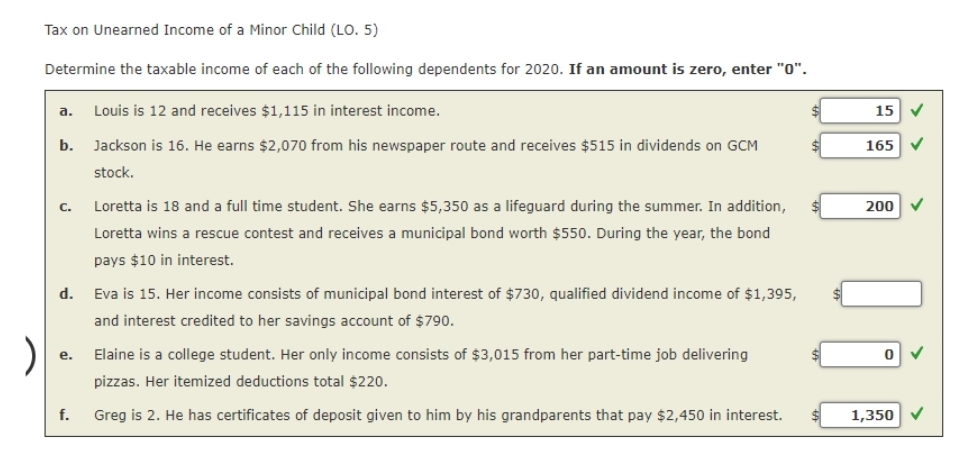

Tax on Unearned Income of a Minor Child (LO. 5) Determine the taxable income of each of the following dependents for 2020. If an amount is zero, enter "0". Louis is 12 and receives $1,115 in interest income. 15 V a. b. Jackson is 16. He earns $2,070 from his newspaper route and receives $515 in dividends on GCM 165 V stock. Loretta is 18 and a full time student. She earns $5,350 as a lifeguard during the summer. In addition, 200 C. Loretta wins a rescue contest and receives a municipal bond worth $550. During the year, the bond pays $10 in interest. d. Eva is 15. Her income consists of municipal bond interest of $730, qualified dividend income of $1,395, and interest credited to her savings account of $790. е. Elaine is a college student. Her only income consists of $3,015 from her part-time job delivering pizzas. Her itemized deductions total $220. f. Greg is 2. He has certificates of deposit given to him by his grandparents that pay $2,450 in interest. 1,350 V

Tax on Unearned Income of a Minor Child (LO. 5) Determine the taxable income of each of the following dependents for 2020. If an amount is zero, enter "0". Louis is 12 and receives $1,115 in interest income. 15 V a. b. Jackson is 16. He earns $2,070 from his newspaper route and receives $515 in dividends on GCM 165 V stock. Loretta is 18 and a full time student. She earns $5,350 as a lifeguard during the summer. In addition, 200 C. Loretta wins a rescue contest and receives a municipal bond worth $550. During the year, the bond pays $10 in interest. d. Eva is 15. Her income consists of municipal bond interest of $730, qualified dividend income of $1,395, and interest credited to her savings account of $790. е. Elaine is a college student. Her only income consists of $3,015 from her part-time job delivering pizzas. Her itemized deductions total $220. f. Greg is 2. He has certificates of deposit given to him by his grandparents that pay $2,450 in interest. 1,350 V

Chapter8: Taxation Of Individuals

Section: Chapter Questions

Problem 44P

Related questions

Question

100%

I need help on part d. Thanks.

Transcribed Image Text:Tax on Unearned Income of a Minor Child (LO. 5)

Determine the taxable income of each of the following dependents for 2020. If an amount is zero, enter "0".

а.

Louis is 12 and receives $1,115 in interest income.

15

b.

Jackson is 16. He earns $2,070 from his newspaper route and receives $515 in dividends on GCM

165

stock.

C.

Loretta is 18 and a full time student. She earns $5,350 as a lifeguard during the summer. In addition,

200

Loretta wins a rescue contest and receives a municipal bond worth $550. During the year, the bond

pays $10 in interest.

d.

Eva is 15. Her income consists of municipal bond interest of $730, qualified dividend income of $1,395,

and interest credited to her savings account of $790.

)

е.

Elaine is a college student. Her only income consists of $3,015 from her part-time job delivering

pizzas. Her itemized deductions total $220.

f.

Greg is 2. He has certificates of deposit given to him by his grandparents that pay $2,450 in interest.

1,350

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT