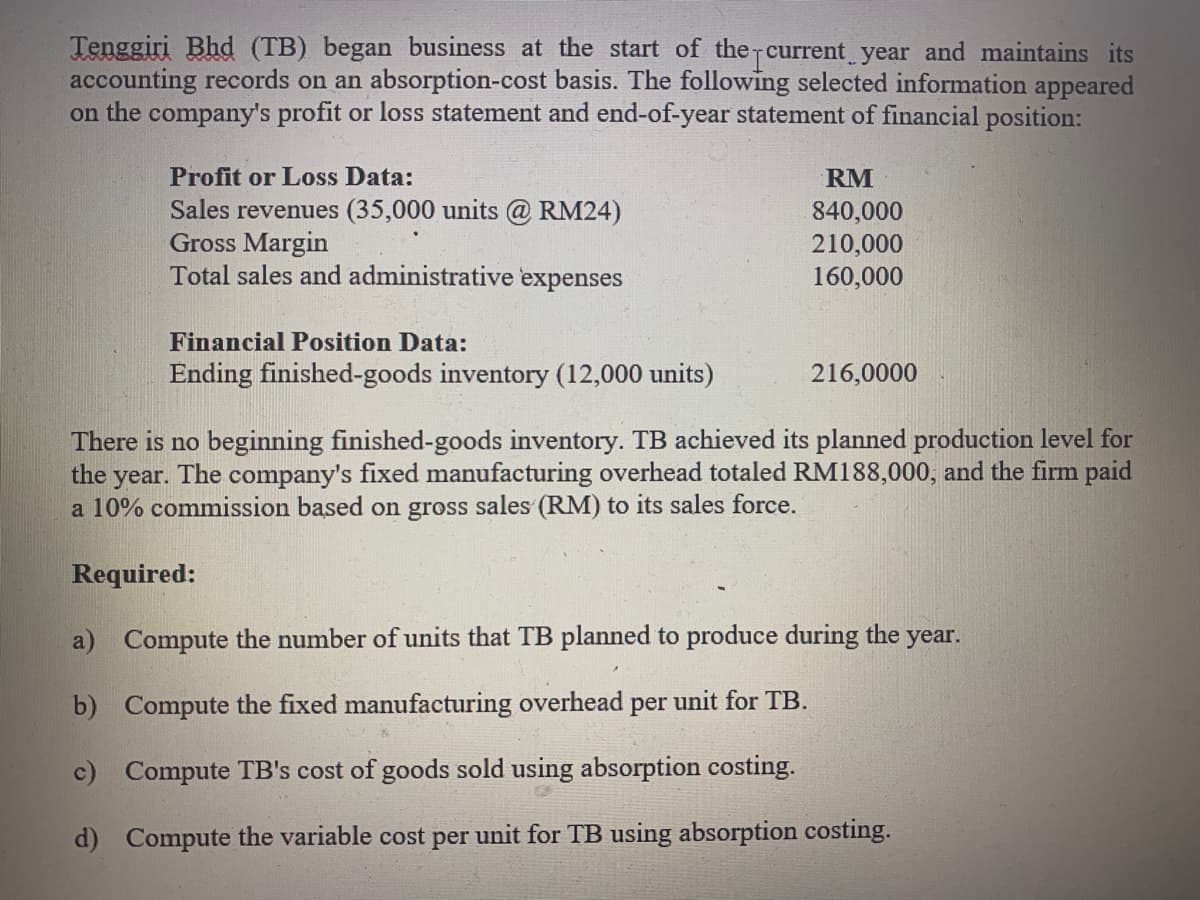

Tenggiri Bhd (TB) began business at the start of the current year and maintains its accounting records on an absorption-cost basis. The following selected information appeared on the company's profit or loss statement and end-of-year statement of financial position: Profit or Loss Data: RM Sales revenues (35,000 units @ RM24) Gross Margin Total sales and administrative expenses 840,000 210,000 160,000 Financial Position Data: Ending finished-goods inventory (12,000 units) 216,0000 There is no beginning finished-goods inventory. TB achieved its planned production level for The company's fixed manufacturing overhead totaled RM188,000, and the firm paid the year. a 10% commission based on gross sales (RM) to its sales force. Required:

Tenggiri Bhd (TB) began business at the start of the current year and maintains its accounting records on an absorption-cost basis. The following selected information appeared on the company's profit or loss statement and end-of-year statement of financial position: Profit or Loss Data: RM Sales revenues (35,000 units @ RM24) Gross Margin Total sales and administrative expenses 840,000 210,000 160,000 Financial Position Data: Ending finished-goods inventory (12,000 units) 216,0000 There is no beginning finished-goods inventory. TB achieved its planned production level for The company's fixed manufacturing overhead totaled RM188,000, and the firm paid the year. a 10% commission based on gross sales (RM) to its sales force. Required:

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 40E: Cuneo Companys income statements for the last 3 years are as follows: Refer to the information for...

Related questions

Question

Transcribed Image Text:Tenggiri Bhd (TB) began business at the start of the current year and maintains its

accounting records on an absorption-cost basis. The following selected information appeared

on the company's profit or loss statement and end-of-year statement of financial position:

Profit or Loss Data:

RM

Sales revenues (35,000 units @ RM24)

Gross Margin

Total sales and administrative expenses

840,000

210,000

160,000

Financial Position Data:

Ending finished-goods inventory (12,000 units)

216,0000

There is no beginning finished-goods inventory. TB achieved its planned production level for

The company's fixed manufacturing overhead totaled RM188,000, and the firm paid

the

year.

a 10% commission based on gross sales (RM) to its sales force.

Required:

a) Compute the number of units that TB planned to produce during the year.

b) Compute the fixed manufacturing overhead per unit for TB.

c) Compute TB's cost of goods sold using absorption costing.

d) Compute the variable cost per unit for TB using absorption costing.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning