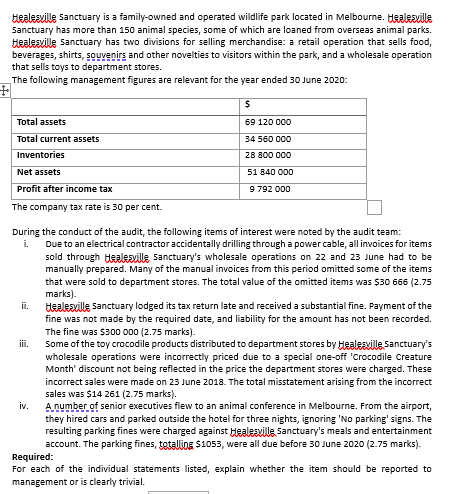

tealesxille Sanctuary is a family-owned and operated wildlife park located in Melbourne. Healesville Sanctuary has more than 150 animal species, some of which are loaned from overseas animal parks. Healesville Sanctuary has two divisions for selling merchandise: a retail operation that sells food, beverages, shirts, souvenirs and other novelties to visitors within the park, and a wholesale operation that sells toys to department stores. The following management figures are relevant for the year ended 30 June 2020: Total assetS 69 120 000 Total current assets 34 560 000 Inventories 28 800 000 Net assets 51 840 000 Profit after income tax 9 792 000 The company tax rate is 30 per cent. During the conduct of the audit, the following items of interest were noted by the audit team: Due to an electrical contractor accidentally drilling through a power cable, all invoices for items sold through tealesxille sanctuary's wholesale operations on 22 and 23 June had to be manually prepared. Many of the manual invoices from this period omitted some of the items that were sold to department stores. The total value of the omitted items was $30 666 (2.75 marks). tealesville Sanctuary lodged its tax return late and received a substantial fine. Payment of the i. ii. fine was not made by the required date, and liability for the amount has not been recorded. The fine was $300 000 (2.75 marks). Some of the toy crocodile products distributed to department stores by Healesvile Sanctuary's wholesale operations were incorrectly priced due to a special one-off 'Crocodile Creature Month' discount not being reflected in the price the department stores were charged. These incorrect sales were made on 23 June 2018. The total misstatement arising from the incorrect sales was $14 261 (2.75 marks). A.number of senior executives flew to an animal conference in Melbourne. From the airport, they hired cars and parked outside the hotel for three nights, ignoring 'No parking' signs. The resulting parking fines were charged against Healesxille sanctuary's meals and entertainment account. The parking fines, totalling $1053, were all due before 30 June 2020 (2.75 marks). iii. iv. Required: For each of the individual statements listed, explain whether the item should be reported to management or is clearly trivial.

tealesxille Sanctuary is a family-owned and operated wildlife park located in Melbourne. Healesville Sanctuary has more than 150 animal species, some of which are loaned from overseas animal parks. Healesville Sanctuary has two divisions for selling merchandise: a retail operation that sells food, beverages, shirts, souvenirs and other novelties to visitors within the park, and a wholesale operation that sells toys to department stores. The following management figures are relevant for the year ended 30 June 2020: Total assetS 69 120 000 Total current assets 34 560 000 Inventories 28 800 000 Net assets 51 840 000 Profit after income tax 9 792 000 The company tax rate is 30 per cent. During the conduct of the audit, the following items of interest were noted by the audit team: Due to an electrical contractor accidentally drilling through a power cable, all invoices for items sold through tealesxille sanctuary's wholesale operations on 22 and 23 June had to be manually prepared. Many of the manual invoices from this period omitted some of the items that were sold to department stores. The total value of the omitted items was $30 666 (2.75 marks). tealesville Sanctuary lodged its tax return late and received a substantial fine. Payment of the i. ii. fine was not made by the required date, and liability for the amount has not been recorded. The fine was $300 000 (2.75 marks). Some of the toy crocodile products distributed to department stores by Healesvile Sanctuary's wholesale operations were incorrectly priced due to a special one-off 'Crocodile Creature Month' discount not being reflected in the price the department stores were charged. These incorrect sales were made on 23 June 2018. The total misstatement arising from the incorrect sales was $14 261 (2.75 marks). A.number of senior executives flew to an animal conference in Melbourne. From the airport, they hired cars and parked outside the hotel for three nights, ignoring 'No parking' signs. The resulting parking fines were charged against Healesxille sanctuary's meals and entertainment account. The parking fines, totalling $1053, were all due before 30 June 2020 (2.75 marks). iii. iv. Required: For each of the individual statements listed, explain whether the item should be reported to management or is clearly trivial.

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter3: Internal Control Over Financial Reporting: Responsibilities Of Management And The External Auditor

Section: Chapter Questions

Problem 21RQSC

Related questions

Question

Transcribed Image Text:tealesxille Sanctuary is a family-owned and operated wildlife park located in Melbourne. Healesville

Sanctuary has more than 150 animal species, some of which are loaned from overseas animal parks.

Healesville Sanctuary has two divisions for selling merchandise: a retail operation that sells food,

beverages, shirts, souvenirs and other novelties to visitors within the park, and a wholesale operation

that sells toys to department stores.

The following management figures are relevant for the year ended 30 June 2020:

Total assetS

69 120 000

Total current assets

34 560 000

Inventories

28 800 000

Net assets

51 840 000

Profit after income tax

9 792 000

The company tax rate is 30 per cent.

During the conduct of the audit, the following items of interest were noted by the audit team:

Due to an electrical contractor accidentally drilling through a power cable, all invoices for items

sold through tealesxille sanctuary's wholesale operations on 22 and 23 June had to be

manually prepared. Many of the manual invoices from this period omitted some of the items

that were sold to department stores. The total value of the omitted items was $30 666 (2.75

marks).

tealesville Sanctuary lodged its tax return late and received a substantial fine. Payment of the

i.

ii.

fine was not made by the required date, and liability for the amount has not been recorded.

The fine was $300 000 (2.75 marks).

Some of the toy crocodile products distributed to department stores by Healesvile Sanctuary's

wholesale operations were incorrectly priced due to a special one-off 'Crocodile Creature

Month' discount not being reflected in the price the department stores were charged. These

incorrect sales were made on 23 June 2018. The total misstatement arising from the incorrect

sales was $14 261 (2.75 marks).

A.number of senior executives flew to an animal conference in Melbourne. From the airport,

they hired cars and parked outside the hotel for three nights, ignoring 'No parking' signs. The

resulting parking fines were charged against Healesxille sanctuary's meals and entertainment

account. The parking fines, totalling $1053, were all due before 30 June 2020 (2.75 marks).

iii.

iv.

Required:

For each of the individual statements listed, explain whether the item should be reported to

management or is clearly trivial.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning