TB MC Qu. 12-83 (Algo) Estimated PV (present value) payback period: Plant Company Plant Company is contemplating the purchase of a new piece of equipment for $47,000. Plant is in the 30% income tax bracket. Predicted annual after-tax cash inflows from this investment are $20,000, $10,000, $12,000, $7,000 and $5.000 for years 1 through 5, respectively. The firm uses straight-line depreciation with no residual value at the end of five years. Assume that the hurdle rate for accepting new capital investment projects for the company is 4%, after-tax. (Note: PV $1 factors for 4% are as follows: for year 1= 0.962, for year 2 = 0.925, for year 3 = 0.889, for year 4 = 0.855, for year 5 0.822; the PV annuity factor for 4%, 5 years 4.452.) At an after-tax discount rate of 4%, the estimated PV (present value) payback period, in years (rounded to two decimal places) is: Multiple Choice 3.07 years. 3.68 years 4.07 years. 4.45 years. More than 5 years.

TB MC Qu. 12-83 (Algo) Estimated PV (present value) payback period: Plant Company Plant Company is contemplating the purchase of a new piece of equipment for $47,000. Plant is in the 30% income tax bracket. Predicted annual after-tax cash inflows from this investment are $20,000, $10,000, $12,000, $7,000 and $5.000 for years 1 through 5, respectively. The firm uses straight-line depreciation with no residual value at the end of five years. Assume that the hurdle rate for accepting new capital investment projects for the company is 4%, after-tax. (Note: PV $1 factors for 4% are as follows: for year 1= 0.962, for year 2 = 0.925, for year 3 = 0.889, for year 4 = 0.855, for year 5 0.822; the PV annuity factor for 4%, 5 years 4.452.) At an after-tax discount rate of 4%, the estimated PV (present value) payback period, in years (rounded to two decimal places) is: Multiple Choice 3.07 years. 3.68 years 4.07 years. 4.45 years. More than 5 years.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter12: Capital Investment Decisions

Section: Chapter Questions

Problem 49P: Cost of Capital, Net Present Value Leakam Companys product engineering department has developed a...

Related questions

Question

1

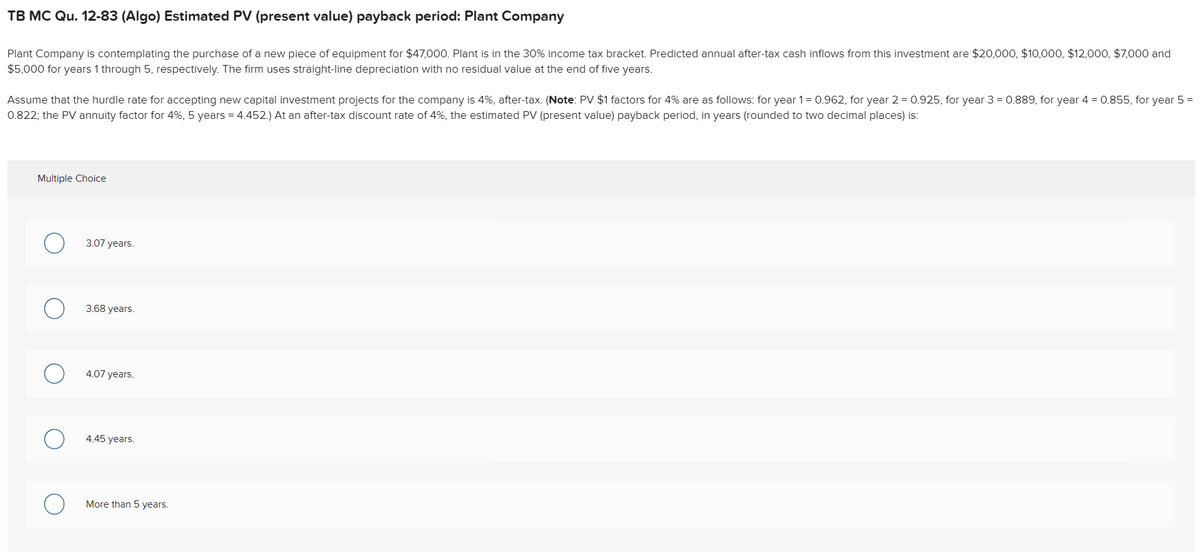

Transcribed Image Text:TB MC Qu. 12-83 (Algo) Estimated PV (present value) payback period: Plant Company

Plant Company is contemplating the purchase of a new piece of equipment for $47,000. Plant is in the 30% income tax bracket. Predicted annual after-tax cash inflows from this investment are $20,000, $10,000, $12,000, $7,000 and

$5,000 for years 1 through 5, respectively. The firm uses straight-line depreciation with no residual value at the end of five years.

Assume that the hurdle rate for accepting new capital investment projects for the company is 4%, after-tax. (Note: PV $1 factors for 4% are as follows: for year 1= 0.962, for year 2 = 0.925, for year 3 = 0.889, for year 4 = 0.855, for year 5 =

0.822; the PV annuity factor for 4%, 5 years = 4.452.) At an after-tax discount rate of 4%, the estimated PV (present value) payback period, in years (rounded to two decimal places) is:

Multiple Choice

3.07 years.

3.68 years.

4.07 years.

4.45 years.

More than 5 years.

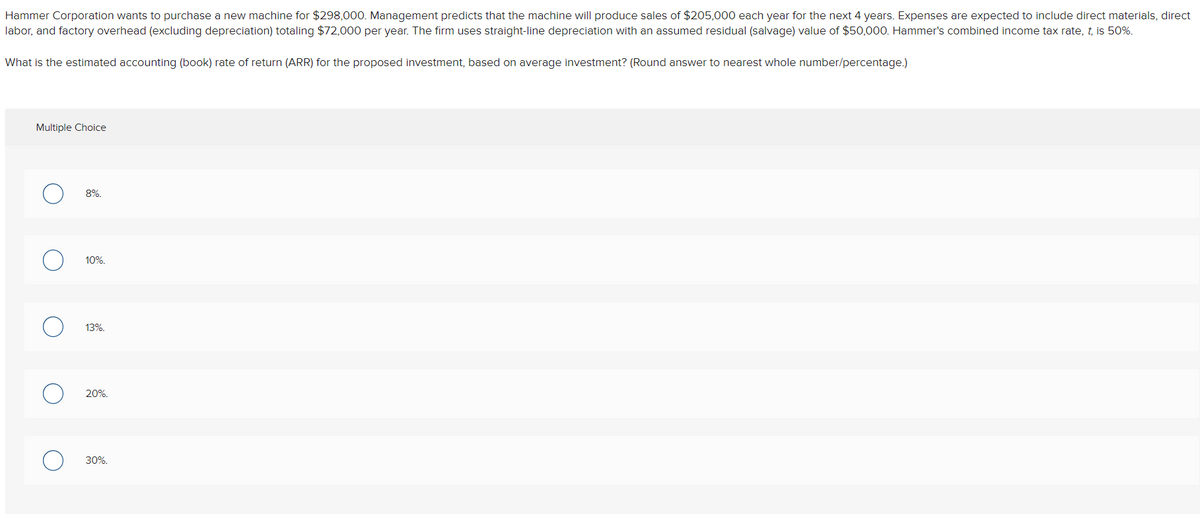

Transcribed Image Text:Hammer Corporation wants to purchase a new machine for $298,000. Management predicts that the machine will produce sales of $205,000 each year for the next 4 years. Expenses are expected to include direct materials, direct

labor, and factory overhead (excluding depreciation) totaling $72,000 per year. The firm uses straight-line depreciation with an assumed residual (salvage) value of $50,000. Hammer's combined income tax rate, t, is 50%.

What is the estimated accounting (book) rate of return (ARR) for the proposed investment, based on average investment? (Round answer to nearest whole number/percentage.)

Multiple Choice

8%.

10%.

13%.

20%.

30%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning