tequired A Reqiured B ssuming a spot rate of $0.048 per rupee on December 20, prepare all journal entries to account for the foreign currency otion, foreign currency firm commitment, and purchase of inventory. (If no entry is required for a transaction/event, select lo journal entry required" in the first account field.) No General Journal Date 11/20 11/20 12/20 12/20 Foreign currency option Cash No journal entry required Firm commitment Foreign exchange gain or loss Forpion Jone > 33 Debit 1,240 2,480 1.240 Credit 1,240 2,480

tequired A Reqiured B ssuming a spot rate of $0.048 per rupee on December 20, prepare all journal entries to account for the foreign currency otion, foreign currency firm commitment, and purchase of inventory. (If no entry is required for a transaction/event, select lo journal entry required" in the first account field.) No General Journal Date 11/20 11/20 12/20 12/20 Foreign currency option Cash No journal entry required Firm commitment Foreign exchange gain or loss Forpion Jone > 33 Debit 1,240 2,480 1.240 Credit 1,240 2,480

Chapter11: Managing Transaction Exposure

Section: Chapter Questions

Problem 9QA

Related questions

Question

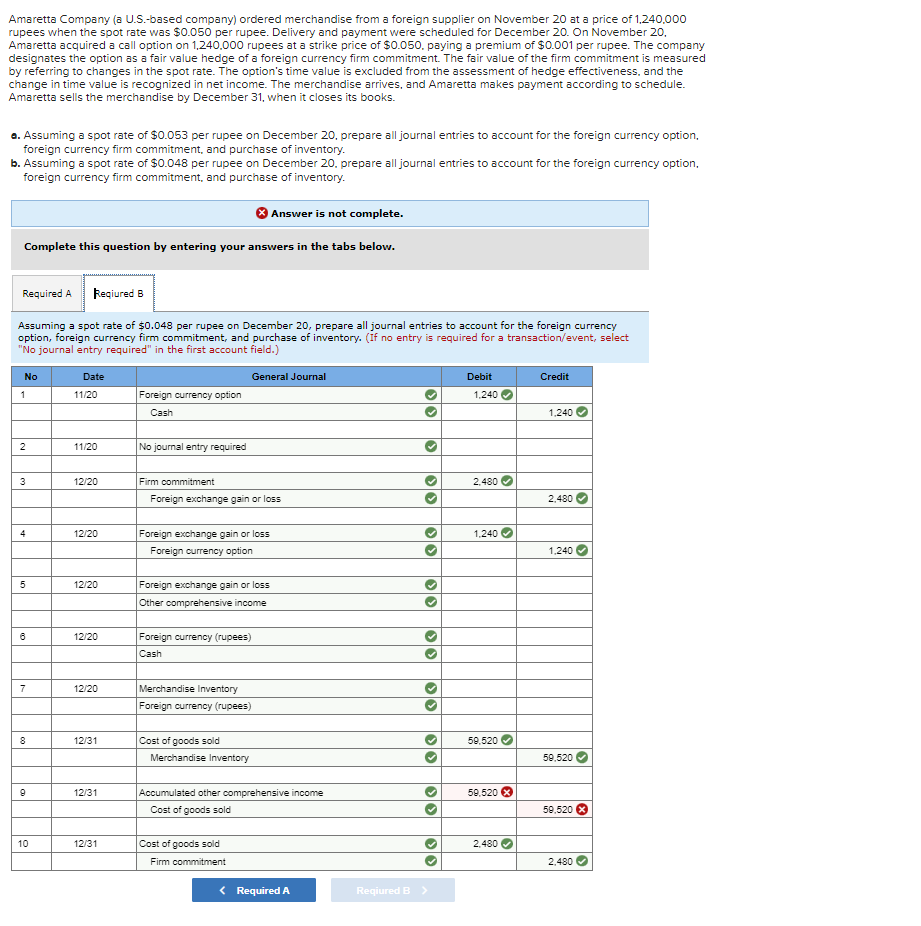

Transcribed Image Text:Amaretta Company (a U.S.-based company) ordered merchandise from a foreign supplier on November 20 at a price of 1,240,000

rupees when the spot rate was $0.050 per rupee. Delivery and payment were scheduled for December 20. On November 20,

Amaretta acquired a call option on 1,240,000 rupees at a strike price of $0.050. paying a premium of $0.001 per rupee. The company

designates the option as a fair value hedge of a foreign currency firm commitment. The fair value of the firm commitment is measured

by referring to changes in the spot rate. The option's time value is excluded from the assessment of hedge effectiveness, and the

change in time value is recognized in net income. The merchandise arrives, and Amaretta makes payment according to schedule.

Amaretta sells the merchandise by December 31, when it closes its books.

a. Assuming a spot rate of $0.053 per rupee on December 20, prepare all journal entries to account for the foreign currency option,

foreign currency firm commitment, and purchase of inventory.

b. Assuming a spot rate of $0.048 per rupee on December 20, prepare all journal entries to account for the foreign currency option,

foreign currency firm commitment, and purchase of inventory.

Answer is not complete.

Complete this question by entering your answers in the tabs below.

Reqiured B

Assuming a spot rate of $0.048 per rupee on December 20, prepare all journal entries to account for the foreign currency

option, foreign currency firm commitment, and purchase of inventory. (If no entry is required for a transaction/event, select

"No journal entry required" in the first account field.)

General Journal

Required A

No

1

2

3

4

5

6

7

8

9

10

Date

11/20

11/20

12/20

12/20

12/20

12/20

12/20

12/31

12/31

12/31

Foreign currency option

Cash

No journal entry required

Firm commitment

Foreign exchange gain or loss

Foreign exchange gain or loss

Foreign currency option

Foreign exchange gain or loss

Other comprehensive income

Foreign currency (rupees)

Cash

Merchandise Inventory

Foreign currency (rupees)

Cost of goods sold

Merchandise Inventory

Accumulated other comprehensive income

Cost of goods sold

Cost of goods sold

Firm commitment

< Required A

33

33

33

33

››

33

33

Reqiured B >

Debit

1,240 ✓

2,480

1,240

59,520

59,520 X

2,480

Credit

1,240

2,480

1,240

59,520

59,520 X

2,480

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you