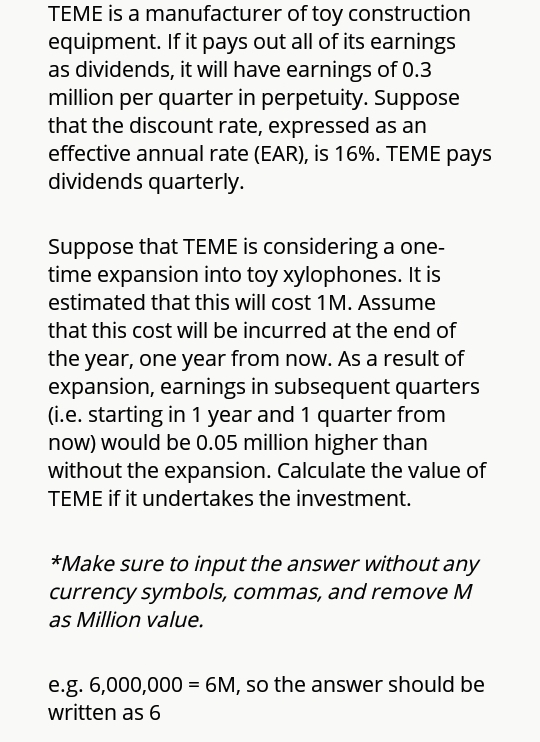

TEME is a manufacturer of toy construction equipment. If it pays out all of its earnings as dividends, it will have earnings of 0.3 million per quarter in perpetuity. Suppose that the discount rate, expressed as an effective annual rate (EAR), is 16%. TEME pays dividends quarterly. Suppose that TEME is considering a one- time expansion into toy xylophones. It is estimated that this will cost 1M. Assume that this cost will be incurred at the end of the year, one year from now. As a result of expansion, earnings in subsequent quarters (i.e. starting in 1 year and 1 quarter from now) would be 0.05 million higher than without the expansion. Calculate the value of TEME if it undertakes the investment.

TEME is a manufacturer of toy construction equipment. If it pays out all of its earnings as dividends, it will have earnings of 0.3 million per quarter in perpetuity. Suppose that the discount rate, expressed as an effective annual rate (EAR), is 16%. TEME pays dividends quarterly. Suppose that TEME is considering a one- time expansion into toy xylophones. It is estimated that this will cost 1M. Assume that this cost will be incurred at the end of the year, one year from now. As a result of expansion, earnings in subsequent quarters (i.e. starting in 1 year and 1 quarter from now) would be 0.05 million higher than without the expansion. Calculate the value of TEME if it undertakes the investment.

Chapter14: Capital Structure Management In Practice

Section: Chapter Questions

Problem 17P

Related questions

Question

Transcribed Image Text:TEME is a manufacturer of toy construction

equipment. If it pays out all of its earnings

as dividends, it will have earnings of 0.3

million per quarter in perpetuity. Suppose

that the discount rate, expressed as an

effective annual rate (EAR), is 16%. TEME pays

dividends quarterly.

Suppose that TEME is considering a one-

time expansion into toy xylophones. It is

estimated that this will cost 1 M. Assume

that this cost will be incurred at the end of

the year, one year from now. As a result of

expansion, earnings in subsequent quarters

(i.e. starting in 1 year and 1 quarter from

now) would be 0.05 million higher than

without the expansion. Calculate the value of

TEME if it undertakes the investment.

*Make sure to input the answer without any

currency symbols, commas, and remove M

as Million value.

e.g. 6,000,000 = 6M, so the answer should be

written as 6

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning