tement follow, along with additional into alance Sheet at December 31

Q: REQUIRED: prepare the Balance Sheet Equation for the following: 1) On 9/1/13, Strand Corp received a…

A: The accounting equation follows the concept that the assets are always equal to the sum of…

Q: Given the following: LIFO method: 250 units left in ending inventory. 1/1/2018 Beginning inventory…

A: As per LIFO method, the ending inventory would consist of the first most items that were received…

Q: What are examples of various types of business-type funds used in governmental units? How are…

A: Fund used by Government Units: When the federal government completes tax-supported activities, a…

Q: How much is the consolidated Retained Earnings as of 12/31/2022?

A: Non-controlling interest, also known as low interest, is a position of ownership where the…

Q: Export-Import Corporation paid the amount of P13,000.00 to Hernando’s Hideaway Resort Corporation…

A: To promote employee motivation or job satisfaction, some employers gives additional benefits to…

Q: For each property type below, find the correct property class and enter the number of years the…

A: Following is the description of the property and their class.

Q: TIPS FOR READING AN EXCHANGE RATE CHART: Read down the chart. For example, in column 1 it says the…

A: Here discuss about the details of the currency exchange rate of different national and its…

Q: On January 1, Wei company begins the accounting period with a $34,000 credit balance in Allowance…

A: The question is based on the concept of Financial Accounting. Doubtful accounts or bad debts are the…

Q: What is the revenue to be recognized by Entity A for the year ended December 31, 2020?

A: Particulars Stand-alone amount Revenue Royalty $25000 Non-Refundable Fees: Construction…

Q: Solano Company has sales of $740.000, cost of goods sold of $490,000, other operating expenses of…

A: Return on investment = Net profit/Average invested assets Investment turnover = Net sales/Average…

Q: Prepare the journal entry at commencement of the lease for Sharrer, assuming (1) Sharrer does not…

A: Solution:- Prepare the journal entry at commencement of the lease for Sharrer (1) Sharrer does not…

Q: The cost of an asset is $1.200,000, and its residual value is $180,000. Essmated usetul ife of the…

A: Formula: Depreciation rate = ( 100 / Useful life years ) x 2

Q: On J anuary 1, 2019, kelly Corporation acquired bonds wiili a face value of $500,000 for $483841.79,…

A: A journal entry is the technique through which a firm records every individual financial…

Q: d. What is Mogi Corp.’s operating profit if all 40,000 gallon of final product can be sold for $55…

A: Transfer price means the price charged by one department from other department of the same company…

Q: Question 17 Consider the following Supplier's credit terms: 2/10. n/45 3/10, n/60 1/15, n/30 Which…

A: Cost of not taking the discount = Discount % / ( 1 - Discount % ) x [ 360/ ( full allowed payment…

Q: Posters.com is a small Internet retailer of high-quality posters. The company has $890,000 in…

A: Formula Return on Investment =Net Operating Income/ Average Operating assets Sales Net…

Q: The Kramer Company had office supplies on hand of $900 at the beginning of the period, purchased…

A: Supplies expense at the end of the period = Office supplies on hand at the beginning of the period +…

Q: The balance in Ashwood Company’s accounts payable account at December 31, 2019, was $1,200,000…

A: Accounts payable (AP) is a financial word that refers to the money owing to vendors for products or…

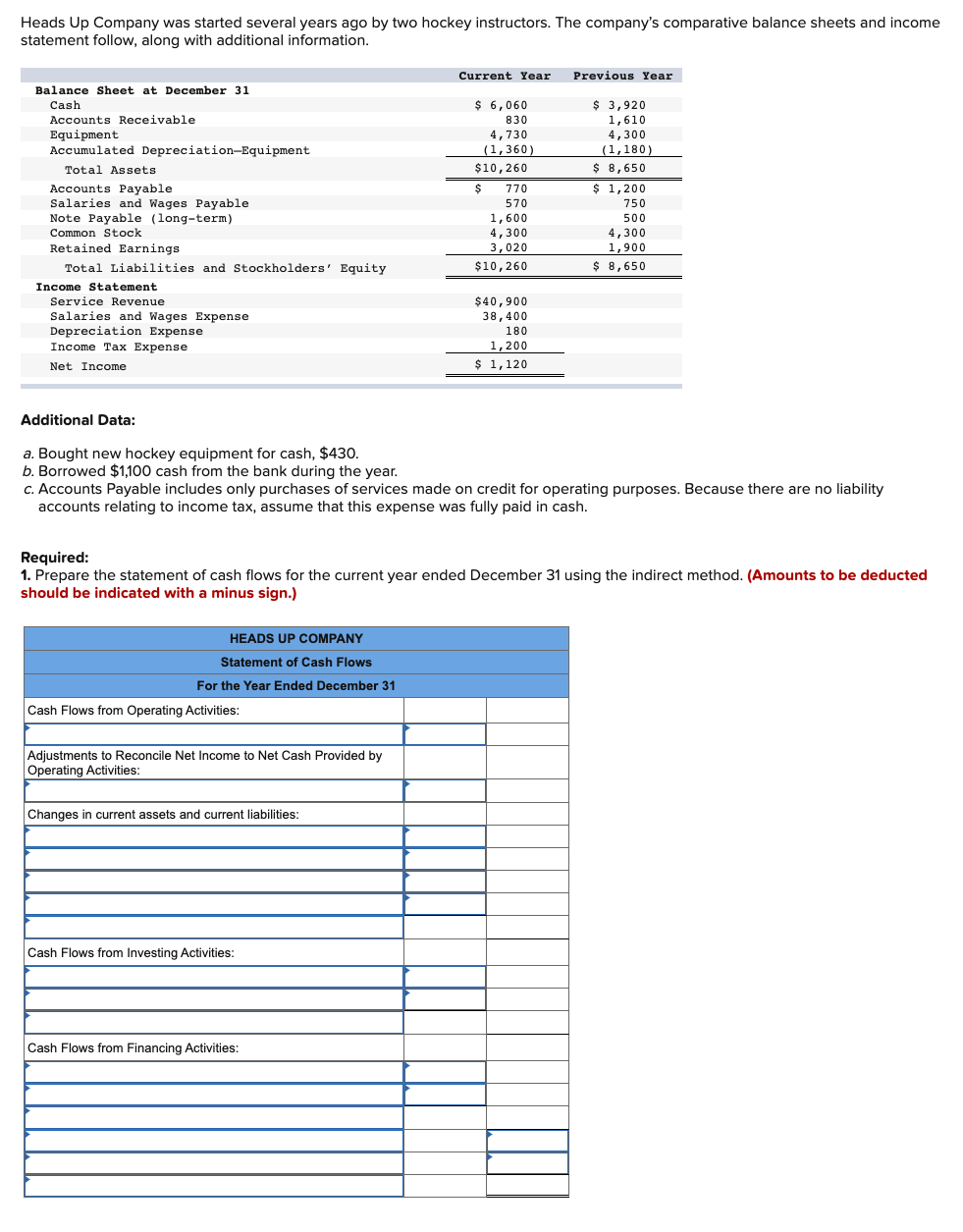

Q: Prepare a statement of cash flows for 2022 using the indirect method. (Show amounts that decrease…

A: Cash Flow statement needs to be prepared as per Indirect Method

Q: On June 30, 2018, Parent Company sold some land to its subsidiary for $240,000. The land had cost…

A: As on December 31,2018 the land is not sold by subsidiary. Land was sold by subsidiary to outsider…

Q: How much was the income tax payable for the first quarter? How much was the income tax payable for…

A: Minimum corporate income tax (MCIT) in total income, beginning in the fourth tax year following the…

Q: Question 25 The minimum cash balance may be set based on the desired number of days' of operations…

A: Minimum Cash Balance is the Cash reserved to meet the operational expenses of the organization. It…

Q: 5. Ben just signed the lease on his first apartment. He wants standard form insurance for the least…

A: 6.$24,800, Since no. of leasehold is not given 7. Municipality will raise money from property tax…

Q: Hi-Tek Manufacturing, Inc., makes two types of industrial component parts—the B300 and the T500. An…

A: An income statement is a financial report that indicates the revenue and expenses of a business. It…

Q: Sheffield Corporation rings up cash sales and sales taxes separately on its cash register. On April…

A:

Q: Complete the bank's balance sheet provided below. (Round your responses to the nearest whole…

A: Statement of financial position (balance sheet) refers to a statement which provides a brief summary…

Q: Marino Company had the following balance sheet On January 1, 2019: 1. Compute the…

A: Goodwill is an intangible asset that arises from the purchase of one company by another. Goodwill is…

Q: Jaybird Company operates in a highly competitive market where the market price for its product is…

A: Answer: Jaybird company need to reduce its total cost by $45,500 to achieve targeted costs per unit

Q: Luxury Shower Products, Inc. makes a variety of ceramic showers and tubs. Luxury has just developed…

A: Contribution margin = sales price per unit - variable cost per unit We will have to first compute…

Q: Sunland Corporation was organized on January 1, 2022. It is authorized to issue 9,600 shares of 8%,…

A: The journal keeps the record for day to day transactions of the business on regular basis.

Q: In Draco Corporation's first year of business, the following transactions affected its equity…

A: Stockholders's equity shows how much the owners of a company have invested in the business- either…

Q: Required

A: A company takeover the control over the another company when it buys more 50% shares of the company.…

Q: On January 2, 2021, Power Company acquired 90% of the outstanding shares of Solar Inc. at book…

A: Consolidation financial statement- Financial statements generated by combining the financial…

Q: 8. Central Drug Store carries a variety of health and beauty aids, including elastic ankle braces.…

A: Budgets are the forecasts or estimates for future period of time. It means quantitative form of…

Q: Chapter 1-Accounting for Partnership Formation & Operation On March 1, of the current year, PP and…

A: 1. Particulars PP QQ 2%doubtful accounts 370 270 Rent expenses 1000 Increase in…

Q: Assume that Clampett, Inc. has $200,000 of sales, $150,000 of cost of goods sold, $60,000 of…

A: Passive income is income without involvement in the work directly and without any direct effort…

Q: Mr Jacob Johnson has net employment income of $41300 (after the deduction of $8600 in RPP…

A: Net income + RPP deduction + income from business + taxable dividend - support payment from former…

Q: 8. Given the following data, calculate product cost per unit under variable costing. Direct labor S7…

A: Formula: Product cost per unit under variable costing = Direct materials + direct labor + Variable…

Q: Fill in the blanks with the number that corresponds to the correct word or phrse below: 2. GDP…

A: The student has asked multiple fill in the blanks.In the next step, I have answered all the fill in…

Q: Described below are certain transactions of Jeno Corporation during 2022. 1. On April 1, the…

A: The process of accounting consists of a set of activities that pertain to the recording of every…

Q: You have taken a loan of $88,000.00 for 30 years at 4.1% compounded quarterly. Fill in the table…

A: Solution:- Given, Loan = $88,000 Life time = 30 years Compounded quarterly at 4.1%

Q: stion 8 Golden Corporation have the following information from its books: Sales P1,600,000 Credit…

A: The average days sales tells about the number of days taken to convert inventory into sales. Average…

Q: Rokat Corporation is a manufacturer of tables sold to schools, restaurants, hotels, and other…

A: In order to determine the no of tables to be produced, the desired ending finished goods are…

Q: 62. How much is the total EXCLUSIONS FROM GROSS INCOME?

A: As per our protocol and guidelines we provide solution to the one question only but you have asked…

Q: The allowable deduction for depreciation for the year 2014 is:

A: Depreciation is the amount of expenses which reduces the net income which means it is a expense…

Q: rnandez is the owner of 20 units of one-bedroom residential apartments which are leased out at a…

A: Calculation of VAT on gross receipt lease rent receipt

Q: Rokat Corporation is a manufacturer of tables sold to schools, restaurants, hotels, and other…

A: Purchase budget: Purchase budget is an estimated plan made to identify the number of units acquired…

Q: Question 1 The Consolidated Statement of Financial Position Electra is a small publicly listed…

A: Determination of Consolidated statement of financial position Electra and Helios Consolidated…

Q: After 6 years from today, what will be the purchasing power of the money in your bank account,…

A: Present Value of Investment Adjusted Rate of Return with regards to Inflation rate

Q: Assets 2022 2021 Cash $55,760 $18,040 Accounts receivable 69,700 62,320…

A: The question is related to Cash Flow Statement. Cash Flow Statement is summary of cash receipts and…

Step by step

Solved in 2 steps with 1 images

- The comparative balance sheet of Prime Sports Gear, Inc., at December 31, the end of the fiscal year, is as follows: Additional data obtained from the records of Prime Sports Gear are as follows: a. Net income for 2013 was 121,610. b. Depreciation reported on income statement for 2013 was 46,500. c. Purchased 165,000 of new equipment, putting 90,000 cash down and issuing 75,000 of bonds for the balance. d. Old equipment originally costing 19,500, with accumulated depreciation of 7,950, was sold for 8,000. e. Retired 60,000 of bonds. f. Declared cash dividends of 64,000. g. Issued 1,500 shares of common stock at 27 cash per share. Open the file CASHFLOW from the website for this book at cengagebrain.com. First, enter the formulas. Then, complete the worksheet in the manner described next. According to the problem, cash increased from 39,600 to 67,210 during the year. This is a 27,610 increase. To record this increase on the worksheet, move to row 17. Since this is the first account you are analyzing, enter the letter a in column C. Then enter 27610 in column D (a debit since cash increased). This brings the year-end balance (column G) to 67,210, its proper balance. Now move to the bottom part of the statement where you see the categories Operating Activities, Investing Activities, and so on. The credit side of the entry has to be entered here. The proper space for this cash entry is on row 59. Enter the letter a in cell E59 and 27610 in cell F59. Notice the totals at the bottom of the page (row 60) now agree. The next account balance that changed is accounts receivable. It increased by 9,035. To enter this change on the worksheet, enter the letter b in cell C18 and 9035 in cell D18 (again, a debit since accounts receivable increased). This brings the year-end balance in column G to 121,250, its proper balance. The change in accounts receivable balance is an operating activity adjustment (as explained in your textbook). Enter the credit side of this entry in cells E34 and F34, and enter the explanation Increase in accounts receivable in cell A34. Note: Your textbook probably shows Net income as the first item under Operating Activities. We will get to that later. The sequence in which you enter items on this worksheet is not important. All other balance sheet accounts must be analyzed in the same manner, placing appropriate debit or credit entries in the top part of the worksheet to obtain the proper balances in column G, and then entering the second side of the entry in the appropriate row on the bottom part of the worksheet. You should use letter references to identify all entries. Also, you must enter a description of the entry in column A under the appropriate activity category. Although a sequence of analyzing the balance sheet from top to bottom is suggested here, this order is not necessary. As mentioned earlier, your textbook may specify a different sequence. Also, note that some accounts may have both debit and credit adjustments to them. The worksheet is not a substitute for a statement of cash flows, but it does provide you with all the numbers you need to properly prepare one. You will be done with your analysis when: a. The individual account balances at December 31, 2013, as shown on the worksheet (column G) equal those shown in the given problem data. b. The transaction column totals are equal (cells D60 and F60). c. The sum of the operating, investing, and financing activities (cell G59) equals the change in cash (cell D59 or F59). When you are finished, enter your name in cell A1. Save your completed file as CASHFLOW2. Print the worksheet when done. Also print your formulas. Check figure: Total credits at 12/31/2013 (cell G31), 860,460.A company purchased a building twenty years ago for $150,000. The building currently has an appraised market value of $235,000. The company reports the building on its balance sheet at $235,000. What concept or principle has been violated? A. separate entity concept B. recognition principle C. monetary measurement concept D. cost principleJada Company had the following transactions during the year: Purchased a machine for $500,000 using a long-term note to finance it Paid $500 for ordinary repair Purchased a patent for $45,000 cash Paid $200,000 cash for addition to an existing building Paid $60,000 for monthly salaries Paid $250 for routine maintenance on equipment Paid $10,000 for major repairs Depreciation expense recorded for the year is $25,000 If all transactions were recorded properly, what is the amount of increase to the Property, Plant, and Equipment section of Jadas balance sheet resulting from this years transactions? What amount did Jada report on the income statement for expenses for the year?

- The comparative balance sheet of Prime Sports Gear, Inc., at December 31, the end of the fiscal year, is as follows: Additional data obtained from the records of Prime Sports Gear are as follows: a. Net income for 2013 was 121,610. b. Depreciation reported on income statement for 2013 was 46,500. c. Purchased 165,000 of new equipment, putting 90,000 cash down and issuing 75,000 of bonds for the balance. d. Old equipment originally costing 19,500, with accumulated depreciation of 7,950, was sold for 8,000. e. Retired 60,000 of bonds. f. Declared cash dividends of 64,000. g. Issued 1,500 shares of common stock at 27 cash per share. You have been asked to prepare a statement of cash flows for Prime Sports Gear for 2013. Review the worksheet called CASHFLOW that has been provided to assist you in preparing the statement. The worksheet has been designed so that as you make entries in columns D and F, column G will be automatically updated. For example, FORMULA1 should be entered as =B17+D17F17. Columns C and E are to be used to enter letter references for each of the debit and credit entries on the worksheet.The comparative balance sheet of Yellow Dog Enterprises Inc. at December 31, 20Y8 and 20Y7, is as follows: Please see the attachment for details: Additional data obtained from the income statement and from an examination of the accounts in the ledger for 20Y8 are as follows:a. Net income, $190,000.b. Depreciation reported on the income statement, $115,000.c. Equipment was purchased at a cost of $395,000, and fully depreciated equipment costing $75,000 was discarded, with no salvage realized.d. The mortgage note payable was not due for six years, but the terms permitted earlier payment without penalty.e. 40,000 shares of common stock were issued at $15 for cash.f. Cash dividends declared and paid, $50,000. InstructionsPrepare a statement of cash flows, using the indirect method.kingbird, inc.had the following transactions. 1.sold land(cost$8320) for $10400.2. Issued common stock at par for $22900. 3.record depreciation on buildings for $12100.4.paid salaries of $6500.5. Issued $1000 of $1 par value common stock for equipment worth $9700.6. Sold equipment (cost $13400,accumulate depreciation $9380) for $1608 (a) for each transaction above, prepare the journal entry

- Ripley Corporation’s accumulated depreciation—furniture account increased by $9,310, while $3,570 of patent amortization was recognized between balance sheet dates. There were no purchases or sales of depreciable or intangible assets during the year. In addition, the income statement showed a loss of $4,490 from the sale of land. Reconcile a net income of $138,100 to net cash flow from operating activities. Refer to the Amount Descriptions list provided for the exact wording of the answer choices for text entries.The following data has been taken from the Shine Machinery Inc., income statement and balance sheet: Dec. 31, Jan. Jan. 1,2013 “Income statement: Net Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ... . .$375,000 Depreciation Expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. 115,000 Amortization of Intangible Assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41,000 Gain on Sale of Plant Assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ….. 91,000 Loss on Sale of Investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . …. . 34,000 Balance sheet: Accounts Receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ...$345,000…The following Statement of Financial Position is related to Jeff Berhad. Additional information: (1) During the year, depreciation for machinery is RM22,750. Machinery with a net value of RM2,760 was disposed at a profit of RM2,000. (2) Depreciation for office equipment during the year is RM5,520. Office equipment with cost of RM24,300 was sold for RM18,780. Loss on disposal of office equipment is RM2,760. (3) The net profit before tax is RM41,770. Tax charge for the year is RM17,250. (4) The cash dividends declared were RM26,910. In addition, the company received cash from issuance of share capital and debenture during the year. Required: (a) Based on the above information, prepare the Statement of Cash Flows for the year ended 31 December 2020 for Jeff Berhad using the indirect method. (b) Based on your understanding, discuss which method is the better way to present the Statement of Cash Flows: Direct Method or Indirect Method?

- During your examination of the 20x3 financial statements of Goyo Company, the following data were discovered. Give any correcting and adjusting entries called for by the information given. Disregard any effects on income tax. Write your answers in the space provided. Adjusting Entries, December 31, 20x3 1. An office equipment purchased on January 2, 20x2, at the cost of P44,000, having an estimated salvage value of P4,000 and an estimated useful life of five (5) years, is now estimated to have a total life of 10 years from January 2, 20x2. The estimated salvage value remains unchanged, the straight-line method of depreciation is used. 2. Interest deducted in advance on notes payable amounts to P10,000. The Interest Expense account has a debit balance of P15,000. The company failed to record interest deducted in advance at the end of 20x1, P6,000; and at the end of 20x2, P6,200. All original entries were made to the Interest Expense account. 3. Merchandise…The statement of the financial position of Happy Easter Enterprise given below did not agree andthe balance of GH¢26,940 was entered in the suspense account.HAPPY EASTER ENTERPRISESTATEMENT OF FINANCIAL POSITION AS AT 30TH JUNE, 2018Non-Current Assets: Cost Depreciation Net Book ValueGH¢ GH¢ GH¢Furniture & Fittings 90,000 36,000 54,000Delivery Van 12,000 6,000 6,000102,000 42,000 60,000Current Assets:Inventory 6,000Accounts receivable 12,000Cash at bank 300 18,300Current Liabilities:Accounts payable (7,200)Net current asset 11,100Net assets 71,100Financed By:Capital 12,000Net profit for the year 32,160Suspense account 26,94071,100Upon investigations, the following errors were discovered:(i) Accounts payable had been understated by GH¢6,000.(ii) The sales figure for the period was understated by GH¢540.(iii) The closing inventory amounted to GH¢7,200 but the amount stated in the statementof financial position was the beginning inventory.(iv) A loan from the D-Bank of GH¢3,000 was…Kolonas, Inc., sold equipment for $5,200 cash. The equipment cost of $74,100 and had accumulated depreciation through the date of the sale of $72,000. At the date of the sale, the journal entry to record the sale will have. A. a Gain on Sale of Equipment for $3,100. B. a Loss on Sale of Equipment for $2,100. C. a Loss on sale of Equipment for $3,100. D. A gain on sale of equipment for $2,100.