is computed using the straight line method. i useful life of the equipment is five years with alue.

Q: The Flounder Company is planning to purchase $589,600 of equipment with an estimated seven-year life…

A: The question is related to Capital Budgeting. The Payback period is the length of time required to…

Q: 1.) Albert, Benny and Camposo planned a business venture where Albert will contribute Benny…

A: Partnership business is the one where two or more persons join hands to share profit and losses by…

Q: Mateo, sole proprietor reported the following changes during the year from his business: Increase…

A: Income for the Year = Increase in Total equity - Additional investment during the year + Drawings…

Q: ABC will be merging with Target Corporation. Equity values were gathered as follows: ABC, separate…

A: Where the present value of combined enterprise is grater than the sum of present value of individual…

Q: A T&T based US subsidiary will announce a $1.50 per share cash dividend on June 1, 2022. It is noted…

A: Determination of ex-dividend date Ex-dividend date would be one business days before the record…

Q: Mary's Baskets Company expects to manufacture and sell 23,000 baskets in 2019 for $7 each. There are…

A: A company's sales revenue is the total amount it earns from the selling of goods or services.…

Q: Sources of business ownership.

A: Introduction:- Funds play vital role in every business for running operations. Companies cannot run…

Q: Mr. and Mrs. Bachman, both age 65, file a joint return. In 2021, they have wages of $30,000,…

A: Gross total income includes all the kinds of income earned during the year including wages,…

Q: The WIP inventoris of DEF Mfgt Inc. were completely destroyed by fire on June 1, 20x1. Amounts for…

A: The cost of goods sold includes the total cost of goods that are sold during the period. The cost of…

Q: Truck 1 cost $34,000 on January 1, 2013. It should be depreciated on a straight-line basis over an…

A: Vision consulting Inc. has two trucks and the depreciation on the same during the previous years is…

Q: S Corporation has a current ratio of 3.4 and an acid-test ratio of 2.6. The corporation's current…

A: The current ratio is calculated as current assets divided by current liabilities. The acid test…

Q: The double entry Non-current assets Case study no. 1: A VAT payer company has the following…

A: Depreciation refers to the reduction in the hysterical cost of the tangible asset acquired by the…

Q: Harmeling Paint Ball (HPB) Corporation needs a new air compressor that costs $80,000. HPB will need…

A: Note: Hi! Thank you for the question, As per the honor code, we are allowed to answer three…

Q: sheffield Corp. incurs the following expenditures in purchasing a truck: cash price $53,000,…

A: Note: Cost of accident insurance and motor vehicle license will not be capitalized with the cost of…

Q: Sales (20,000 units @ 60 per unit) $1,200,000 Less: Variable cost 20,000@ $45 900,000 Contribution…

A: Calculation of Number of units to be sold next year Budgeted Unit sales for next year = 20,000 units…

Q: In the income statement below, ABC Trade Inc. wants to find the resulting net income for the year…

A: The net income is calculated as difference between total income and total expenses.

Q: what is Debit balance and Credit balance in ledger?

A: Introduction: A ledger account is a record of commercial transactions. It is a discrete record…

Q: The following information is available from Goodyear Company’s 2022 accounting records:…

A: COST OF GOODS SOLD IS THE TOTAL AMOUNT OF COST DIRECTLY RELATED TO PRODUCTION OF GOODS AND SERVICES.

Q: Imperial Jewelers manufactures and sells a gold bracelet for $407.00. The company’s accounting…

A: Introduction: Financial Advantage Associates provides a broad range of financial services. Its…

Q: Perit Industries has $175,000 to invest. The company is trying to decide between two alternative…

A: Net present value(NPV) is the difference between present value of all cash inflows and initial…

Q: A Company owns

A: These are the accounting transactions that are having a monetary impact on the financial statement…

Q: The double entry Equity Case study no. 1: A mimber of persons and/or companies decide to setup a…

A: As per the guidelines, the answer to the first question has been provided. If you require answers to…

Q: PV of DBO – Jan. 1, 20x1 2,000,000 FVPA– Jan.1, 20x1 1,800,000 PV of DBO – Dec. 31, 20x1 2,900,000…

A: An cost is the decrease in asset value as it is used to produce income. If the asset will be…

Q: 4. On December 31, 2019, Don accepted a note receivable from Mike's Builders for $1,000 as a good…

A: The accrued interest is the interest expense due for payment but not paid yet.

Q: ld be required to do the same. Interest is paid on partner’s capital accounts at an annual rate of…

A: When agreement when there is two or more partners to share profit in a great raichur equal ratio…

Q: Chart of Accounts of A Service Business ASSETS LIABILITIES Current Assets 101 Current Liabilities…

A: INTRODUCTION: In every business organization various accounting terms are used. It becomes necessary…

Q: 11. Ace Company had a pretax accounting income of P5,000,000 for its first year of operations. The…

A: Taxable income is the one which is computed after deducting all the expenses from the revenue and…

Q: Which statement is incorrect regarding equity-settled share-based payment transactions? A. the…

A: Equity settled share payments are those transactions in which own equity shares or stock options are…

Q: Toothpaste is a necessary, frequently purchased consunmer product. In an average week a retailer…

A: Gross Margin is a financial measure that measures the financial health and working of an…

Q: 1

A: All sorts of future cash flows in respect of adding interest on present value are known as future…

Q: Sales (20,000 units @ 60 per unit) $1,200,000 Less: Variable cost 20,000@ $45 900,000 Contribution…

A: Profit commonly known as net operating income is the excess of revenue over expenses .

Q: 1. For reporting purposes, currencies are defined as Operating, International and…

A: Disclaimer: “Since you have asked multiple questions, we will solve the first question for you. If…

Q: On January 1, 2019, Villanueva Company classified noncurrent assets as held for sale that had a…

A: Here discuss about the fact to use the non current assets which are held for use and not use for…

Q: Difference between Financial Accounting Standards Board and International Accounting Standards…

A: The Financial Accounting Standards Board was established to create reporting guidelines. It is one…

Q: Howard has an ROI of 26% based on revenues of $408,000. The investment turnover is 2. What is the…

A: Residual Income: When used in a business context, the term "residual income" refers to the amount of…

Q: What is the difference between book value accounting and market value accounting? How do interest…

A: The answer is stated below:

Q: Simon Company’s year-end balance sheets follow. At December 31 Current Yr 1 Yr Ago 2 Yrs Ago…

A: Inventory Turnover Ratio: The pace at which inventory stock is sold, or utilized, and replaced is…

Q: The board of directors of Blossom Corporation is considering two plans for financing the purchase of…

A: Bonds are trade-able assets that are issued by the companies. It provides a fixed interest rate to…

Q: be invested at the beginning of each quarter at 10 % compounded quarterly in order to have P140,000…

A: The answer has been mentioned below.

Q: Buenos Company has two divisions, Divisior X and Division Y. Division X has a productiom capacity of…

A: In the given question, Division X has production capacity of 6,000 units and current production…

Q: During Year 1, Peninsula Corporation acquired, as financial ssets at fair value through profit or…

A:

Q: Which of the following bank reconciliation adjustments would result in an increase to the company's…

A: Bank reconciliation is used for reconciling the balance in the banks books with that of the balance…

Q: Given the income statement below, Mega Trade Inc. wants to find the resulting net income for the…

A: Income Statement is part of Financial Statements statement which represents Revenue and Expenses…

Q: Pinkton Corporation keeps careful track of the time required to fill orders. The times recorded for…

A: Delivery cycle time: It implies to the time gap that exists between the receipt of an order from the…

Q: Francisco Company has 10 employees, each of whom earns $2,500 per month and is paid on the last day…

A: Introduction: Salary is a regular payment made by an employer to an employee based on the work and…

Q: Company provdes the following ABC costing information: Total Costs Activity-cost drivers itles…

A: Activity Based Costing is a method identifying activities and then assigning indirect cost and…

Q: Assets available for unsecured creditors after payments of liabilities with priority are calculated…

A: Total amount to be realized from assets = $115,000 + $100,000 + $220,000 = $435,000 Amount…

Q: Required: a) Using the information provided prepare a flexible budget statement for 27,000 units for…

A:

Q: Question. Please specify the journal entry and whose account it belongs to? Loan amount - 16,00,000…

A: A journal entry is used to record a business transaction in an organization's accounting records. A…

Q: Crane Medical manufactures hospital beds and other institutional furniture. The company’s…

A: The question is based on the concept of Financial Ratios. Gross margin percentage is calculated by…

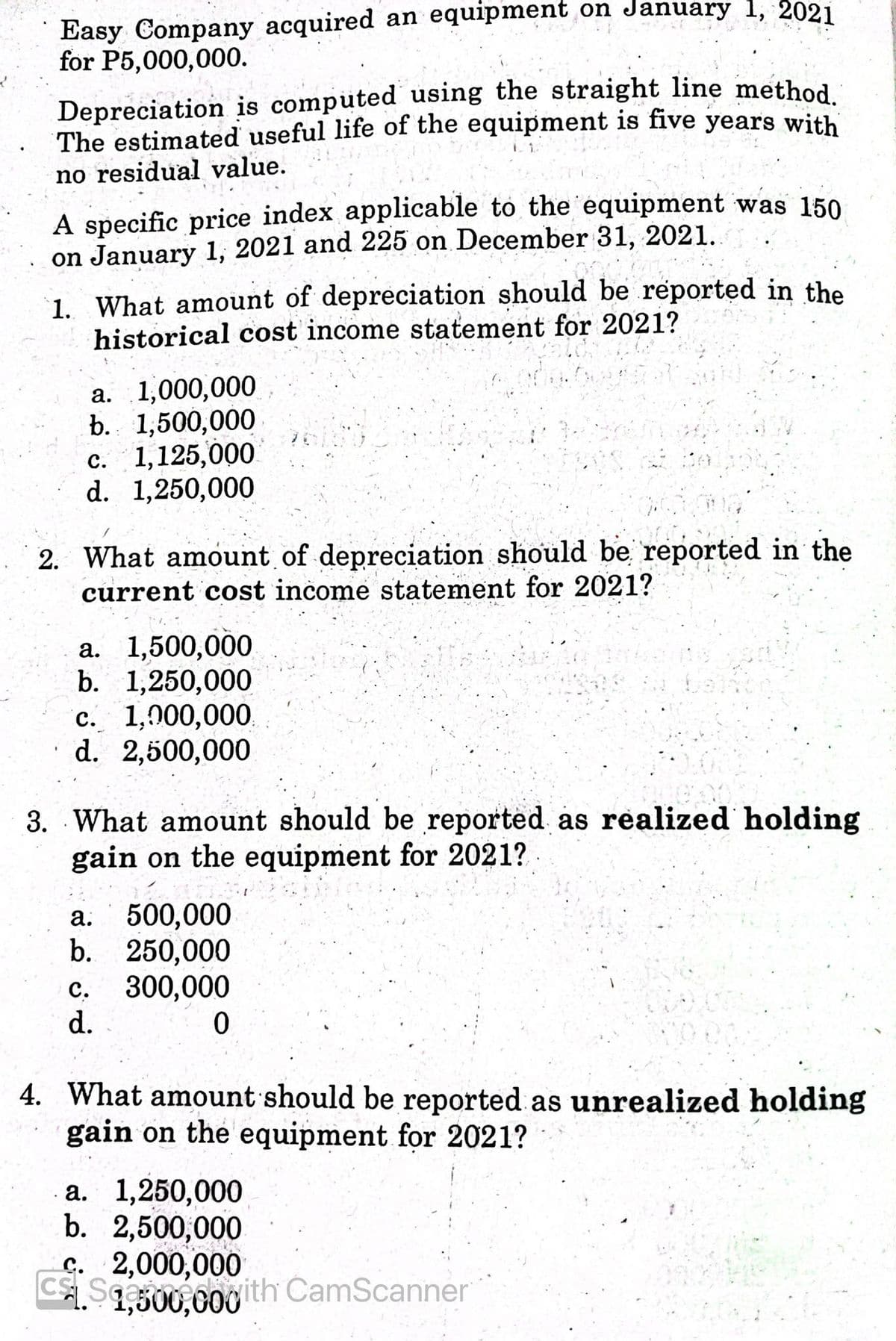

ANSWER NUMBER 4 ONLY. THANK YOU

Step by step

Solved in 2 steps

- On May 10, 2019, Horan Company purchased equipment for 25,000. The equipment has an estimated service life of 5 years and zero residual value. Assume that the straight-line depreciation method is used. Required: Compute the depreciation expense for 2019 for each of the following four alternatives: 1. Horan computes depreciation expense to the nearest day. (Use 12 months of 30 days each and round the daily depreciation rate to 2 decimal places.) 2. Horan computes depreciation expense to the nearest month. Assets purchased in the first half of the month are considered owned for the whole month. 3. Horan computes depreciation expense to the nearest whole year. Assets purchased in the first half of the year are considered owned for the whole year. 4. Horan records one-half years depreciation expense on all assets purchased during the year.Kam Company purchased a machine on January 2, 2019, for 20,000. The machine had an expected life of 8 years and a residual value of 300. The double-declining-balance method of depreciation is used. Required: 1. Compute the depreciation expense for each year of the assets life and book value at the end of each year. 2. Assuming that the company has a policy of always changing to the straight-line method at the midpoint of the assets life, compute the depreciation expense for each year of the assets life. 3. Assuming that the company always changes to the straight-line method at the beginning of the year when the annual straight-line amount exceeds the double-declining-balance amount, compute the depreciation expense for each year of the assets life.Hunter Company purchased a light truck on January 2, 2019 for 18,000. The truck, which will be used for deliveries, has the following characteristics: Estimated life: 5 years Estimated residual value: 3,000 Depreciation method for financial statements: straight-line method Depreciation for income tax purposes: MACRS (3-year life) From 2019 through 2023, each year, Hunter had sales of 100,000, cost of goods sold of 60,000, and operating expenses (excluding depreciation) of 15,000. The truck was disposed of on December 31, 2023, for 2,000. Required: 1. Prepare an income statement for financial reporting through pretax accounting income for each of the 5 years, 2019 through 2023. 2. Prepare, instead, an income statement for income tax purposes through taxable income for each of the 5 years, 2019 through 2023. 3. Compare the total income for all 5 years under Requirements 1 and 2.

- Gray Companys financial statements showed income before income taxes of 4,030,000 for the year ended December 31, 2020, and 3,330,000 for the year ended December 31, 2019. Additional information is as follows: Capital expenditures were 2,800,000 in 2020 and 4,000,000 in 2019. Included in the 2020 capital expenditures is equipment purchased for 1,000,000 on January 1, 2020, with no salvage value. Gray used straight-line depreciation based on a 10-year estimated life in its financial statements. As a result of additional information now available, it is estimated that this equipment should have only an 8-year life. Gray made an error in its financial statements that should be regarded as material. A payment of 180,000 was made in January 2020 and charged to expense in 2020 for insurance premiums applicable to policies commencing and expiring in 2019. No liability had been recorded for this item at December 31, 2019. The allowance for doubtful accounts reflected in Grays financial statements was 7,000 at December 31, 2020, and 97,000 at December 31, 2019. During 2020, 90,000 of uncollectible receivables were written off against the allowance for doubtful accounts. In 2019, the provision for doubtful accounts was based on a percentage of net sales. The 2020 provision has not yet been recorded. Net sales were 58,500,000 for the year ended December 31, 2020, and 49,230,000 for the year ended December 31, 2019. Based on the latest available facts, the 2020 provision for doubtful accounts is estimated to be 0.2% of net sales. A review of the estimated warranty liability at December 31, 2020, which is included in other liabilities in Grays financial statements, has disclosed that this estimated liability should be increased 170,000. Gray has two large blast furnaces that it uses in its manufacturing process. These furnaces must be periodically relined. Furnace A was relined in January 2014 at a cost of 230,000 and in January 2019 at a cost of 280,000. Furnace B was relined for the first time in January 2020 at a cost of 300,000. In Grays financial statements, these costs were expensed as incurred. Since a relining will last for 5 years, Grays management feels it would be preferable to capitalize and depreciate the cost of the relining over the productive life of the relining. Gray has decided to nuke a change in accounting principle from expensing relining costs as incurred to capitalizing them and depreciating them over their productive life on a straight-line basis with a full years depreciation in the year of relining. This change meets the requirements for a change in accounting principle under GAAP. Required: 1. For the years ended December 31, 2020 and 2019, prepare a worksheet reconciling income before income taxes as given previously with income before income taxes as adjusted for the preceding additional information. Show supporting computations in good form. Ignore income taxes and deferred tax considerations in your answer. The worksheet should have the following format: 2. As of January 1, 2020, compute the retrospective adjustment of retained earnings for the change in accounting principle from expensing to capitalizing relining costs. Ignore income taxes and deferred tax considerations in your answer.Chapman Inc. purchased a piece of equipment in 2018. Chapman depreciated the equipment on a straight-line basis over a useful life of 10 years and used a residual value of $12,000. Chapmans depreciation expense for 2019 was $11,000. What was the original cost of the building? a. $98,000 b. $110,000 c. $122,000 d. $134,000Hathaway Company purchased a copying machine for 8,700 on October 1, 2019. The machines residual value was 500 and its expected service life was 5 years. Hathaway computes depreciation expense to the nearest whole month. Required: 1. Compute depredation expense (rounded to the nearest dollar) for 2019 and 2020 using the: a. straight-line method b. sum-of-the-years-digits method c. double-declining-balance method 2. Next Level Which method produces the highest book value at the end of 2020? 3. Next Level Which method produces the highest charge to income in 2020? 4. Next Level Over the life of the asset, which method produces the greatest amount of depreciation expense?

- Depreciation Methods Sorter Company purchased equipment for 200,000 on January 2, 2019. The equipment has an estimated service life of 8 years and an estimated residual value of 20,000. Required: Compute the depreciation expense for 2019 under each of the following methods: 1. straight-line 2. sum-of-the-years-digits 3. double-declining-balance 4. Next Level What effect does the depreciation of the equipment have on the analysis of rate of return?On January 1, 2014, Klinefelter Company purchased a building for 520,000. The building had an estimated life of 20 years and an estimated residual value of 20,000. The company has been depreciating the building using straight-line depreciation. At the beginning of 2020, the following independent situations occur: a. The company estimates that the building has a remaining life of 10 years (for a total of 16 years). b. The company changes to the sum-of-the-years-digits method. c. The company discovers that it had ignored the estimated residual value in the computation of the annual depreciation each year. Required: For each of the independent situations, prepare all journal entries related to the building for 2020. Ignore income taxes.Albany Corporation purchased equipment at the beginning of Year 1 for 75,000. The asset does not have a residual value and is estimated to be in service for 8 years. Calculate the depreciation expense for Years 1 and 2 using the double-declining-balance method. Round to the nearest dollar.

- Refer to the information for Cox Inc. above. What amount would Cox record as depreciation expense for 2019 if the units-of-production method were used ( Note: Round your answer to the nearest dollar)? a. $179,400 b. $184,000 c. $218,400 d. $224,000Depreciation Methods On January 1, 2019, Loeffler Company acquired a machine at a cost of $200,000. Loeffler estimates that it will use the machine for 4 years or 8,000 machine hours. It estimates that after 4 years the machine can be sold for $20,000. Loeffler uses the machine for 2,100 and 1,800 machine hours in 2019 and 2020, respectively. Required: Compute depreciation expense for 2019 and 2020 using the (1) straight-line, (2) double-declining-balance, and (3) units-of-production methods of depreciation.At the beginning of 2020, Holden Companys controller asked you to prepare correcting entries for the following three situations: 1. Machine X was purchased for 100,000 on January 1, 2015. Straight-line depreciation has been recorded for 5 years, and the Accumulated Depreciation account has a balance of 45,000. The estimated residual value remains at 10,000, but the service life is now estimated to be 1 year longer than originally estimated. 2. Machine Y was purchased for 40,000 on January 1, 2018. It had an estimated residual value of 4,000 and an estimated service life of 8 years. It has been depreciated under the sum-of-the-years-digits method for 2 years. Now, the company has decided to change to the straight-line method. 3. Machine Z was purchased for 80,000 on January 1, 2019. Double-declining-balance depreciation has been recorded for 1 year. The estimated residual value is 8,000 and the estimated service life is 5 years. The computation of the depreciation erroneously included the estimated residual value. Required: Prepare any necessary correcting journal entries for each situation. Also prepare the journal entry for each situation to record the depreciation for 2020. Ignore income taxes.