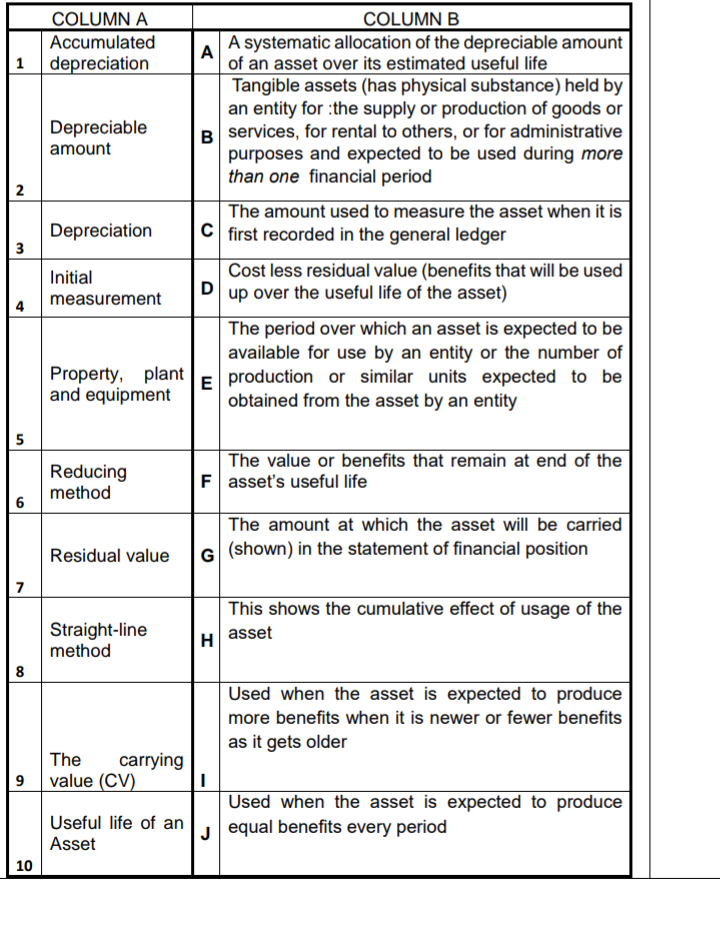

COLUMN A Accumulated 1 depreciation 2 3 5 6 7 8 Depreciable amount 10 Depreciation Initial measurement Property, plant and equipment Reducing method Residual value Straight-line method The 9 value (CV) carrying Useful life of an Asset COLUMN B A A systematic allocation of the depreciable amount of an asset over its estimated useful life Tangible assets (has physical substance) held by an entity for the supply or production of goods or B services, for rental to others, or for administrative purposes and expected to be used during more than one financial period The amount used to measure the asset when it is C first recorded in the general ledger D Cost less residual value (benefits that will be used up over the useful life of the asset) E The value or benefits that remain at end of the Fasset's useful life The amount at which the asset will be carried G (shown) in the statement of financial position H The period over which an asset is expected to be available for use by an entity or the number of production or similar units expected to be obtained from the asset by an entity I J This shows the cumulative effect of usage of the asset Used when the asset is expected to produce more benefits when it is newer or fewer benefits as it gets older Used when the asset is expected to produce equal benefits every period

COLUMN A Accumulated 1 depreciation 2 3 5 6 7 8 Depreciable amount 10 Depreciation Initial measurement Property, plant and equipment Reducing method Residual value Straight-line method The 9 value (CV) carrying Useful life of an Asset COLUMN B A A systematic allocation of the depreciable amount of an asset over its estimated useful life Tangible assets (has physical substance) held by an entity for the supply or production of goods or B services, for rental to others, or for administrative purposes and expected to be used during more than one financial period The amount used to measure the asset when it is C first recorded in the general ledger D Cost less residual value (benefits that will be used up over the useful life of the asset) E The value or benefits that remain at end of the Fasset's useful life The amount at which the asset will be carried G (shown) in the statement of financial position H The period over which an asset is expected to be available for use by an entity or the number of production or similar units expected to be obtained from the asset by an entity I J This shows the cumulative effect of usage of the asset Used when the asset is expected to produce more benefits when it is newer or fewer benefits as it gets older Used when the asset is expected to produce equal benefits every period

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 29BE

Related questions

Question

Match

Transcribed Image Text:COLUMN A

Accumulated

1 depreciation

2

3

5

6

7

8

9

10

Depreciable

amount

Depreciation

Initial

measurement

Property, plant

and equipment

Reducing

method

Residual value

Straight-line

method

carrying

The

value (CV)

Useful life of an

Asset

COLUMN B

A

A systematic allocation of the depreciable amount

of an asset over its estimated useful life

Tangible assets (has physical substance) held by

an entity for the supply or production of goods or

B services, for rental to others, or for administrative

purposes and expected to be used during more

than one financial period

The amount used to measure the asset when it is

C first recorded in the general ledger

D

Cost less residual value (benefits that will be used

up over the useful life of the asset)

The value or benefits that remain at end of the

F asset's useful life

The amount at which the asset will be carried

G (shown) in the statement of financial position

H

The period over which an asset is expected to be

available for use by an entity or the number of

production or similar units expected to be

obtained from the asset by an entity

I

J

This shows the cumulative effect of usage of the

asset

Used when the asset is expected to produce

more benefits when it is newer or fewer benefits

as it gets older

Used when the asset is expected to produce

equal benefits every period

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College