual Retirement Account (IRA) in which both the original earnings and the interest in the account are not subject to taxation. If the account has an annual interest rate of 11.8% compounded annually, how much is in the account at the end of 45 years? (Round your answer to the nearest cent.)Just prior to the payout period the amount of money that is available in the contract as principal paid in over the life of the annuity is determined at $200,000. The total annuity is currently valued at $360,000. The annuity payment is calculated at $24,000 per year. Our client wants to retire at age 65. The IRS Tables multiplier from the IRS Table for Age 65 is 15 (remaining life expectancy). What amount will be tax-excludible to the annuitant? $1,111 until the principal amount has been exhausted $888.89 for the life of the annuitant $1,111 for the life of the annuitant $888.89 until the principal amount has been exhausted

- Consider the following accounts and determine if the account is a current liability, a noncurrent liability, or neither. A. Cash B. Federal income tax payable this year C. Long-term note payable D. Current portion of a long-term note payable E. Note Payable due in four years F. Interest Expense G. State income taxIn the following ordinary annuity, the interest is compounded with each payment, and the payment is made at the end of the compounding period.An individual retirement account, or IRA, earns tax-deferred interest and allows the owner to invest up to $5000 each year. Joe and Jill both will make IRA deposits for 30 years (from age 35 to 65) into stock mutual funds yielding 9.8%. Joe deposits $5000 once each year, while Jill has $96.15 (which is 5000/52) withheld from her weekly paycheck and deposited automatically. How much will each have at age 65? (Round your answer to the nearest cent.) Joe $ Jill $Self-employed persons can make contributions for their retirement into a special tax-deferred account called a Keogh account. Suppose you are able to contribute $10,000 into this account at the end of each year. How much will you have at the end of 30 years if the account pays 3% annual interest? (Round your answer to the nearest cent.)

- E3-15. A taxpayer is about to receive a $1,000 bonus from her employer. She would like to put this bonus into a retirement account. She has come to you for advice as to whether she should put the $1,000 into a traditional deductible IRA or a Roth IRA. You learn that she faces a current marginal tax rate of 28% and expects to face the same rate in 40 years, when she plans to withdraw the funds at age 70. She expects to earn a pretax rate of return of 10% in either retirement account by investing the funds in corporate bonds. Advise the taxpayer as to what she should do. E3-16. Assume the same facts as presented in E3-15, with the exception that the taxpayer expects her tax rate to be 20% when she retires in 40 years. What should the taxpayer do now?Tax Exemptions Exemptions allow people to take money out of their paychecks for specific uses before the income is taxed. These deductions are generally handled through the employer. Examples include: Flexible Spending Accounts. A few thousand dollars a year can be held back from your paycheck to pay for essential items such public transportation to and from work, and medical expenses. Individual Retirement Account Contributions. Under this exemption, you can put aside a certain amount of money for retirement without paying taxes on it. For example, the 2014 limit was $5, 500. Example: A single person earns $40,000 a year. Each month their employer takes out $200 and puts it into a retirement account a year). The employer also takes out $50 a month for transportation ($600 a year). This reduces the amount of income counted towards taxes by $3, 000 The employee can still spend the $50 on bus or train tickets for their commute, but the earnings do not count as income for tax purposes.…14. In the following ordinary annuity, the interest is compounded with each payment, and the payment is made at the end of the compounding period.An individual retirement account, or IRA, earns tax-deferred interest and allows the owner to invest up to $5000 each year. Joe and Jill both will make IRA deposits for 30 years (from age 35 to 65) into stock mutual funds yielding 9.1%. Joe deposits $5000 once each year, while Jill has $96.15 (which is 5000/52) withheld from her weekly paycheck and deposited automatically. How much will each have at age 65? (Round your answer to the nearest cent.) Joe $ Jill $ 16. Calculate the present value of the annuity. (Round your answer to the nearest cent.) $11,000 annually at 5% for 10 years.

- For payroll tax purposes, monthly depositors: (a) Are those whose payroll taxes were $50,000 or less during the lookback period. (b) Excludes new employers. (c) Must deposit their payroll taxes on the last day of every month. (d) Will never have to make a next-day deposit.Early withdrawals from retirement plans may be subject to an extra tax (10 percent penalty). Which of the following claims about IRA payouts is correct?A parent on the day the child is born wishes to determine what lump sum would have to be paid into an account bearing interest at 5% compounded annually, in order to withdraw P20,000 each on the child's 18th, 19th, 20th and 21st birthdays. How much is the lump sum amount?