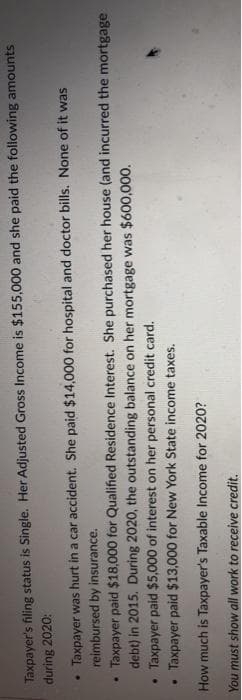

Taxpayer's filing status is Single. Her Adjusted Gross Income is $155,000 and she paid the following amouh during 2020: Taxpayer was hurt in a car accident. She paid $14,000 for hospital and doctor bills. None of it was reimbursed by insurance. Taxpayer paid $18,000 for Qualified Residence Interest. She purchased her house (and incurred the mortgage debt) in 2015. During 2020, the outstanding balance on her mortgage was $600,000. Taxpayer paid $5,000 of interest on her personal credit card. Taxpayer paid $13,000 for New York State income taxes. How much is Taxpayer's Taxable Income for 2020?

Taxpayer's filing status is Single. Her Adjusted Gross Income is $155,000 and she paid the following amouh during 2020: Taxpayer was hurt in a car accident. She paid $14,000 for hospital and doctor bills. None of it was reimbursed by insurance. Taxpayer paid $18,000 for Qualified Residence Interest. She purchased her house (and incurred the mortgage debt) in 2015. During 2020, the outstanding balance on her mortgage was $600,000. Taxpayer paid $5,000 of interest on her personal credit card. Taxpayer paid $13,000 for New York State income taxes. How much is Taxpayer's Taxable Income for 2020?

Chapter10: Deduct Ions And Losses: Certain Itemized Deduct Ions

Section: Chapter Questions

Problem 38P

Related questions

Question

100%

If answered within 30mins,it would be appreciable!!

Transcribed Image Text:Taxpayer's filing status is Single. Her Adjusted Gross Income is $155,000 and she paid the following amounts

during 2020:

Taxpayer was hurt in a car accident. She paid $14,000 for hospital and doctor bills. None of it was

reimbursed by insurance.

Taxpayer paid $18,000 for Qualified Residence Interest. She purchased her house (and incurred the mortgage

debt) in 2015. During 2020, the outstanding balance on her mortgage was $600,000.

Taxpayer paid $5,000 of interest on her personal credit card.

Taxpayer paid $13,000 for New York State income taxes.

How much is Taxpayer's Taxable Income for 2020?

You must show all work to receive credit.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT