"Tax-Pro" can access data, existing on other systems, to produce the necessary reports. So the data from other systems, is considered for "Tax-Pro" as: * Output O Processing O Input O Feedback

"Tax-Pro" can access data, existing on other systems, to produce the necessary reports. So the data from other systems, is considered for "Tax-Pro" as: * Output O Processing O Input O Feedback

Purchasing and Supply Chain Management

6th Edition

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

ChapterC: Cases

Section: Chapter Questions

Problem 3.8A

Related questions

Question

Management Information Systems

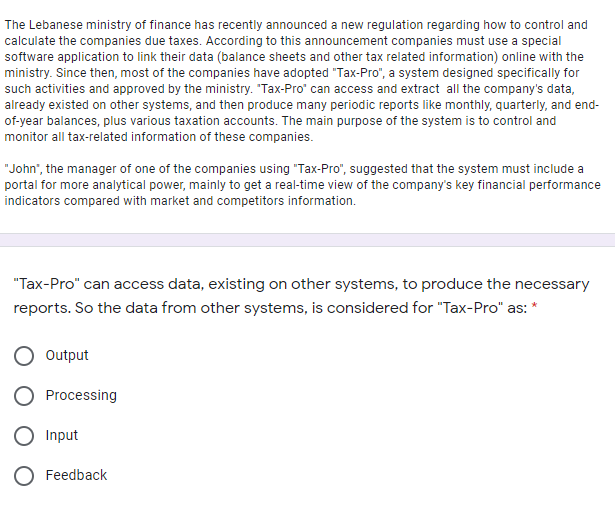

Transcribed Image Text:The Lebanese ministry of finance has recently announced a new regulation regarding how to control and

calculate the companies due taxes. According to this announcement companies must use a special

software application to link their data (balance sheets and other tax related information) online with the

ministry. Since then, most of the companies have adopted "Tax-Pro", a system designed specifically for

such activities and approved by the ministry. "Tax-Pro" can access and extract all the company's data,

already existed on other systems, and then produce many periodic reports like monthly, quarterly, and end-

of-year balances, plus various taxation accounts. The main purpose of the system is to control and

monitor all tax-related information of these companies.

"John", the manager of one of the companies using "Tax-Pro", suggested that the system must include a

portal for more analytical power, mainly to get a real-time view of the company's key financial performance

indicators compared with market and competitors information.

"Tax-Pro" can access data, existing on other systems, to produce the necessary

reports. So the data from other systems, is considered for "Tax-Pro" as: *

Output

O Processing

O Input

Feedback

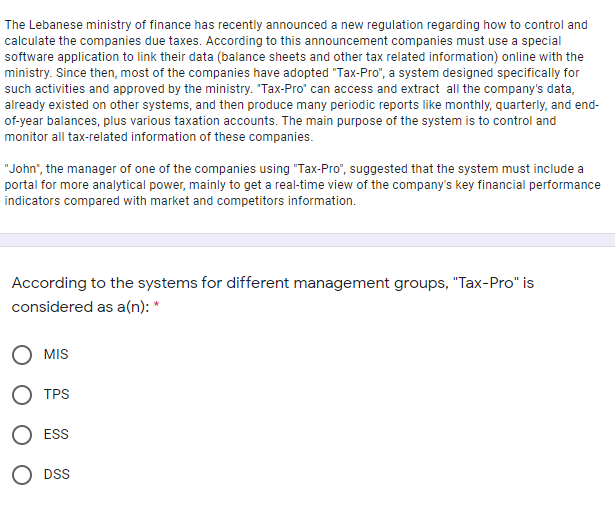

Transcribed Image Text:The Lebanese ministry of finance has recently announced a new regulation regarding how to control and

calculate the companies due taxes. According to this announcement companies must use a special

software application to link their data (balance sheets and other tax related information) online with the

ministry. Since then, most of the companies have adopted "Tax-Pro", a system designed specifically for

such activities and approved by the ministry. "Tax-Pro" can access and extract all the company's data,

already existed on other systems, and then produce many periodic reports like monthly, quarterly, and end-

of-year balances, plus various taxation accounts. The main purpose of the system is to control and

monitor all tax-related information of these companies.

"John", the manager of one of the companies using "Tax-Pro", suggested that the system must include a

portal for more analytical power, mainly to get a real-time view of the company's key financial performance

indicators compared with market and competitors information.

According to the systems for different management groups, "Tax-Pro" is

considered as a(n): *

O MIS

O TPS

O ESS

O DSS

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Purchasing and Supply Chain Management

Operations Management

ISBN:

9781285869681

Author:

Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:

Cengage Learning

Purchasing and Supply Chain Management

Operations Management

ISBN:

9781285869681

Author:

Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:

Cengage Learning